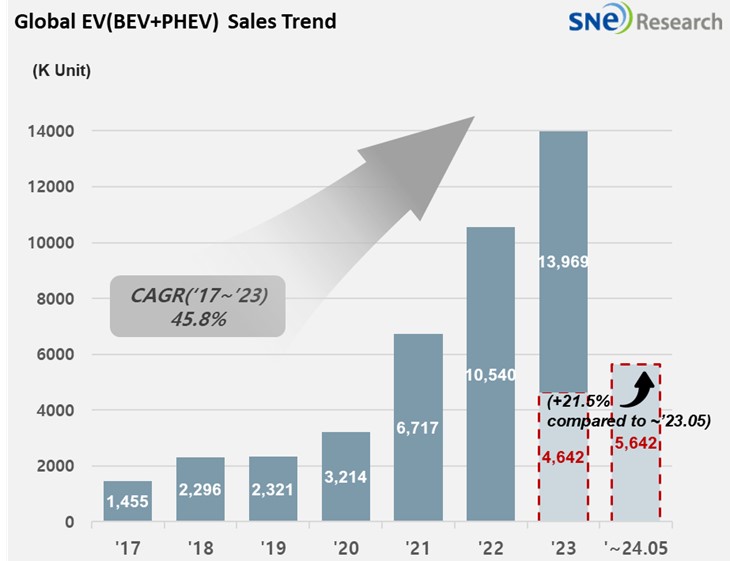

From Jan to May 2024, Global[1] Electric Vehicle Deliveries[2] Posted Approx. 5.642 Mil Units, a 21.5% YoY Growth.

- BYD stayed No. 1; Tesla remained bearish

From

Jan to May 2024, the number of electric vehicles registered in countries around

the world was approximately 5.642 million units, a 21.5% YoY increase.

(Source: Global EV and Battery Monthly Tracker – June 2024, SNE Research)

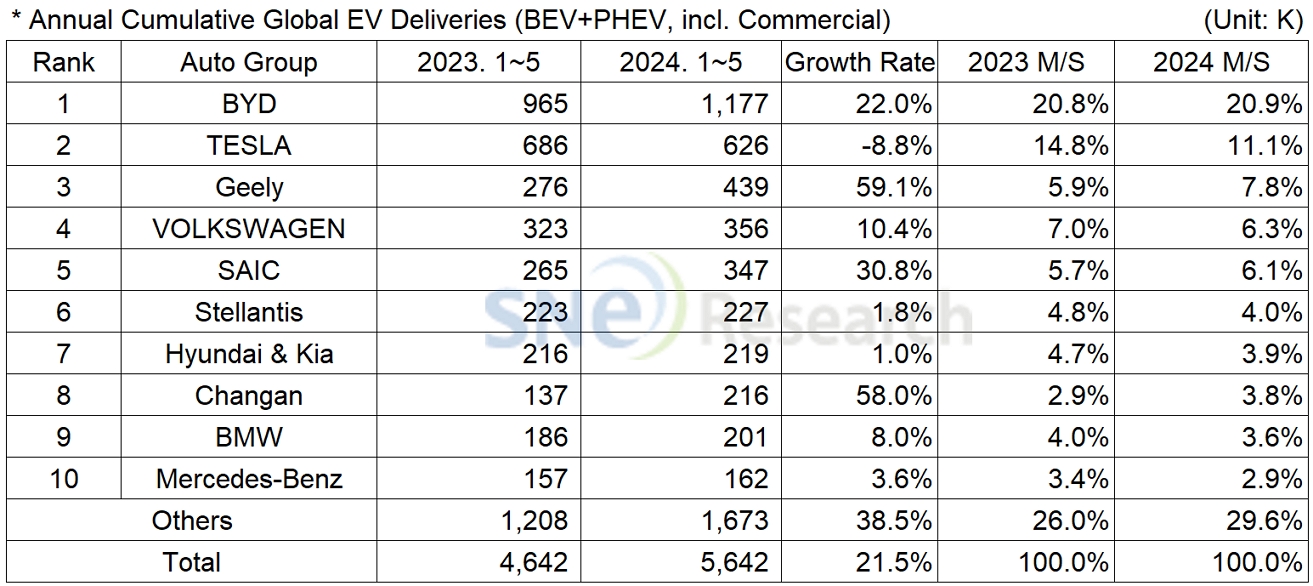

If we look at the global EV sales by major OEMs from Jan to May 2024, BYD continued to be on the global top position, recording a 22.0% YoY growth. The sales of Song(宋), Seagull (海鸥), and Dolphin (海豚) were all favorable again last month. BYD has continuously expanded its market share by offering a broad range of options to customers especially in the Chinese market through its sub-brands such as Denza(腾势) and Yangwang(仰望) and also based on a variety of segments that it offers. BYD has been taking a two-track approach to take the leading position in the market; one, taking advantage of its price competitiveness in areas where the electrification rate of local OEMs is relatively slow such as Europe, the ASEAN-5 region, and South America; the other, building local production facilities in areas where no tariff walls exist. The number of BYD’s BEV sold, excluding PHEV, was approximately 554k units, which almost reached to a similar level as Tesla of which sales all 100% consist of BEVs.

