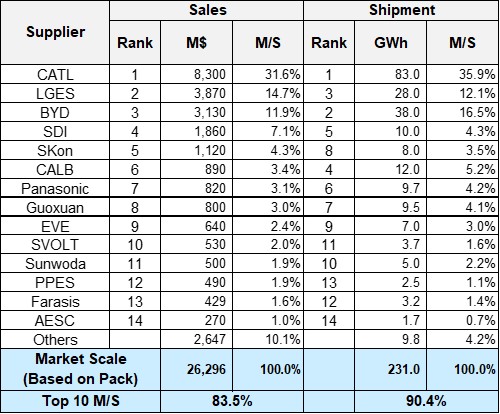

The sales result of battery makers in Q2 2024 was 231.0GWh, worth of 26.3B$ (based on pack).

The K-battery makers’ market share based on their sales were: LGES ranked 2nd with 14.7%; SDI ranked 4th with 7.1%; and SK On ranked 5th with 4.3%, making all of them entering in the global top 5. CATL from China stayed on top in the ranking with 31.6% of the global market share, while BYD captured 3rd place with 11.9% of market share.

Based on shipment, CATL topped the list (35.9%), and BYD ranked 2nd (16.5%). If we look at the K-battery makers’ market share based on their shipment: LGES ranked 3rd with 12.1%; SDI ranked 5th with 4.3%; and SK On took the 7th place with 3.5%, making their combined market shares reach 19.9% of the global market share.

Panasonic took the 7th place based on sales and 6th place based on shipment, mainly focusing on selling cylindrical cells to Tesla.

While the K-battery makers, CATL, and BYD hold strong positions on the list, CALB showed a rapid growth as it started to supply in earnest to new EV makers such as Xpeng and NIO as well as a major OEM, Geely.

*) SNE Research Estimate, 2024

If we look at the ranking based on sales, most of companies below top 7 were the Chinese makers, except PPES making Panasonic’s prismatic battery, indicating that competitions have been getting fierce in the battery industry. The shares taken by top 10 companies, based on both sales and shipment, were 83.5% and 90.4% respectively, showing that top 10 companies were still doing well.

Slowdown in EV demand surplus stocks continued from 2023 have made the battery makers increasingly concerned about performance deterioration. On the other hand, the growth of Chinese makers is intimidating as they have accelerated their entrance to the overseas market based on their success in the domestic market of China. In addition, many major OEMs have been increasingly adopting LFP batteries, making the Chinese battery makers’ market share every expanding based on their stable supply chain and economy of scale. Even in the non-China market, the K-battery trio, whose combined market share was below 50%, was outperformed by CATL. Given the current status, the Chinese battery makers are expected to see a continuous increase in their shares as they are leading the LFP battery market. In the mid- to long-term, it is expected that the K-trio would gradually recover their shares in the global market through development of low and middle-priced products, local production, and safe and high-quality technology when the Chinese companies, instead, are expected to face tougher regulations in Europe and the US.