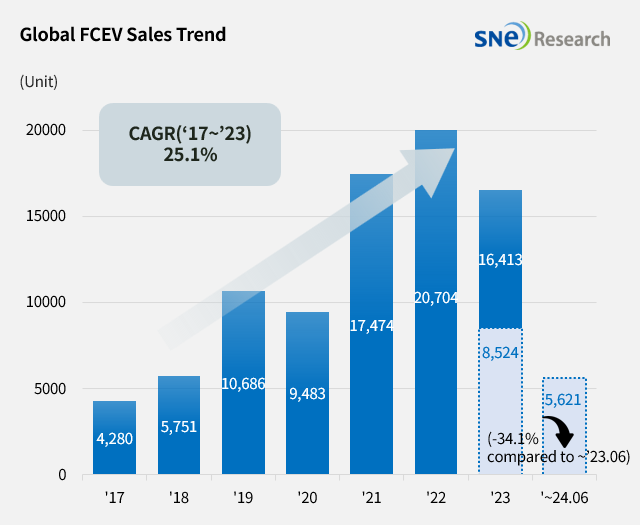

In 2024 1H, Global FCEV Market with a 34.1% YoY Degrowth

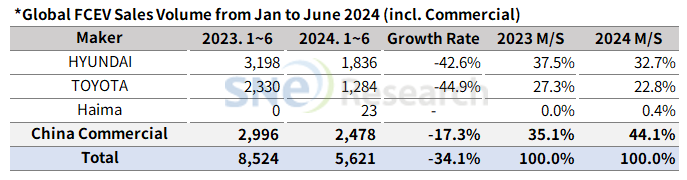

- Hyundai Motor Group ranked No. 1 in global FCEV market in 2024 1H.

A total number of globally registered FCEVs sold in 1H 2024 was 5,621 units, recording a 34.1% YoY decline.

(Source: Global FCEV Monthly Tracker – July 2024, SNE Research)

By company, Hyundai Motor sold 1,836 units of NEXO and ELEC CITY, posting a 42.6% decline from the same period of last year but still capturing the top position in the ranking. Such a drop in sales of Hyundai Motor was mainly caused by a declining sale of NEXO in the Korean domestic market. Toyota, selling 1,284 units of Mirai and Crown, posted a 44.9% YoY decline. Haima from China delivered a small quantity of Haima 7X-H, a hydrogen electric vehicle developed based on the existing MPV, Haima 7X. Other Chinese makers recorded a continuous sales revolving around the commercial vehicle market.

(Source: Global FCEV Monthly Tracker – July 2024, SNE Research)

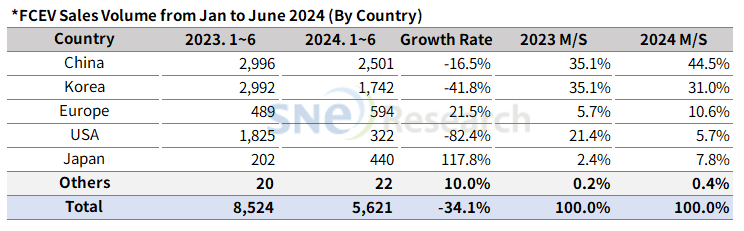

By country, due to a sluggish sale of NEXO, Korea saw a drop in its FCEV market share, accounting for 31.0% of market share – a 41.8% decline from the same period of last year. China recorded a continuous growth centered on hydrogen commercial vehicles, taking the top position not only in the ranking of global EV market share but also the FCEV vehicle market. In Europe, 578 units of Toyota Mirai was sold, a 21.5% YoY increase. On the other hand, sale of Mirai plummeted and recorded an 82.4% YoY decline in the US. In Japan, 384 units of Toyota Crown, newly launched in the market last year, were sold, posting a 117.8% YoY increase.

(Source: Global FCEV Monthly Tracker – July 2024, SNE Research)

Since reaching the pinnacle in 2022, the FCEV market exhibited a 20.7% degrowth in 2023, and the trend of degrowth has deepened this year. In the Korean domestic market, which has remained at the top of the list in terms of hydrogen vehicle market share, saw a continuous decline in sales, leading to a reduction in the overall market scale. The fluctuating price of hydrogen; increasing cost of charging; and shortage of infrastructure; all of these, hindering consumers’ convenient use of hydrogen vehicles, are deemed as main reasons for such decline in the FCEV market. Unlike the roadmap proposed by the government, distribution of hydrogen vehicles has slowed down and plans of releasing new models are not encouraging, either. Given such circumstances, the Ministry of Environment announced that it would expand the distribution of hydrogen vehicles mainly focusing on commercial vehicles, not passenger cars. It is uncertain that when the FCEV market, of which infrastructure, economic feasibility, and related state policies are not enough, would overcome current, sluggish growth and eventually expand further.