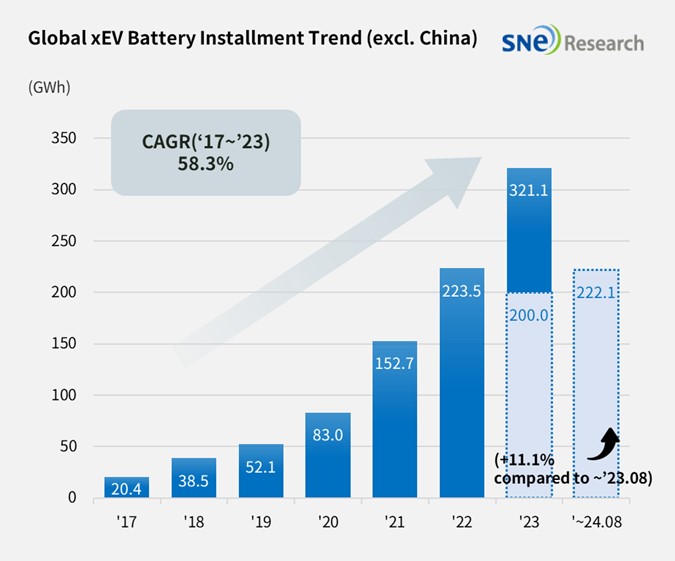

From Jan to Aug 2024, Non-Chinese Global[1] EV Battery Usage[2] Posted 222.1GWh, a 11.1% YoY Growth

- K-trio’s combined M/S recorded 46.4% from Jan to Aug 2024

Battery installation for

global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from

January to Aug in 2024 was approx. 221.1GWh, a 11.1% YoY growth.

(Source: Global EV and Battery Monthly Tracker – Sept 2024, SNE Research)

