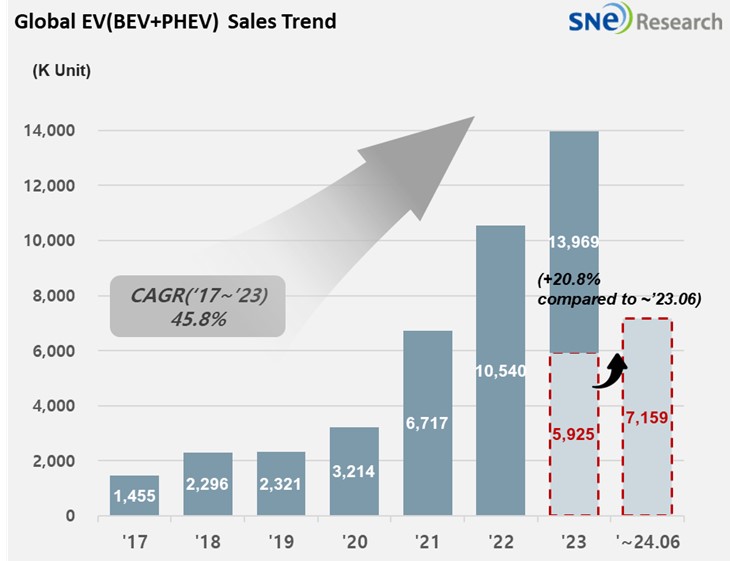

From Jan to June 2024, Global[1] Electric Vehicle Deliveries[2] Posted Approx. 7.159 Mil Units, a 20.8% YoY Growth

- In 2024 1H, BYD ranked No. 1 and Tesla was bearish

From

Jan to June 2024, the number of electric vehicles registered in countries

around the world was approximately 7.159 million units, a 20.8% YoY increase.

(Source: Global EV and Battery Monthly Tracker – July 2024, SNE Research)

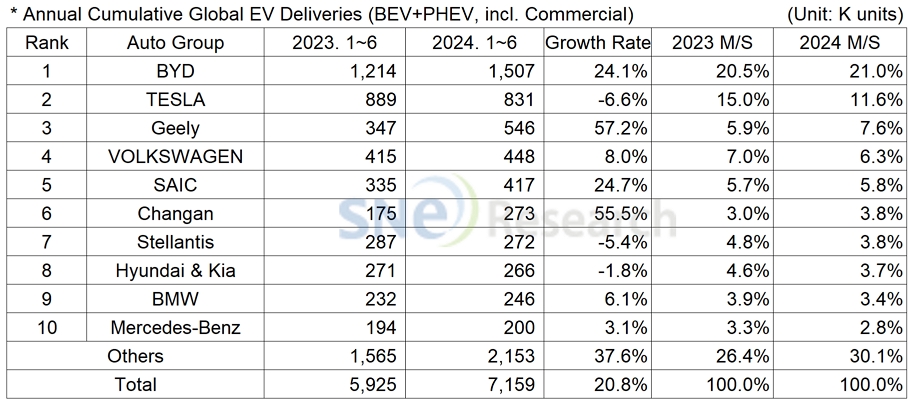

If we look at the global EV sales by major OEMs from Jan to June 2024, BYD kept the top position in the ranking, posting a 24.1% YoY growth. The sales of Song(宋), Seagull (海鸥), and Dolphin (海豚) were all favorable again last month. BYD has continuously expanded its market share by offering a broad range of options to customers especially in the Chinese market through its sub-brands such as Denza(腾势) and Yangwang(仰望) and also based on a variety of segments that it offers. BYD has been taking a two-track approach to take the leading position in the market; one, taking advantage of its price competitiveness in areas where the electrification rate of local OEMs is relatively slow such as Europe, the ASEAN-5 region, and South America; the other, building local production facilities in areas where no tariff walls exist. The number of BYD’s BEV sold, excluding PHEV, was approximately 697k units, which almost reached to a similar level as Tesla of which sales consist of 100% BEVs.