Tesla ranked 2nd, posting a 8.8% YoY degrowth with reduced sales of its main line-ups, Model 3 and Y. It has been reported that Tesla would reduce the production of Model Y at its Shanghai factory by at least 20 percent in an effort to deal with a slowdown in demand for Model Y in the Chinese market.

During the rapid growth phase of EV market, new models from different segments have been continuously released. On the other hand, Tesla has released its new models slower than other car makers. This has made Tesla, whose about 90 percent of total sales consists of those of Model 3 and Y, witness its gap with other companies gradually narrowing.

The 3rd place was captured by Geely Group. ZEEKR (极氪), the premium brand of Geely, saw more than 40k units of ZEEKR 001 sold as well as over 40k units of its light EV model, Panda (熊猫) Mini in the Chinese domestic market. In other markets than China, Geely Group has been rapidly expanding its global market share, led by Volvo and Polestar. The group launched sub-brands such as Galaxy (银河) and LYNK & CO (领克) to intensively target the medium/premium market by diversifying its portfolio.

(Source: Global EV and Battery Monthly Tracker – June 2024, SNE Research)

Hyundai Motor Group sold approx. 219k units, recording a 1.0% YoY growth. Although the sales of its main models – IONIQ 5 and EV6 – were slower compared to the last year, Hyundai was able to escape from the degrowth of last month thanks to favorable sales of KONA Electric and Niro EV as well as global expansion of EV 9 sales. As the group launched Casper Electric and EV 3, to which battery made by HLI Green Power – the group’s Indonesian joint venture with LG Energy Solution – is installed, it is expected to lead the popularization of electric vehicles by aptly meeting the needs of consumers who have been hesitating to choose EVs over vehicles with internal combustion engine.

(Source: Global EV and Battery Monthly Tracker – June 2024, SNE Research)

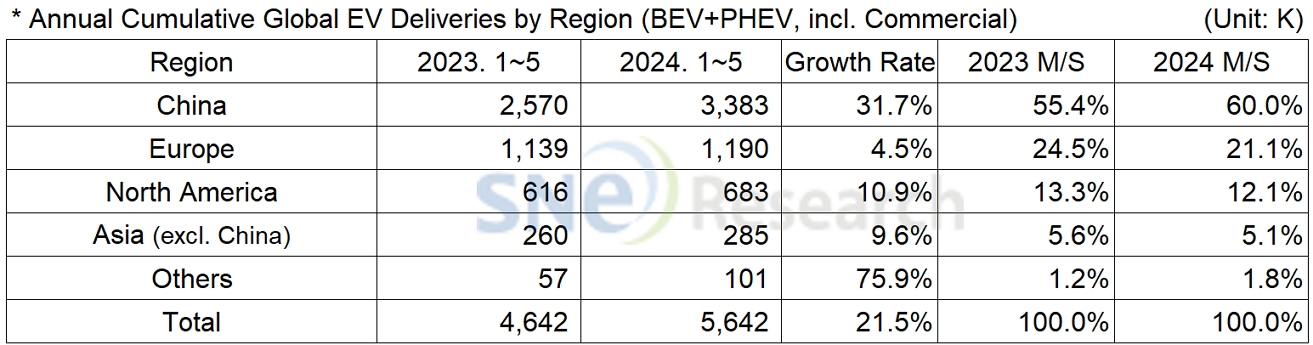

By region, China firmly stayed No. 1 as the world’s biggest EV market, accounting for 60.0% of market share. Following the US, Europe has also recently announced the imposition of tariffs on Chinese electric vehicles. While some of the Chinese car makers such as BYD and CHERY are expected to avoid tariff barriers by establishing their local manufacturing system, Chinese start-ups seem to face the crisis of restructuring sooner than expected in the Chinese EV market which has almost saturated.

In Europe, the electrification rate has been adjusted as the Euro 7 regulation relaxed in consideration of local EV demand slowdown and OEMs’ concerns about profit reduction. Against this backdrop, the existing vehicle line-ups have been suffering from deterioration, which is expected to be addressed in 2025 when the CO₂ regulations are strengthened and new vehicle models are expected to bring about momentum in the market.

On the other hand, North America, where high growth in the EV market was expected from earlier this year, seemed to be struggling with Tesla staying in the downward trajectory. However, Tesla is expected to see a rebound in sales as its Model 3 Highland becomes eligible for tax credits offered under the IRA. Tesla is also planning for a new light EV project called ‘Redwood’ as well as the facelift of Model Y. All of these make us pay attention to whether Tesla can be leading the growth of North American EV market again.

With the EV market going through a chasm phase, OEMs postponed their electrification plans, leading to deterioration of their major EV line-ups. To name a few, Tesla’s Model S, 3, X, and Y, and VW’s ID series are those EV line-ups to be regarded as old, sooner or later. It seems necessary to establish measures to address deteriorating EV line-ups, boost the consumer confidence, and promote the popularization of electric vehicles with aptly-developed, new line-ups.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.