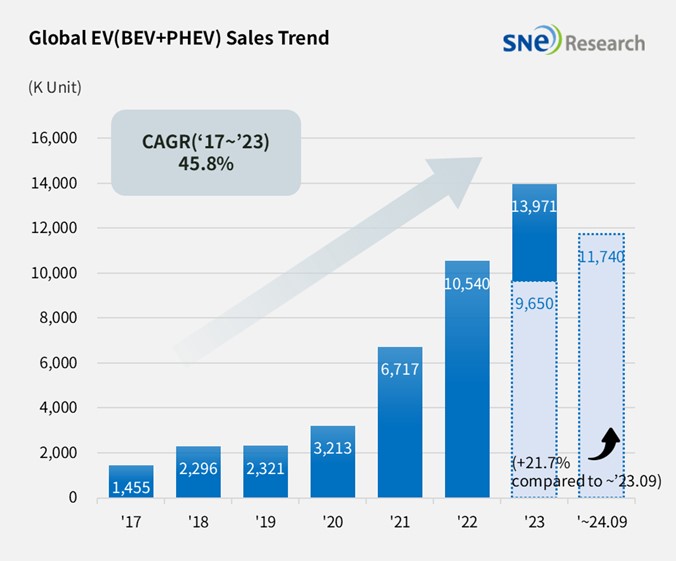

From Jan to Sep 2024, Global[1] Electric Vehicle Deliveries[2] Recorded Approximately 11.74 Mil Units, a 21.7% YoY Growth

- In September 2024, approximately 1.71 million units of electric vehicles were delivered; BYD ranked No. 1 in the ranking of global EV sales

From Jan to September 2024, the number of electric vehicles registered in countries around the world was approximately 11.74 million units, a 21.7% YoY increase.

(Source: Global EV and Battery Monthly Tracker – Oct 2024, SNE Research)

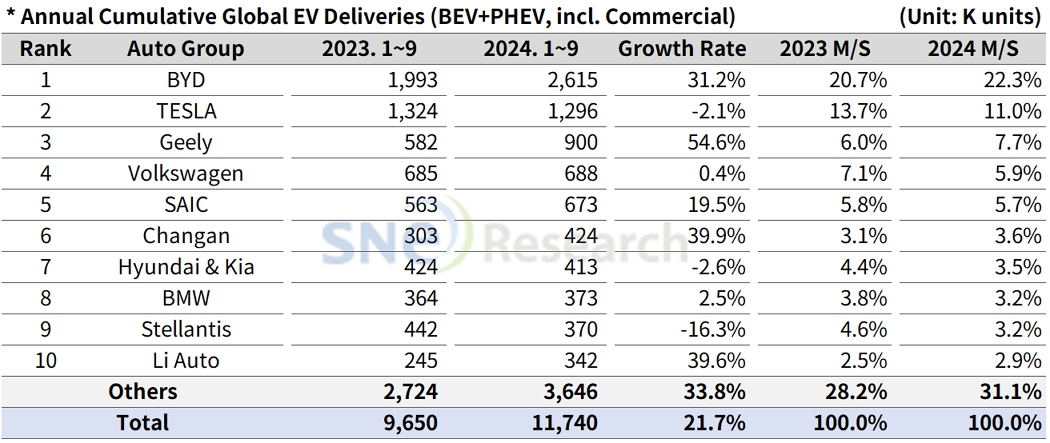

If we look at the global EV sales by major OEMs from Jan to Sep 2024, BYD took No. 1 position in the ranking by selling 2.615 million units and posting a 31.2% YoY growth. Favorable sales of PHEV line-ups, such as Song(宋), Seagull (海鸥), Qin(秦), and Dolphin (海豚), have mainly led the growth of BYD. BYD has been steadily expanding its market share by diversifying its brand portfolio through many sub-brands such as Denza (腾势), Yangwang (仰望), and FangCheong Bao (方程豹). BYD takes a two-track approach to target different markets in the world. In Europe, the ASEAN-5 region, and South America, where the electrification rate of local OEMs is slow, BYD tries to dominate the market in advance based on its price competitiveness. In the US and Europe, where tariff barriers are high, BYD establishes its production lines locally to avoid the tariffs.

In Q3 2024, BYD posted approx. US$ 28.2 billion in sales, a 24% increase from last year. BYD’s Q3 sales is US$ 3 billion more than that of Tesla, US$ 25.2 billion. Even amidst the prolonged chasm phase in the global EV market (except the Chinese domestic one), BYD has been expanding its global presence under difficult circumstances such as the EU’s tariff rate against Chinese electric vehicles.

