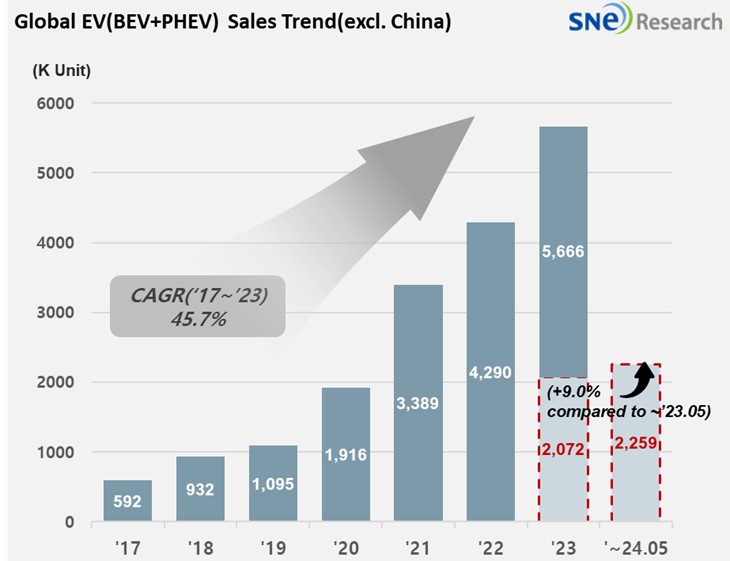

From Jan to May 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded 2.259 Mil Units, a 9.0% YoY Growth

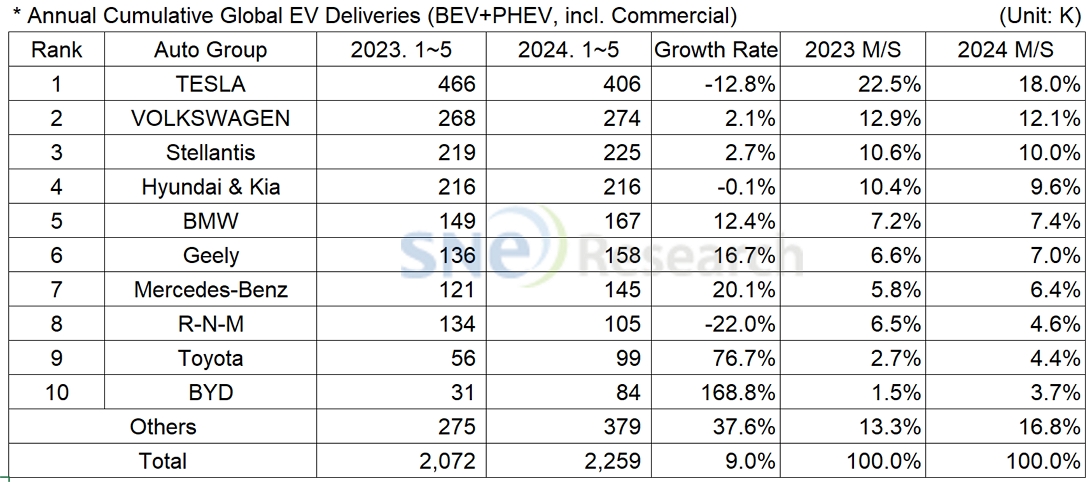

- Tesla ranked No. 1 despite of being in downward trajectory

From

Jan to May in 2024, the total number of electric vehicles registered in

countries around the world except China was approx. 2.259 million units, a 9.0%

YoY increase.

(Source: Global EV & Battery Monthly Tracker – June 2024, SNE Research)

In the non-China market from Jan to May in 2024, Tesla still remained No. 1 although it posted a degrowth. Tesla showed a 12.8% YoY degrowth with a decline in sales of Model 3 and Y. To be specific, in Europe and North America, Tesla saw approx. 16% decline in sales, respectively, compared to the same period of last year. Particularly in North America, the sale of Model 3 dropped significantly, which can be regarded as a major reason for the degrowth.

The Volkswagen Group, where Audi and Skoda belong to, posted a 2.1% YoY growth and ranked 2nd on the list. The Group has been experiencing a YoY decline in sale of ID. Series line-up, but, thanks to solid sales of Audi Q4 e-tron, Q8 e-tron, and Skona ENYAQ models, it managed to be in an upward trend.

