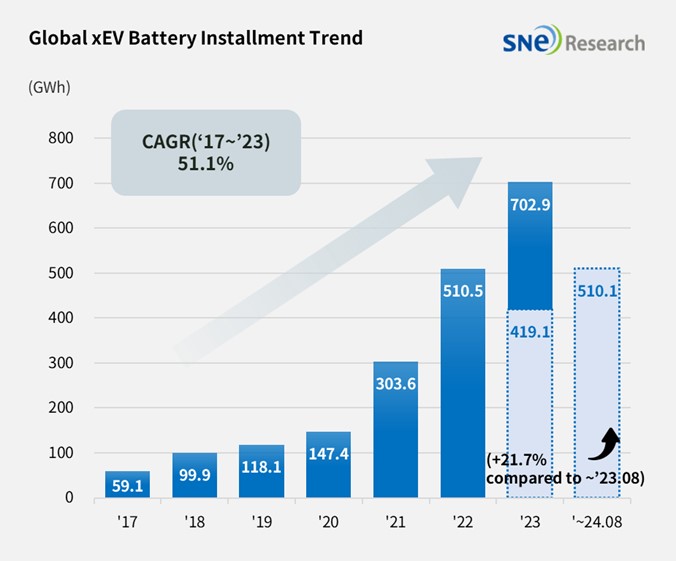

From Jan to Aug 2024, Global[1] EV Battery Usage[2] Posted 510.1GWh, a 21.7% YoY Growth

- From Jan to Aug 2024, K-trio’s M/S accounted for 21.1%

From January to July 2024, the amount of energy held by

batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was

approximately 510.1GWh, a 21.7% YoY growth.

(Source: 2024 Sep Global Monthly EV and Battery Monthly Tracker, SNE Research)

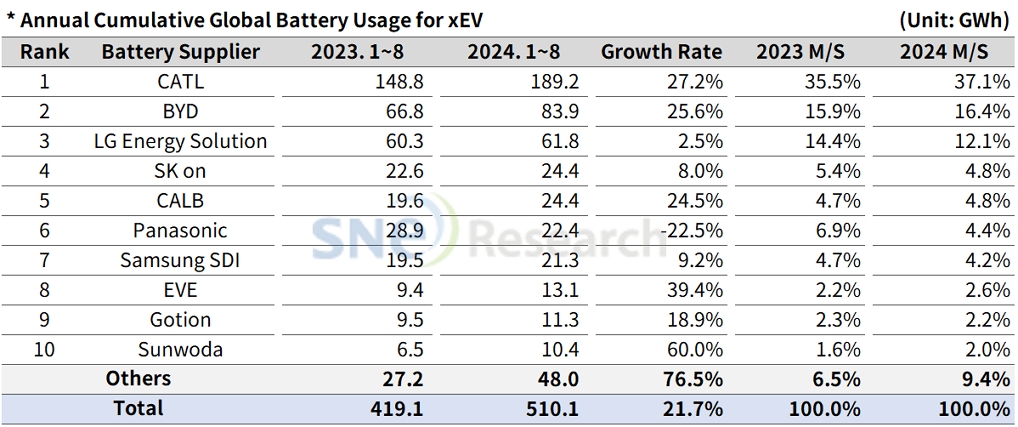

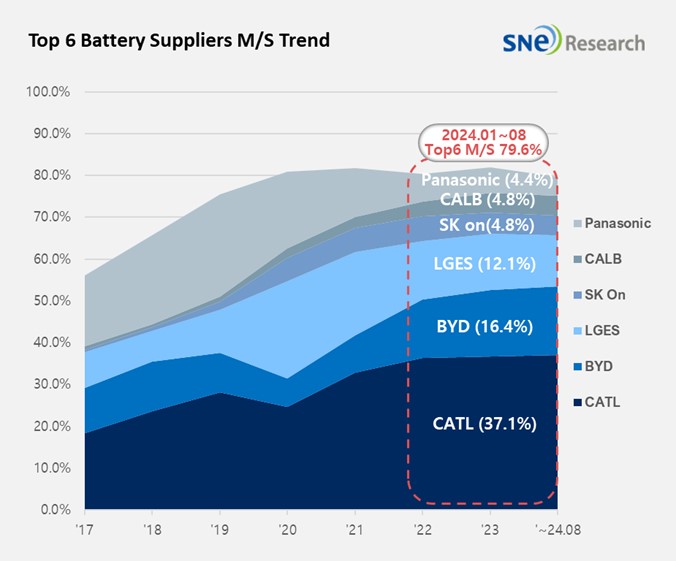

The combined usage of batteries made by the K-trio companies for electric vehicles from Jan to August 2024 were higher than that from the same period of last year. LG Energy Solution stayed at the 3rd place in the ranking with a 2.5%(61.8GWh) YoY growth, while SK On took the 4th place with a 8.0%(24.4GWh) growth. Samsung SDI posted the highest YoY growth among the K-trio companies with 9.2%(21.3GWh). On the other hand, the combined market shares of K-trio were 21.1%, declined by 3.4%p compared to the same period of last year.

