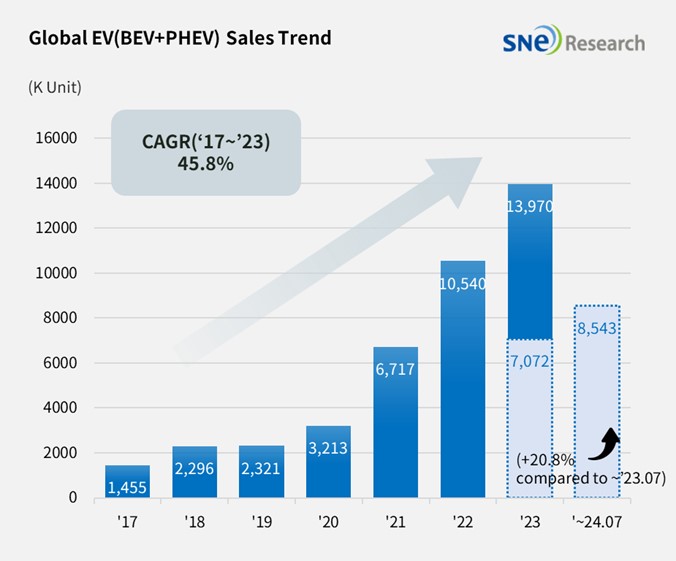

From Jan to July 2024, Global[1] Electric Vehicle Deliveries[2] Posted Approx. 8.543 Mil Units, a 20.8% YoY Growth

- BYD stayed global No. 1 in the ranking, and European market slowed down.

From Jan to July 2024, the number

of electric vehicles registered in countries around the world was approximately

8.543 million units, a 20.8% YoY increase.

(Source: Global EV and Battery Monthly Tracker – Aug 2024, SNE Research)

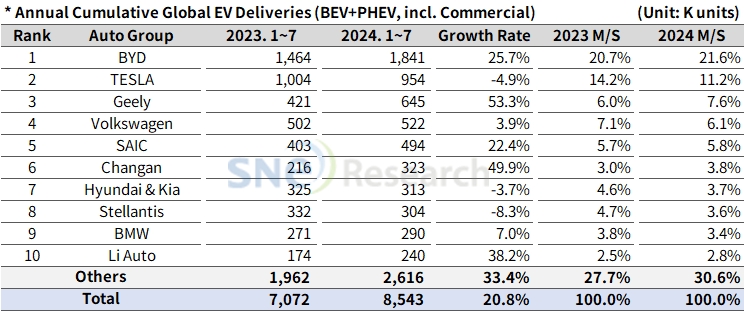

If we look at the global EV sales by major OEMs from Jan to July 2024, BYD kept the top position in the ranking, selling 1.841 million units and posting a 25.7% YoY growth. Favorable sales of major plug-in hybrid line-ups, such as Song(宋), Seagull (海鸥), Qin(秦), and Dolphin (海豚), have led the growth of BYD. BYD has continuously expanded its market share by diversifying its brand portfolio through its sub-brands such as Denza(腾势), Yangwang(仰望), and FangCheong Bao(方程豹). BYD has been taking a two-track approach to take the leading position in the market; one, taking advantage of its price competitiveness in areas where the electrification rate of local OEMs is relatively slow such as Europe, the ASEAN-5 region, and South America; the other, building local production facilities in areas where no tariff walls exist. The number of BYD’s BEV sold, excluding PHEV, was approximately 835k units, which almost reached to a similar level as Tesla of which sales(954k units) consist of 100% BEVs.

Tesla ranked 2nd on the list, posting a 4.9 YoY degrowth, with sales of its main vehicles – Model 3 and Y, accounting for about 95% of the entire sales – declining. It saw a 12.2% YoY decrease only in Europe, and, in North America, Tesla witnessed an 8.3% decrease in its sales. Due to a recent slowdown in demand for EV, Tesla has cut its production volume. Europe, a major export partner of Tesla’s Shanghai factory, has recently increase tariffs, which added more pressures upon pricing. All of these have led to an expectation that Tesla may suffer from a slowdown in sales due to additional pressures from insufficient competitiveness.

The 3rd place was taken by Geely Group. ZEEKR 001, by Geely’s premium brand ZEEKR (极氪), and its light EV model, Panda (熊猫) Mini, were sold more than 50k units respectively in the Chinese domestic market. In other markets than China, Geely Group has been rapidly expanding its global market share mainly led by Volvo and Polestar. The group launched sub-brands such as Galaxy (银河) and LYNK & CO (领克) to intensively target the medium/premium market by diversifying its portfolio.

(Source: Global EV and Battery Monthly Tracker – Aug 2024, SNE Research)

Hyundai Motor Group sold approx. 312k units but recording a 3.7% YoY degrowth. Although IONIQ 5 and EV 6 were sold less than the same period of last year, the global sales of EV9 has expanded. In addition, with the delivery of newly-launched EV3 to customers starting, the motor group is expected to get back on track sooner or later. Also, as Casper Electric, to which battery made by HLI Green Power – an Indonesian joint venture between Hyundai Motor and LG Energy Solution – is installed, is about to be delivered to customers, it is expected that the motor group would lead the popularization of electric vehicle by aggressively targeting the affordable EV market.

(Source: Global EV and Battery Monthly Tracker – Aug 2024, SNE Research)

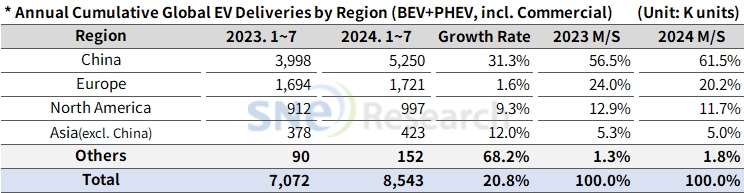

By region, China, which accounted for 61.5% of market share, firmly stayed No. 1 as the world’s biggest EV market. The global EV market growth was led by China who recorded more than 30% of growth compared to the same period of last year.

In Europe, the sales of BEV+PHEV posted a low growth of 1.6% YoY due to deepened chasm period, but the sales of HEV posted a 18.2% YoY increase. This has proven that the electrification trend has slowed down along with adjustments to the Euro 7 regulation. All of these are based on concerns about possible decreases in profit by the existing OEMs when EVs demand slow down.

In North America, where a seesaw game between the two Presidential candidates has continued, posted a 9.3% YoY growth. Despite the implementation of IRA, a slowdown in demand for EVs has not been solved, which seemed to lead OEMs to focus more on developing hybrids, instead. Recently, Hyundai Motor Group also announced that it would mass produce EREVs (Extended-Range Electric Vehicle) and expand hybrid line-ups, targeting the North American market.

The US and Europe have fiercely continued to prevent the Chinese electric vehicles from entering their regions. The EU has a plan to impose max. 46.3% of tariff on electric vehicles manufactured in China from this November. Tariff on Tesla, made in China, has increased from 10% to 19%. In addition, tariffs on other Chinese EV makers are scheduled to increase; 27% on BYD, 29.3% on Geely; and 46.3% on SAIC. The US announced last May that it would increase its tariffs on Chinese EVs from 25% to 100%. Canada also came up with a measure to impose 100% tariff on China-made electric vehicles. In these major regions, tariffs on Chinese EVs have been intentionally increased in an effort to secure competitiveness of those regional car and battery makers. However, all of these have led the Chinese EV makers to preoccupy their pies in newly-emerging markets such as South America and Southeastern Asia. In fact, BYD has been swiftly expanding its market share in the non-China market by selling 48k units mainly in Thailand and 42k units in South America, mainly in Brazil.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.