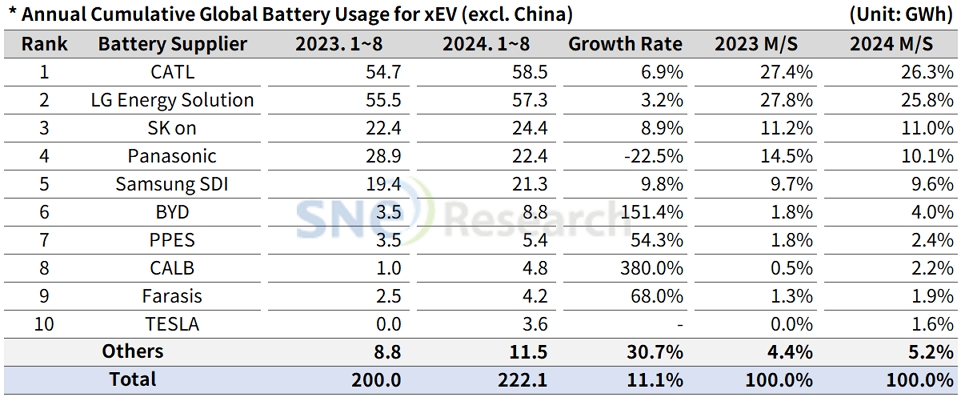

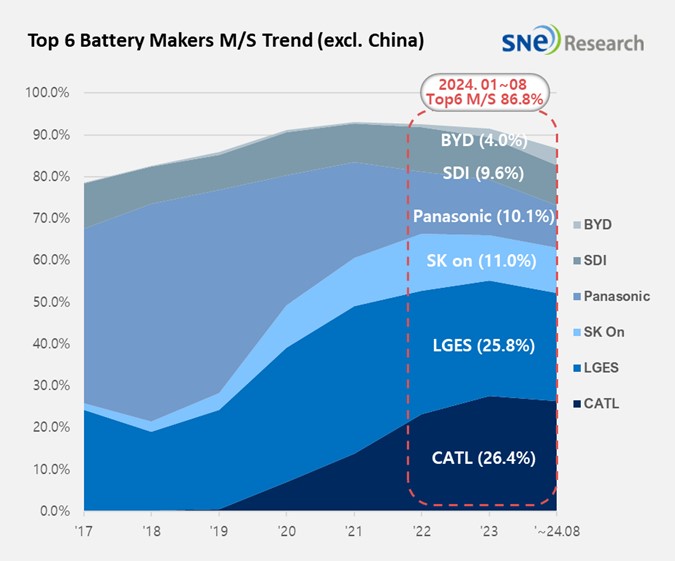

The combined usage of batteries made by the K-trio companies for electric vehicles from Jan to Aug 2024 were higher than that from the same period of last year. LG Energy Solution stayed on the 2nd place in the ranking with a 3.2%(57.3GWh) YoY growth, while SK On ranked 3rd with a 8.9%(24.4GWh) YoY growth. Samsung SDI posted the highest YoY growth, 9.8%(21.3GWh), among the K-trio companies. On the contrary, the combined market shares of K-trio were 46.4%, declined by 2.3%p compared to the same period of last year.

(Source: Global EV and Battery Monthly Tracker – Sept 2024, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI showed the highest growth among the K-trio based on favorable sales of BMW and Rivian. Sales of BMW i4, i5, and i7 and Rivian R1S and R1T, to which Samsung SDI’s battery is installed, were better than the same period of last year. Other than these, Audi Q8 e-Tron and JEEP Wranlger PHEV continuously sold well.

SK On saw a growth in the usage of its battery in accordance with sales of Hyundai Motor Group, Mercedes, Ford, and Volkswagen. Despite a slowdown in sales earlier this year, Hyundai’s IONIQ 5, EV6, and EV9; Mercedes Benz EQA and EQB; and Ford F-150 Lightning all enjoyed a recovery in sales, propping up the growth in the usage of SK On’s battery.

LG Energy Solution stayed in an upward trend in the usage of its battery as EV models popular in Europe and North America – Tesla Model 3/Y, VW ID.4, Ford Mustang Mach-E, and GM Cadillac LYRIQ – showed solid sales in those regions. Other than these, the sales of Hyundai IONIQ 6 and KONA Electric in Europe, to which LG Energy Solution’s battery is installed, significantly increased compared to the same period of last year.

From Jan to Aug 2024, sales of EV(BEV+PHEV), except HEV, in Europe posted approx. 2.7% degrowth compared to the same period of last year. With Tesla also posting a degrowth in sales, the usage of LG Energy Solution’s battery in Europe has declined. However, the sales of electric vehicles, to which battery made by Samsung SDI and SK On are installed, were favorable, leading to an overall increase in the usage of K-battery.

Panasonic, the only Japanese company in the top 10 on the list, recorded 22.4GWh from Jan to Aug this year, ranking 4th on the list but recording a 22.5% YoY degrowth. The major reason for Panasonic’s degrowth was a slowdown in sales of Tesla Model 3 due to its transformation to the facelifted version earlier this year. As sales of Model 3 have recently expanded and Panasonic was reported to launch advanced 2170 and 4680 cells supplied to Tesla, Panasonic is expected to rapidly regain its market share mainly focusing on Tesla.

CATL accounted for the biggest market share in the non-China global market with a 6.9%(58.5GWh) YoY growth. Currently, major global OEMs such as Tesla, BMW, Mercedes, Volkswagen, and Hyundai Motor Group adopt CATL’s battery for their electric vehicles. In order to address the oversupply issue in the Chinese domestic market, CATL turned their eyes to overseas markets such as Brazil, Thailand, Israel, and Australia, leading to an expectation that it would rapidly expand its market share around the globe.

(Source: Global EV and Battery Monthly Tracker – Sept 2024, SNE Research)

During the first half of 2024, the usage of battery made by Chinese makers took up 38.9% in the non-China global market. As more emphasis has been placed on the safety of battery and price competitiveness, global OEMs have been expanding their plans to adopt LFP battery which can create more profits for them. Given this circumstance, it seems that the Chinese battery makers have benefitted from their advance entrance to LFP battery. However, with the US IRA implemented and increasing trade tariffs in different countries, the Chinese battery makers would face an upper limit on the pace of their overseas market expansion. If the K-trio push mass production of LFP battery forward and establish a stable supply chain, it would lead to a positive change in their market shares in future.

[2] Based on battery installation for xEV registered during the relevant period.