From Jan to Sept 2024, Global FCEV Market with a 17.4% YoY Degrowth

- Hyundai Motor Group ranked No. 1 in global FCEV market from Jan to Sept 2024

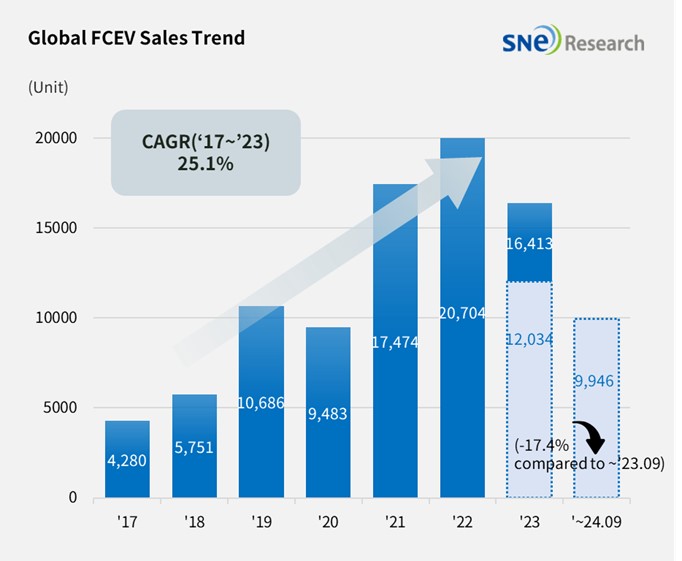

A total number of globally registered FCEVs sold from Jan to Sept 2024 was 9,946 units, recording a 17.4% YoY decline.

(Source: Global FCEV Monthly Tracker – Oct 2024, SNE Research)

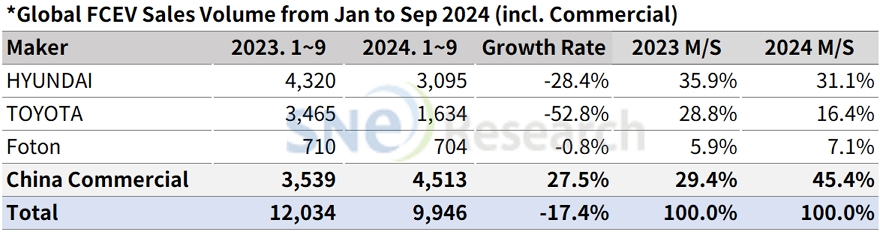

By company, Hyundai Motor sold a total of 3,095 units of NEXO and ELEC CITY, posting a 28.4% YoY degrowth but still capturing the top position on the list. Such a sudden drop in sales was mainly caused by a declining sale of NEXO in the Korean domestic market. However, as Hyundai Motor Company has secured government subsidies for its hydrogen trucks in New Zealand and signed a MOU to commence collaboration with Skoda Group on establishing a hydrogen mobility ecosystem, the motor company is expected to see a rebound in sales. Toyota, selling 1,634 units of Mirai and Crown, recorded a 52.8% YoY decline. Haima from China delivered a small number of Haima 7X-H, a hydrogen electric vehicle developed based on its existing MPV, Haima 7X. Other Chinese makers recorded a steady sale centered around their commercial vehicles.

(Source: Global FCEV Monthly Tracker – Oct 2024, SNE Research)

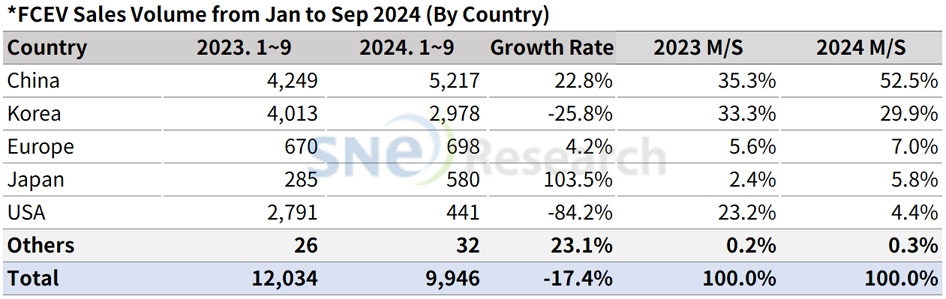

By country, due to a sluggish sale of NEXO, Korea experienced a 25.8% YoY degrowth, accounting for 29.9% of market share, declined by 3.4%p. China recorded a continuous growth focusing on hydrogen commercial vehicles, capturing No. 1 position not only in the global EV market but also in the FCEV market. In Europe, 680 units of Toyota Mirai was sold, posting a 4.2% YoY increase. On the other hand, sales of Mirai in the US have plummeted, posting a 84.2% YoY decrease. In Japan, 384 units of newly launched Toyota Crown were sold, becoming the only vehicle to exhibit a triple-digit growth among others.

(Source: Global FCEV Monthly Tracker – Oct 2024, SNE Research)

Since reaching the pinnacle in 2022, the FCEV market recorded a 20.7% degrowth in 2023, and the trend of degrowth has accelerated further this year. The Korean domestic market, which boasted the largest market share, has witnessed a continuous decline in sales, leading to a downsizing in the overall market. Unlike the government roadmap, the distribution of hydrogen vehicles has slowed down, and new vehicle launching plans are not even close to the target. Given the current circumstances, the Ministry of Environment announced that it would expand the distribution of hydrogen vehicles, centered around commercial vehicles, not passenger ones. It is still opaque that when the FCEV market, of which infrastructure, economic feasibility, and related state policies are not enough, would finally see a recovery from the current slowdown.