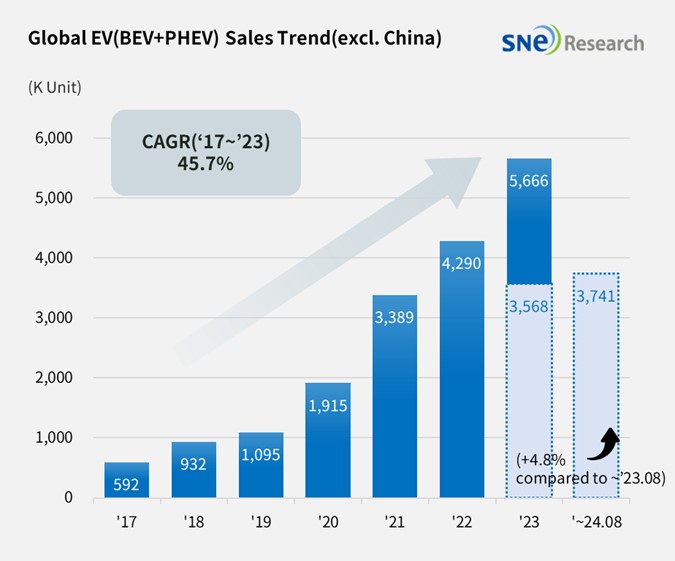

From Jan to Aug 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded 3.741 Mil Units, a 4.8% YoY Growth

- Tesla ranked No. 1 in non-China EV market but posting a degrowth again.

From Jan to July 2024, the total number of electric

vehicles registered in countries around the world except China was approx. 3.741 million units, a 4.8% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Sep 2024, SNE Research)

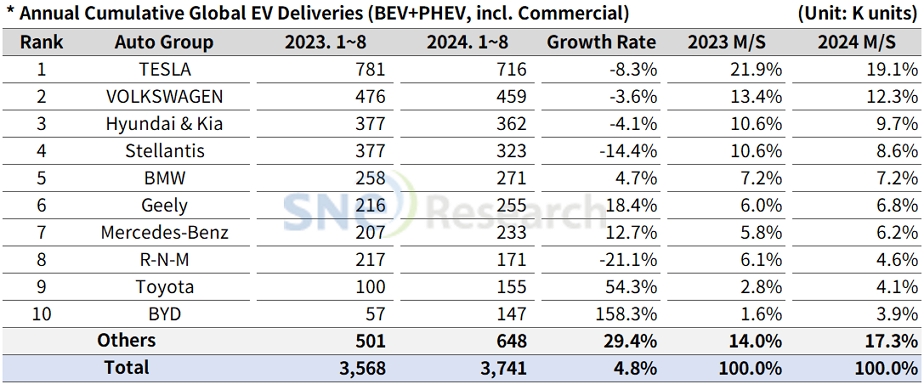

If we look at the number of electric vehicles sold in the world except the China market from Jan to Aug 2024, despite posting a degrowth, Tesla stayed top on the list. Tesla recorded an 8.3% YoY degrowth as the sales of Model 3/Y, which take up about 95% of Tesla’s entire sales, have decreased. It saw a 16.2% YoY decrease in Europe only and an 8.4% YoY decrease in North America.

The Volkswagen Group, where Audi, Porsche, and Skoda belong to, posted a 3.6% YoY degrowth and ranked 2nd. Although Audi’s Q4 e-tron, ENYAQ and PHEV model saw a steady increase in sales, the sales of VW’s main model, ID Series, have been sluggish. It seems that those vehicles targeting the European market have been directly affected by the continuing slowdown in demand for EVs in the European market.

Hyundai Motor Group sold approx. 362k units, posting a 4.1% YoY degrowth. The sales of IONIQ 5 and EV6 experienced a slowdown compared to the same period of last year, but the global sales of EV9 has been expanding, and the newly-launched EV3 started to be delivered to customers. In addition, with a rapid drop in sales of GM and Volkswagen in China, Hyundai Motor Group is likely to benefit from it. From the end of 2024 or beginning of 2025, when the launch of new models such as IONIQ 9 and EV4 in Europe and North America is scheduled, Hyundai Motor Group is expected to see a recovery in its growth.

(Source: Global EV & Battery Monthly Tracker – Sep 2024, SNE Research)

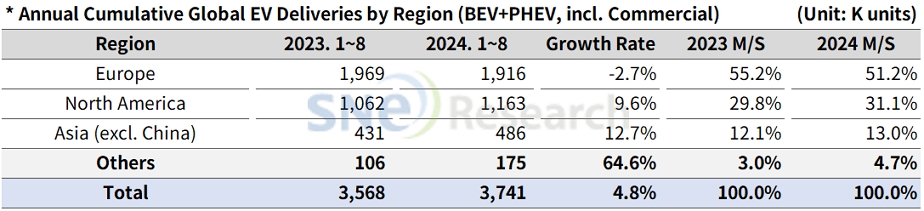

By region, the European market posted a 2.7% degrowth, but stilling accounting for more than half of the non-China market. In the European market, BMW(8.5%), Mercedes-Benz(14.7%), and Geely(21.6%) all recorded a double-digit YoY growth. On the other hand, the sales of Tesla, Stellantis, and Renault exhibited a degrowth, showing that the European regions hit a speed bump in growth.

North America, where a seesaw game between the two Presidential candidates has continued, posted a 9.3% YoY growth. In North America, Tesla continuously posted a degrowth in sales, but with the increasing sales of Hyundai Motor Group, Stellantis, and Ford, the North American market stayed in an upward trend. In particular, Hyundai Motor Group recorded the second-highest sales, following Tesla, in North America.

In Asia (excl. China), BYD and SAIC saw a rapid increase in sales, posting a 72.7% and 74.0% YoY growth, respectively.

(Source: Global EV & Battery Monthly Tracker – Sep 2024, SNE Research)

Recently, the EU announced that it would lower the tariff rate against electric vehicles made in China from max. 47.6%p to 46.3%p from this November, but it is still a high rate. Differences in tariff rates applied to companies also significantly vary depending on how cooperative companies are. Based on this, sales of BYD (tariff rate 27.4%p applied) exceeded those of SAIC (tariff rate 46.3%p applied) in Europe. Despite the regulations and tariff barrier against the Chinese EVs in Europe and the US, the overseas sales of Chinese EVs have been expanding as the Chinese EV makers have diversified their strategies to flexibly respond to changes in the global environmental regulations. Currently, BYD, Xpeng, Chery, and Geely are reported to work on establishing their local production facilities in Europe. In addition, they are entering the South American and Southeast Asian markets at a rapid pace as well, with BYD posting over 800% YoY growth in Brazil. Amidst the lingering presence of large obstacles to overcome the chasm phase, such as reduced subsidies, insufficient infrastructure, and concerns about battery safety, top priority should be securing the cost competitiveness through local production supported by battery-related technology in order to compete with the Chinese electric vehicles.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.