If we look at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI showed the highest growth among the K-trio based on favorable sales of BMW and Rivian. To be specific, BMW i4, i5, and i7 and Rivian R1S and R1T to which Samsung SDI’s battery is installed were sold more than the same period of last year. Other than these, Audi Q8 e-Tron and JEEP Wranlger PHEV also showed solid sales last month.

SK On saw a growth in the usage of its battery in accordance with the sales of Hyundai Motor Group, Mercedes, Ford, and Volkswagen. Despite a slowdown in sales earlier this year, Hyundai’s IONIQ 5, EV6, and EV9; Mercedes Benz EQA and EQB; and Ford F-150 Lightning all enjoyed a recovery in sales, propping up the growth in the usage of SK On’s battery.

LG Energy Solution stayed in an upward trend in the usage of its battery as EV models popular in Europe and North America – Tesla Model 3/Y, VW ID.4, Ford Mustang Mach-E, and GM Cadillac LYRIQ – showed solid sales in those regions. Other than these, the sales of Hyundai IONIQ 6 and KONA Electric in Europe, to which LG Energy Solution’s battery is installed, significantly increased compared to the same period of last year.

From Jan to Aug 2024, sales of EV(BEV+PHEV), except HEV, in Europe posted approx. 2.7% degrowth compared to the same period of last year. With Tesla also posting a degrowth in sales, the usage of LG Energy Solution’s battery in Europe has declined. However, the sales of electric vehicles, to which battery made by Samsung SDI and SK On are installed, were favorable, leading to an overall increase in the usage of K-battery.

Panasonic, the only Japanese company in the top 10 on the list, recorded 22.4GWh from Jan to Aug this year, ranking 6th on the list but recording a 22.5% YoY degrowth. The major reason for Panasonic’s degrowth was a slowdown in sales of Tesla Model 3 due to its transformation to the facelifted version earlier this year. As sales of Model 3 have recently expanded and Panasonic was reported to launch advanced 2170 and 4680 cells supplied to Tesla, Panasonic is expected to rapidly regain its market share mainly focusing on Tesla.

CATL, firmly holding the global top position, recorded a 27.2%(189.2GWh) YoY growth. Major Chinese OEMs, such as ZEEKR, AITO, and Li Auto in the Chinese domestic market – the world’s largest electric vehicle market – have CATL’s battery inside, and global major OEMs also chose CATL’s battery for their vehicles such as Tesla Model 3/Y, BMW iX, Mercedes EQ series, and VW ID series.

BYD ranked 2nd on the list with a 25.6%(83.9GWh) YoY growth. Amidst the increasing competition among global OEMs for hybrid technologies, BYD has been aggressively targeting the BEV and PHEV markets by launching a new, hybrid vehicle which can drive 2,100km per charge. BYD has been increasing its market shares at a rapid pace not only in the Chinese domestic market but also in Asia and Europe.

(Source: 2024 Sep Global Monthly EV and Battery Monthly Tracker, SNE Research)

The Chinese battery makers have been making progress in the global market where the number of electric vehicles with LFP battery has been increasing. In China, the state subsidy offered to battery with high energy density was reduced, while the number of electric vehicle models with LFP battery, which is more competitive in terms of thermal safety and price competitiveness, has significantly increased. In other regions than China, more electric vehicles adopt LFP battery in order to have higher price competitiveness. As the Chinese companies already predominated the LFP battery market, it is expected that they would maintain the current level of domination – almost similar to monopoly – for a while. However, LG Energy Solution signed an agreement to supply pouch-type CTP with Renault, and Samsung SDI and SK On are also reported to prepare for mass production of LFP battery. In this regard, the K-battery makers would also be able to supply LFP battery for electric vehicles in 2026. As the EV market has slowed down, demand for battery with higher price competitiveness has been increasing. In addition, due to the recent fire incidents occurred in electric vehicles, public demand for safer battery has been expanding, which may lead to possible changes in the landscape of LFP battery market.

[2] Based on battery installation for xEV registered during the relevant period.