The 3rd place was captured by Stellantis Group with a 2.7% growth based on favorable sales of both BEV and PHEV models such as Peugeot e-208, Fiat 500e, Jeep Wrangler 4xe, and Grand Cherokee 4xe.

(Source: Global EV & Battery Monthly Tracker – June 2024, SNE Research)

Hyundai Motor Group showed a similar performance to the same period of last year. Although the sales of Hyundai’s main models – IONIQ and EV 6 – slowed down a bit compared to the previous year, KONA Electric and Niro EV saw a positive sign in their sales and the global sales of EV 9 expanded. Not only in the BEV line-up but also in the PHEV line-up, Sportage and Tuscon also enjoyed solid sales. As the group launched Casper Electric and EV 3, to which battery made by HLI Green Power – the group’s Indonesian joint venture with LG Energy Solution – is installed, it is expected to lead the popularization of electric vehicles by aptly meeting the needs of consumers who have been hesitating to choose EVs over vehicles with internal combustion engine.

(Source: Global EV & Battery Monthly Tracker – June 2024, SNE Research)

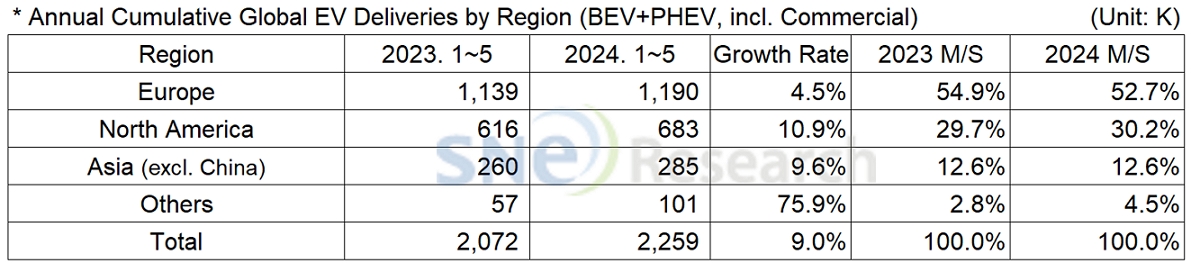

By region, the European market posted a 4.5% growth, accounting for more than half of the non-China market share. Volkswagen, BMW, and Hyundai Motor Group all recorded a similar sales to the same period of last year, but, with Tesla and Stellantis experiencing a degrowth, the growth of EV market in Europe seems to hit speed bumps recently. What’s noteworthy is that Volvo EX 30 by Geely was successfully received in the European as it entered the best seller list as soon as it was launched. BYD has been also exerting efforts to expand its sales based on price competitiveness, leading to an expectation that the Chinese OEMs would rapidly increase their shares in the European market.

On the other hand, North America, where high growth in the EV market was expected from earlier this year, seemed to be struggling with Tesla staying in the downward trajectory. However, Tesla is expected to see a rebound in sales as its Model 3 Highland becomes eligible for tax credits offered under the IRA. While Tesla showed a sluggish performance, Hyundai Motor Group sold approx. 80k units in the North American market, posting about a 65% YoY growth. Stellantis, Ford, and Toyota also showed a growth.

In Asia (excl. China), BYD and SAIC Group enjoyed a significant growth in sales in Thailand and South America, posting a 58.1% and 103.3% YoY growth in sales, respectively. Toyota’s sales have been expanding, mostly centered on PHEV, thanks to the successful launch of Crown and steady sales of Prius.

Recently, the situation in Europe and the US is almost like a tariff war waged against China as Europe decided to impose additional tariffs on electric vehicles made in China. The Chinese EV manufacturers have been expanding their export to avoid competitions in the Chinese domestic market which has already saturated. As the Chinse electric vehicles, equipped with price competitiveness, have threatened the EV industry around the world, the trade barrier is getting higher and higher. In this regard, the Chinese EV makers have been trying to find a new path in South America and Australia by establishing local production facilities to evade from tariff barriers. Particularly Brazil, the biggest economy in the South American region, emerged as a new market where a significant volume of vehicles was imported from China.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.