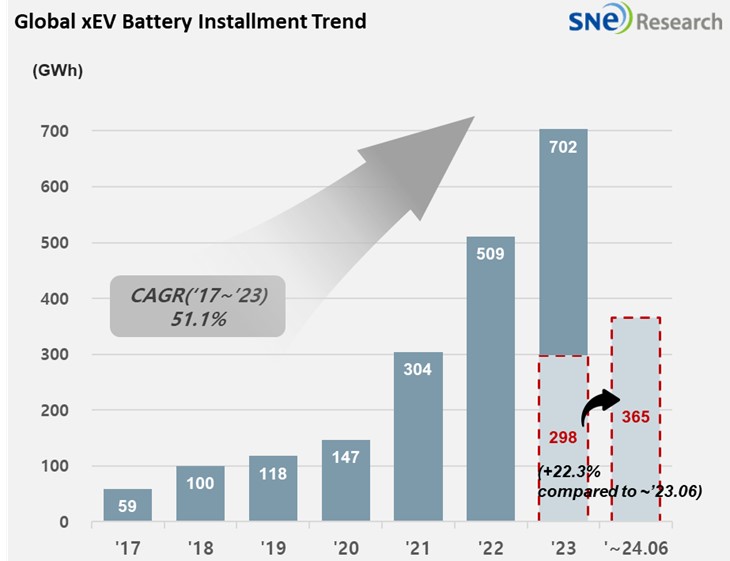

From Jan to June 2024, Global[1] EV Battery Usage[2] Posted 364.6GWh, a 22.3% YoY Growth

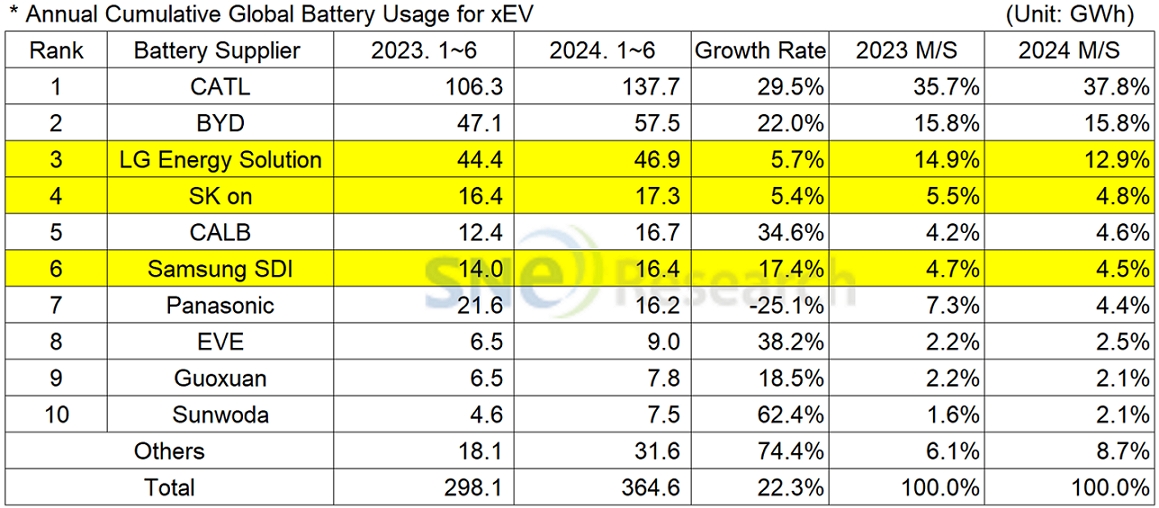

- From Jan to June 2024, K-trio’s M/S accounted for 22.1%.

From January to June 2024, the amount of energy held by

batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was

approximately 364.6GWh, a 22.3% YoY growth.

(Source: 2024 July Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined usage of batteries made by the K-trio companies for electric vehicles in the 1st half of 2024 were higher than that from the same period of last year. LG Energy Solution ranked 3rd with a 5.7% (46.9GWh) YoY growth, while SK On took the 4th place with a 5.4% (17.3GWh) YoY growth. Samsung SDI posted the highest YoY growth among the K-trio companies with 17.4% (16.4GWh). On the other hand, the combined market shares of K-trio were 22.1%, declined by 3.0%p compared to the same period of last year.