Tesla ranked 2nd on the list, posting a 6.6% YoY degrowth, with sales of its main vehicles – Model 3 and Y – declining. Recently, Tesla has been reported to decrease the production of Model Y at its Shanghai Gigafactory at least 20% in order to respond to a slowdown in demand for Model Y in the Chinese market. While new vehicles models have been continuously launched in various segments when the EV market was rapidly growing, Tesla was not quick enough to prepare for its new models, which inevitably narrowed a gap between Tesla and other car makers.

The 3rd place was taken by Geely Group. ZEEKR 001, by Geely’s premium brand ZEEKR (极氪), and its light EV model, Panda (熊猫) Mini, were sold more than 110k units in the Chinese domestic market. In other markets than China, Geely Group has been rapidly expanding its global market share mainly led by Volvo and Polestar. The group launched sub-brands such as Galaxy (银河) and LYNK & CO (领克) to intensively target the medium/premium market by diversifying its portfolio.

(Source: Global EV and Battery Monthly Tracker – July 2024, SNE Research)

Hyundai Motor Group sold approx. 266k units but recording a 1.8% YoY degrowth. Although sales of KONA Electric, Niro EV, and EV9 have expanded, the existing major models such as IONIQ 5 and EV6 were sold less than the same period of last year. As the Group launched Casper Electric and EV3, to which battery made by HLI Green Power – the group’s Indonesian joint venture with LG Energy Solution – is installed, it is expected to lead the popularization of electric vehicles by aptly meeting the needs of consumers who have been hesitating to choose EVs over vehicles with internal combustion engine.

(Source: Global EV and Battery Monthly Tracker – July 2024, SNE Research)

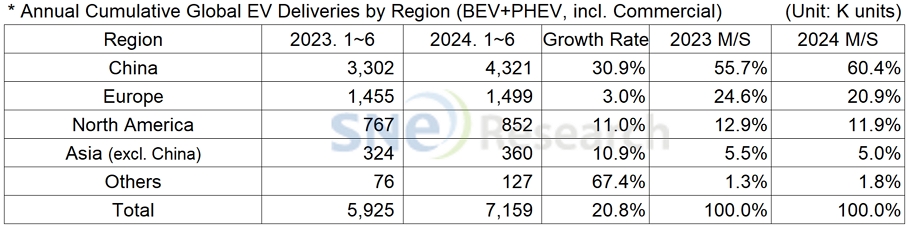

By region, China, which accounted for 60.4% of market share, firmly stayed No. 1 as the world’s biggest EV market. Following the US, Europe also released tariff guidelines on the import of Chinese electric vehicles. BYD and CHERY are expected to deviate from the tariffs by establishing local production systems and to diversify their export partners.

In Europe, the electrification rate has been adjusted as the Euro 7 regulation relaxed in consideration of local EV demand slowdown and OEMs’ concerns about profit reduction. All of these bottlenecks are expected to be removed around 2025 when the CO2 regulations are strengthened and newly-launched vehicles create new momentum for the market.

On the other hand, North America, where high growth in the EV market was forecasted from earlier this year, seemed to go through another downward adjustment with growing uncertainties around the US Presidential election. Despite the IRA, the US EV market has been obviously slowing down, making OEMs postpone or terminate their ramp-up plans. Instead, those OEMs are now modifying their strategies to increase the ratios of ICE vehicles and hybrid models.

Unlike China, where the EV market has steadily been growing based on state policies to promote the purchase of electric vehicles and the renewal of equipment, Europe and the US have witnessed a significant reduction in the EV market growth under the government policies that are completely opposite to those of China. In response to the relaxation of regulations on CO2 emissions in Europe and the US as well as upcoming Presidential election in the US, OEMs announced that they would add more flexibility to their market strategies rather than sticking to their previous, aggressive ramp-up plans. Given the global economic crisis, weakened consumer confidence, and lead time required before local production, regions other than China are highly likely to see a lower growth in their 2024 EV markets than previously expected.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.