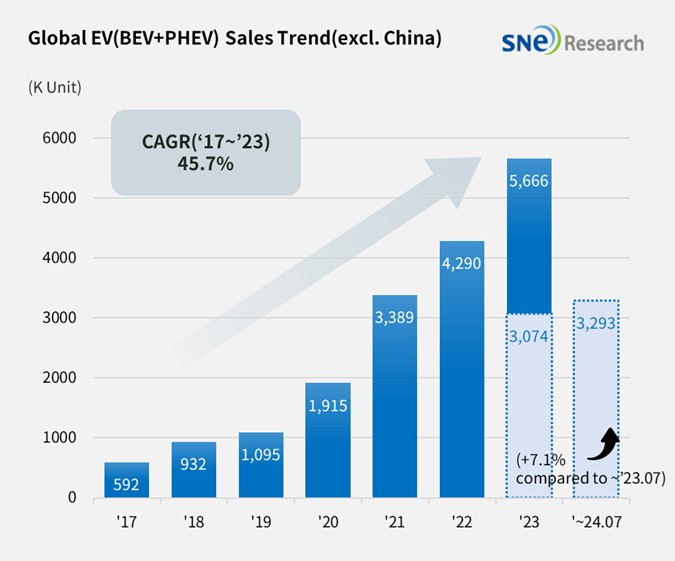

From Jan to July 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded 3.293 Mil Units, a 7.1% YoY Growth

- Tesla ranked No. 1 in non-China EV market but posting a degrowth

From Jan to July 2024, the total number of electric

vehicles registered in countries around the world except China was approx. 3.293

million units, a 7.1% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Aug 2024, SNE Research)

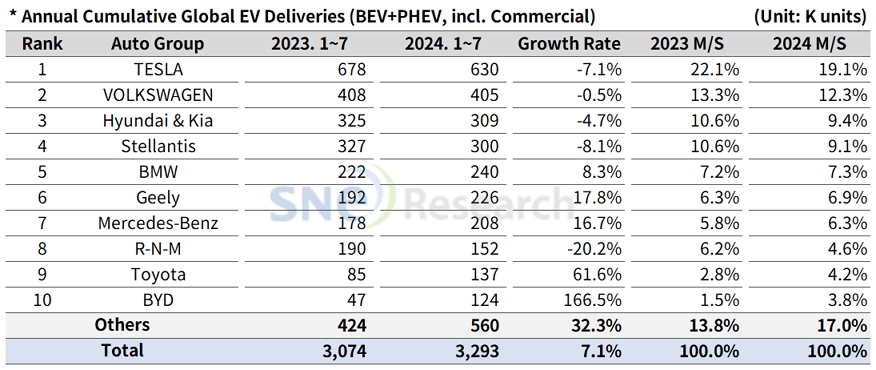

If we look at the number of electric vehicles sold in the world except the China market from Jan to July 2024, despite posting a degrowth, Tesla stayed top on the list. Tesla exhibited a 7.1% YoY degrowth as the sales of Model 3/Y, which take up about 95% of Tesla’s entire sales, has decreased. It saw a 12.2% YoY decrease in Europe only and an 8.3% YoY decrease in North America. Tesla’s Shanghai Factory, which decided to reduce the production volume due to a slowdown in EV demand, has faced increasing tariffs in its major export partner region, Europe. This has made it difficult for Tesla to maintain its price competitiveness and thus, possibly witness a prolonged slowdown in its sales.

The Volkswagen Group, where Audi, Porsche, and Skoda belong to, posted a 0.5 YoY degrowth and ranked 2nd on the list. Although Audi’s Q4/8 e-tron and PHEV models have been steadily sold, VW’s major models, ID.3/4/5, were sold less compared to the previous. It seems that those vehicles targeting the European market have been directly affected by continued slowdown in demand for EVs in the European market.

The 3rd place was taken by Hyundai Motor Group, selling approximately 309k units and posting a 4.7% YoY degrowth. Although IONIQ 5 and EV 6 were sold less than the same period of last year, the global sales of EV9 has expanded. In addition, with the delivery of newly-launched EV3 to customers starting, the motor group is expected to get back on track sooner or later. Also, as Casper Electric, to which battery made by HLI Green Power – an Indonesian joint venture between Hyundai Motor and LG Energy Solution – is installed, is about to be delivered to customers, it is expected that the motor group would lead the popularization of electric vehicle by aggressively targeting the affordable EV market.

(Source: Global EV & Battery Monthly Tracker – Aug 2024, SNE Research)

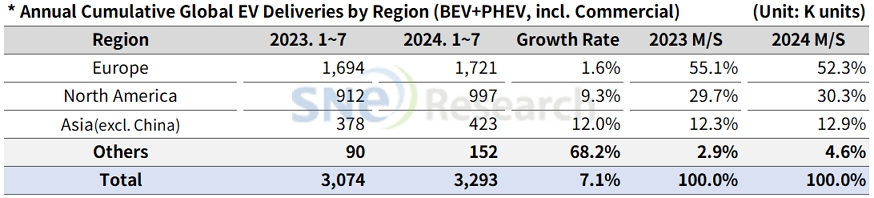

By region, the European market posted a 1.6% growth which is lower than the previous but still accounting for more than half of the non-China market share. In the European market, BMW(12.6%), Mercedes-Benz(20.0%), and Geely(22.3%) all recorded a double-digit YoY growth. On the other hand, the sales of Tesla, Stellantis, and Renault exhibited a degrowth, showing that the European regions hit a speed bump in growth.

North America, where a seesaw game between the two Presidential candidates has continued, posted a 9.3% YoY growth. While Tesla experienced a degrowth in sales again, the sales volume of Hyundai Motor Group, Stellantis, and Ford have increased and led the growth of North American region. In particular, Hyundai Motor Group recorded the second-highest sales, following Tesla, in North America.

In Asia (excl. China), BYD and SAIC witnessed a sudden increase in sales, posting a 67.9% and 91.8% YoY growth, respectively. Toyota posted a 90.8% YoY growth thanks to successful launch of its PHEV model, Crown.

(Source: Global EV & Battery Monthly Tracker – Aug 2024, SNE Research)

Despite those measures to put a break on China-made electric vehicles through tariff barriers in the US and Europe, the overseas sales of Chinese electric vehicles have been continuously expanding. The EU announced a plan to impose max. 46.3% tariff on electric vehicles manufactured in China from November this year. In order to respond to these measures, the Chinese EV makers have been trying to diversify their strategies to smoothly deal with changes in the relevant global regulations. Currently, it has been reported that BYD, Xpeng, Chery, and Geely are working on the establishment of local production lines in Europe. BYD, which has already completed the vertical integration of value chain from battery cell to EV manufacturing, has signed an agreement with Huawei to use the tech company’s advanced autonomous driving technology so that it can secure its price competitiveness and upgrade its technology. BYD announced that the joint autonomous driving technology would be installed to a SUV model made under its new sub-brand, FangCheong Bao(方程豹). Attentions should be made to whether countries around the world can protect their domestic markets through tariff policies from increasing price competitiveness and technical prowess of Chinese electric vehicles.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.