(Source: 2024 July Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio, the growth in battery usage by Samsung SDI was favorably affected by solid sales of BMW’s EV line-up such as i4, i5, i7, and iX, Audi Q8 e-Tron, and JEEP Wranlger PHEV in Europe as well as high sales of Rivian R1T/R1S in North America. Samsung SDI saw almost 40% decline in its operating profit in the 2nd quarter of this year due to the chasm phase that the EV market has been recently facing. However, as it is expected that demand for electric vehicle battery would recover within the 4th quarter of this year, Samsung SDI forecasted that the battery industry would eventually achieve high growth in the mid to long term although it could be possible to see delays in recovery of battery demand for electric vehicles. Against this backdrop, Samsung announced that it would maintain the size of its CAPEX unlike other battery makers postponing or reducing their investments in production. Samsung SDI also has a plan to further attract new clients, expand the production of P6 battery in the States, and prepare for mass production of 46-pi cylindrical battery as well as LFP battery.

SK On saw a gradual growth in its battery usage as Hyundai’s IONIQ 5 and EV 6, of which sales showed poor performance earlier this year, rebounded in the 1st half of this year and posted sales similar to that from the same period of last year. Both IONIQ 5 and EV6, to which the 4th generation battery by SK On is installed, have had their facelift versions launched in the market, which led to an expectation that their global sales would gradually increase, together with EV9. Other than these Korean EV models, Ford F-150 and Mercedes EQA/B, for which SK On’s battery is used, posted solid sales. Since its foundation, SK On has been in red for 11 consecutive quarters as of the 2nd quarter this year. The battery maker announced that it experienced operating losses worth of KRW 460.1 billion due to reduced operation rates in factories affected by slowdown in the EV market as well as increases in initial costs with its new factory in Hungary operating. As SK On expected that EV demand would recover in the latter half of this year with possible downward stabilization of metal price and expansion of new EV model lineups, it announced to reach the breakeven point within the second half through cost reduction activities.

LG Energy Solution’s growth was led by solid sales of popular models in Europe and North America such as Tesla Model 3/Y, Volkswagen ID.4, Ford Mustang Mach-E, GM Cadillac LYRIQ. Particularly, the sales volume of Tesla Model 3, which momentarily slowed down while going through the facelift process, has significantly increased, leading to a huge increase in the usage of LGES battery. Recently, new models, to which batteries made by the joint ventures between LG Energy Solution and global OEMs are installed, have been released in the market For instance, KIA’s compact SUV EV3 and Hyundai Casper Electric were officially launched and delivered to customers. Both of them are equipped with NCMA battery cell, manufactured by HLI Green Power – an Indonesia joint venture between LGES and Hyundai Motor Group. HLI Green Power, starting its operation last April and currently mass-producing battery products without any disruption, is expected to meet the rapidly increasing need for electric vehicles in the ASEAN region as a new production base in Asia. LG Energy Solution felt pressures from fixed cost when the operation rates in its European plants dropped after the demand for electric vehicles declined in the 2nd quarter of this year. However, good news was released in North America, saying that the tax credits offered under the IRA have increased more than double. Thanks to such favorable changes in the North American market, LGES announced that it managed to earn the operating profit of KRW 195.3 billion, a 24.2% QoQ. LG Energy Solution forecasted that, as consumer sentiment weakened after the trend of high interest rates prolonged and uncertainties in the market still lingered such as possibilities in slowing down the pace of electrification by major OEMs, the market conditions lying ahead would be touch for battery makers. In this regard, LGES foresaw that its annual sales in 2024 would decline more than 20% compared to last year. Despite such difficulties in the business environment, however, LGES placed an emphasis on that it would continue to exert its efforts to increase sales by expanding battery shipment to new models made by major OEMs in North America and Europe; meeting the need from IT product companies for their premium-line products; and expanding sales of ESS for grid.