BYD’s BEV sales (excluding PHEV) recorded about 1.142 million units, which almost reached a similar level as Tesla of which sales (1.296 million units) consist of 100% BEVs.

Tesla saw a decline in sales of Model 3 and Y, which take up about 95% of its entire sales, thereby posting a 2.1% YoY degrowth and taking the 2nd place on the list. To be specific, in Europe, Tesla registered 12.3% YoY decline and 5.9% decline in North America.

The 3rd place was taken by Geely Group. ZEEKR 001, by Geely’s premium brand ZEEKR (极氪), and its light EV model, Panda (熊猫) Mini, were sold more than 80k units respectively in the Chinese domestic market. In other markets than China, Geely Group has been rapidly expanding its global market share mainly led by Volvo and Polestar. Geely Group launched different sub-brands such as Galaxy (银河) and LYNK & CO (领克), intensively targeting midsize/premium vehicle markets.

(Source: Global EV and Battery Monthly Tracker – Oct 2024, SNE Research)

Hyundai Motor Group sold approx. 413k units of electric vehicles, recording a 2.6% YoY degrowth. Although IONIQ 5 and EV 6 sold less than the same period of last year, the global sales of EV 9 have expanded. Especially in the North American market, Hyundai Motor Group delivered more electric vehicles than Stellantis, Ford, and GM. EV 3 and Casper Electric, to which LG Energy Solution’s battery is installed, have been sold well at a rapid pace since their launch. All of this led to an expectation that Hyundai would return to an upward trend at the end of this year, mainly centered around the entry-level electric vehicle market.

(Source: Global EV and Battery Monthly Tracker – Oct 2024, SNE Research)

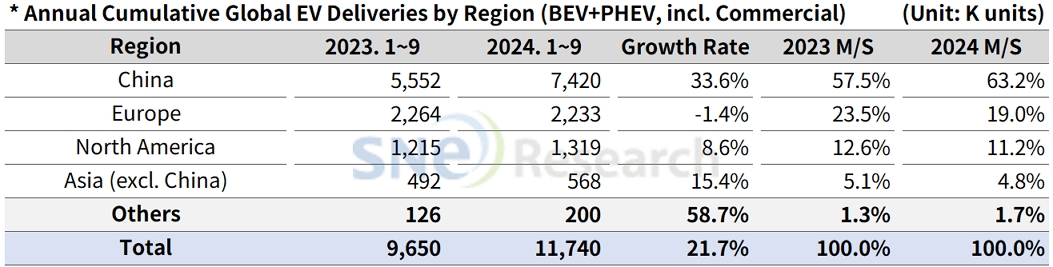

By region, China, accounting for 63.2% of market share, firmly stayed No. 1 as the world’s biggest EV market. China, registering a 33.6% YoY growth, has been leading the growth of the global EV market.

Europe, hit hardest by the chasm phase, posted a 1.4% YoY degrowth in EV deliveries. On the other hand, sales of HEVs in the region posted a 16.7% YoY increase. This has proven that the electrification trend has slowed down along with adjustments to the Euro 7 regulation. All of these are based on concerns about possible decreases in profit from the existing OEMs when EVs demand slow down.

The North American region posted an 8.6% YoY growth. Despite the implementation of IRA, a slowdown in demand for EVs has not been solved, but OEMs seem to place a more focus on the development of hybrid vehicles, instead. Recently, many OEMs, including Hyundai Motor Group, announced the development of EREVs (Extended-Range Electric Vehicle), actively responding to the market demand for hybrid vehicles.

The EU decided to apply max. 45.3% tariff rate against electric vehicles made in China for 5 years from Oct 30, 2024. For example, Tesla would face 17.8%, BYD 27.0%, Geely 28.8%, and SAIC 45.3% of tariff in Europe. SAIC and other companies, who were not cooperative with the EU’s investigation, would face 45.3% of tariff as the most additional tariff, 35.3%p, was imposed on them. Even though different countries around the world have been trying to secure their local car makers’ and battery companies’ competitive edge by increasing tariffs against the China-made EVs, the Chinese EV makers have not been wavered but further expanding their overseas market shares based on their price competitiveness. In particular, the Chinese EV companies are dominating the emerging EV markets such as South America and Southeastern Asia where the Japanese OEMs traditionally took up a large portion of ICE vehicle market. To be specific, BYD sold 56k units in South America, mainly in Brazil, and 66k units in Asia, centered around Thailand, rapidly expanding its presence in the market other than China.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period