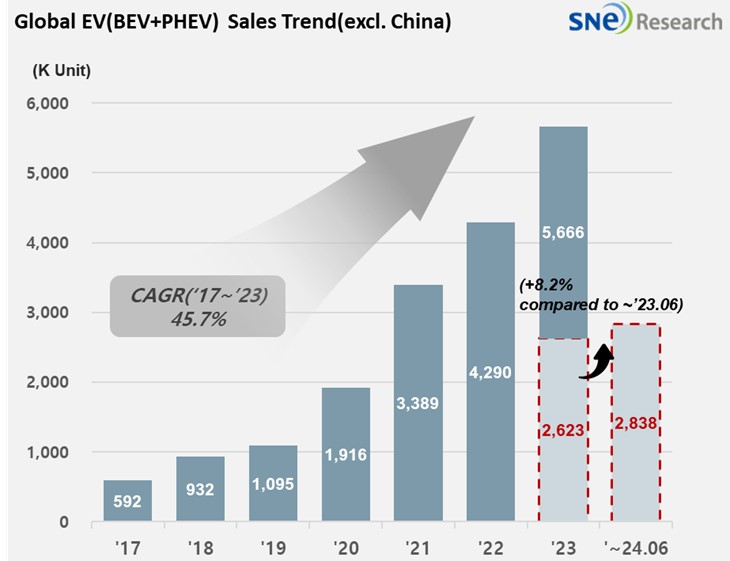

From Jan to June 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded 2.838 Mil Units, a 8.2% YoY Growth

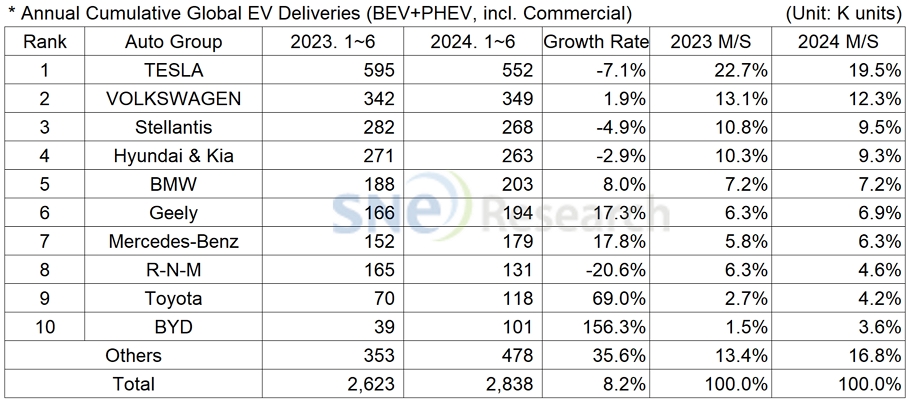

- Tesla ranked No. 1 in non-China EV market but still remaining bearish

From

Jan to June 2024, the total number of electric vehicles registered in countries

around the world except China was approx. 2.838 million units, an 8.2% YoY

increase.

(Source: Global EV & Battery Monthly Tracker – July 2024, SNE Research)

In the non-China market from Jan to June in 2024, Tesla stayed top on the list although it posted a 7.1% YoY degrowth with a decline in sales of Model 3 and Y. The major reason behind degrowth was a reduction in sales of Model Y in Europe and North America.

The Volkswagen Group, where Audi, Porsche, and Skoda belong to, posted a 1.9% YoY growth and ranked 2nd on the list. The Group has been experiencing a YoY decline in sales of ID. Series line-up, but, thanks to solid sales of Audi Q4 e-tron, Q8 e-tron, and Skoda ENYAQ models, it continued to be in an upward trend.

The 3rd place was taken by Stellantis Group with a 4.9% YoY degrowth with sales of both PHEV and BEV declining.

(Source: Global EV & Battery Monthly Tracker – July 2024, SNE Research)

Hyundai Motor Group posted a 2.9% YoY degrowth. Although global sales of KONA Electric, Niro EV, and EV 9 have expanded, Hyundai’s main models – IONIQ 5 and EV 6 – have been sold almost 50% less in the Korean domestic market compared to the same period of last year. Such decrease in their sales seemed to be affected by a slowdown in EV demand and the timing when the Korean government finalized the EV subsidy policy earlier this year. On the other hand, sales of IONIQ 5 and EV 6 in North America increased significantly. All of this added up to the group achieving sales at a similar level to the same period of last year.

(Source: Global EV & Battery Monthly Tracker – July 2024, SNE Research)

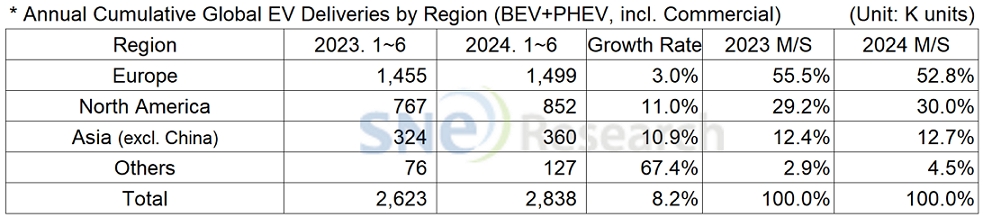

By region, the European market posted a 3.0% growth but accounting for more than half of the non-China market share. While Volkwagen, BMW, and Mercedes all recorded sales at a similar level to those from the same period of last year, Tesla and Stellantis saw a decline in their sales, holding back the growth of EV market in Europe. What’s noteworthy is that Volvo EX 30 by Geely was successfully received in the European as it entered the best seller list as soon as it was launched. BYD has been also exerting efforts to expand its sales based on price competitiveness, leading to an expectation that the Chinese OEMs would rapidly increase their shares in the European market.

On the other hand, North America, where high growth in the EV market was expected from earlier this year, seemed to be struggling with Tesla staying in the downward trajectory. However, Tesla is expected to see a rebound in sales as its Model 3 Highland becomes eligible for tax credits offered under the IRA. While Tesla showed a sluggish performance, Hyundai Motor Group sold approx. 97k units in the North American market, posting about 54% YoY growth. Stellantis, Ford, and Toyota also showed a growth.

In Asia (excl. China), BYD and SAIC Group enjoyed a significant growth in sales in Thailand and South America, posting a 49% and 106% YoY growth in sales, respectively. Toyota’s sales have been expanding, mostly centered on PHEV, thanks to the successful launch of Crown and steady sales of Prius.

As the rate of electrification in the non-China market has slowed down, the speed of local ramp-up in Europe and North America has been also adjusted. While global OEMs have turned from aggressive strategies to alternative one with more flexibility in order to respond to the market changes, the Chinese OEMs have become more proactive in entering Europe as well as new markets in South America and Australia. As it is expected that other countries than the US and Europe would take protectionist measures as well and actively promote production on their own soil, companies, whose financial structure is not strong enough to weather through this global market changes, are expected to face inevitable restructuring.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.