Panasonic, the only Japanese company in the top 10 on the list, recorded 16.2GWh from Jan to June this year, ranking 7th on the list but recording a 25.1% YoY degrowth. The major reason for Panasonic’s degrowth was a slowdown in sales of Tesla Model 3 due to its transformation to the facelifted version. As sales of Model 3 have recently expanded and Panasonic was reported to launch advanced 2170 and 4680 cells supplied to Tesla, Panasonic is expected to rapidly regain its market share mainly focusing on Tesla.

CATL, firmly holding the global No. 1 position, recorded a 29.5% (137.7GWh) YoY growth. While major OEMs such as ZEEKR, AITO, and Ideal in the Chinese domestic market – the world’s largest electric vehicle market – have CATL’s battery inside, global major OEMs have also chosen CATL’s battery for their vehicles such as Tesla Model 3/Y, BMW iX, Mercedes EQ series, and VW ID series. Although CATL saw a 13.2% YoY decline in sales of the 2nd quarter this year, recording RMB 87 billion, the net profit was RMB 12.36 billion, a 13.4% YoY increase. It was the third-highest profitability that CATL achieved since its foundation. In last April, CATL introduced high-performance LFP battery Shenxing Plus, and it is scheduled to launch its new NCM product, Qilin. With both of the new products already decided to particular vehicles after launching, CATL is expected to further increase its share in the Chinese domestic market.

BYD, ranked 2nd on the global list with a 22.0%(57.5GWh) YoY growth. Amidst the increasing competition among global OEMs for hybrid technologies, BYD has been aggressively targeting the BEV and PHEV markets by launching a new, hybrid vehicle which can drive 2,100km per charge. Attentions should be paid to BYD, who has been breaking its sales record every quarter, whether it can eventually outrun Tesla in terms of BEV sales.

(Source: 2024 July Global Monthly EV and Battery Monthly Tracker, SNE Research)

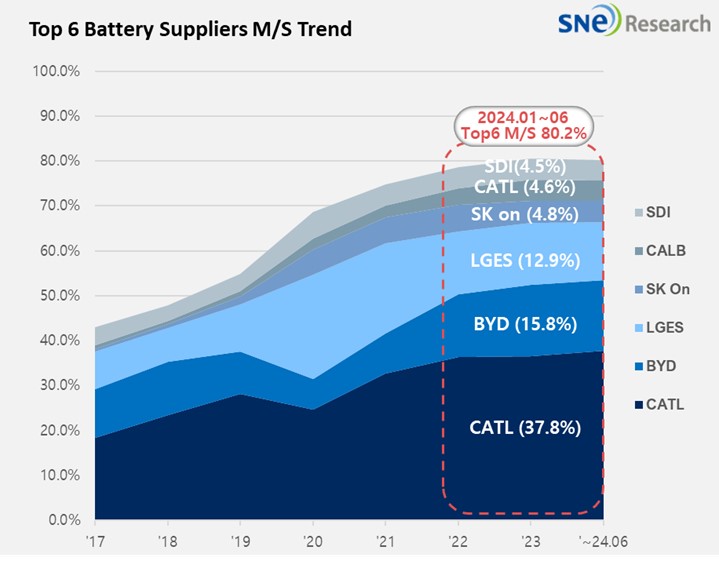

While the global EV battery market has maintained its growth at around 20% in the 1st half of 2024, the K-trio battery makers’ market shares combined have been in a downward trend. Such a downtrend seems to be mainly affected by the fact that a slowdown in demand for electric vehicles has not been resolved yet. From the 2nd half of this year, however, it is expected that metal prices, which have a significant impact on the price of cathode, would go through downward stabilization, and the market would recover with new EV line-ups helping relieve the slowdown in demand. In the meantime, the Chinese companies have continued to grow even in this chasm period based on a steady growth of EV sales in the Chinese domestic market where the government promotes the large-scale renewal of equipment and trade-ins of consumer goods. In addition, the adoption of LFP battery in regions other than China has expanded, which has become more favorable to the Chinese battery manufacturers. On the other hand, the US and Europe declared to take protectionist measures against those electric vehicles made in China, which may benefit the Korean battery manufacturers instead.

[2] Based on battery installation for xEV registered during the relevant period.