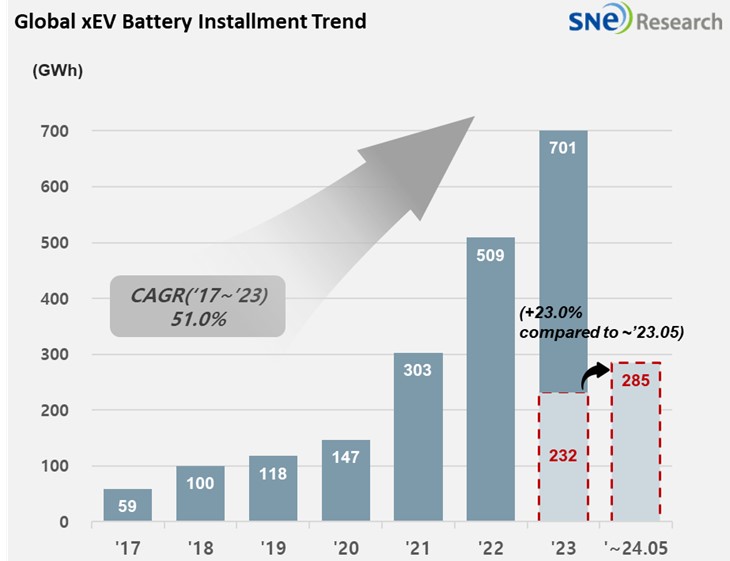

From Jan to May 2024, Global[1] EV Battery Usage[2] Posted 285.4GWh, a 23.0% YoY Growth

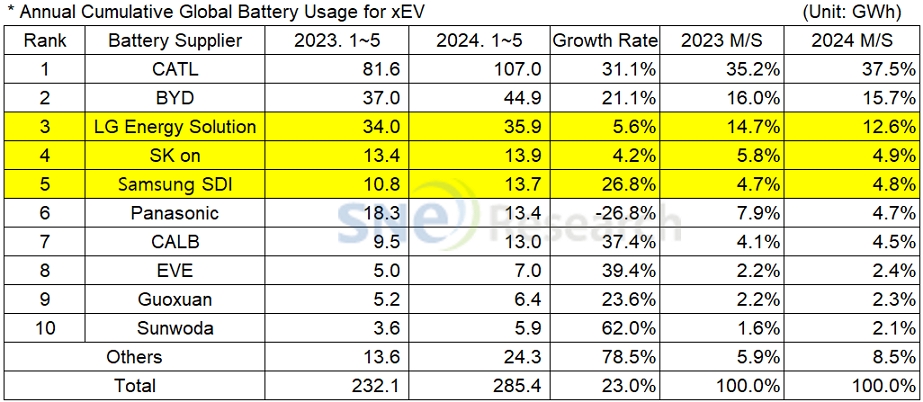

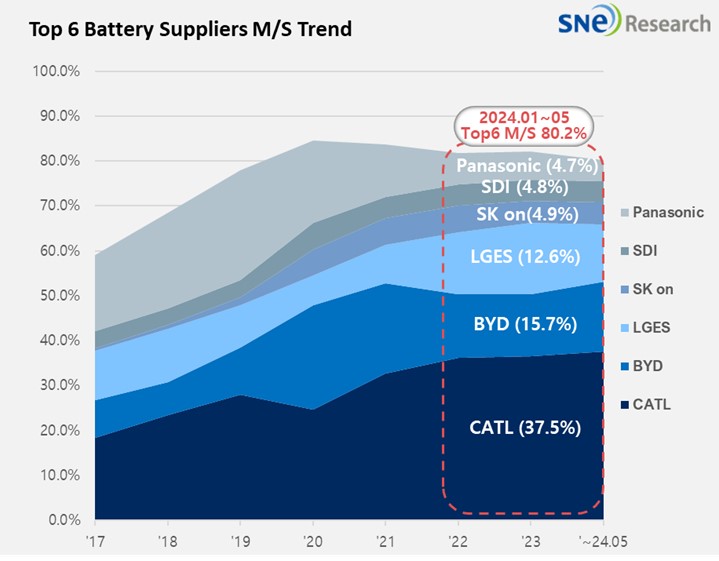

- From Jan to May 2024, K-trio’s M/S accounted for 22.3%

From January to March 2024, the amount of energy held by batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 285.4GWh, a 23.0% YoY growth.

(Source: 2024 June Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of K-trio companies were 22.3%, declined by 2.8%p compared to the same period of last year. LG Energy Solution ranked 3rd with a 5.6% (35.9GWh) YoY growth, while Samsung SDI posted the highest growth of 26.8% (13.7GWh) among the K-trio companies. With SK On recording a 4.2% growth (13.9GWh), all three Korean makers exhibited a noteworthy growth.

(Source: 2024 June Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio, Samsung SDI remained in an upward trajectory based on solid sales of BMW i4/X/5 and Audi Q8 e-Tron in Europe and strong sales of Rivian R1T/R1S in North America. Samsung SDI, targeting the premium EV battery market for BEV and PHEV, started supplying P6 along with its high-value-added battery P5, announcing that it would be greatly helpful to enhance the overall profitability of its vehicle battery group from Q2 this year.

SK On registered a growth thanks to growing sales of Ford F-150, KIA EV 9, and Mercedes EQ Series in North America despite a YoY decline in sales of Hyundai IONIQ 5 and EV 6. As the major two models – IONIQ 5 and EV 6 – all welcomed their facelifted versions to which SK On’s 4th-generation battery is installed, SK On is expected to see a rebound in its battery sales from Q2. SK On is scheduled to retool its Ford-dedicated battery production line at Plant 2 in the state of George for Hyundai within this year and to start operating the Plant 3 in Hungary with 30GWh capacity. Through these efforts, SK On aims to turning into profit making in the latter half of this year.

LG Energy Solution’s growth was led by solid sales of highly popular models in Europe and North America such as Tesla Model 3/Y, Ford Mustang Mach-E, and Hyundai IONIQ 6. Recently, new models, to which batteries made by the joint ventures between LG Energy Solution and global OEMs are installed, have been released in the market. For instance, KIA’s compact SUV EV3 was officially launched with NCMA battery cell, manufactured by HLI Green Power – an Indonesia joint venture between LGES and Hyundai Motor Group, installed inside. In addition, KIA’s sedan EV 4, scheduled to be released early next year, is expected to have the battery made by HLI Green Power inside. GM’s Cadillac LYRIQ, released in the Korean market last month, also has NCMA battery cell by Ultium Cells, a joint venture between LGES and GM. With a large 102kWh battery pack installed, it can drive up to 465km on a full charge. As the 2nd Ultium Cells plant is planned to increase its production and a new model from GM on the Ultium platform is set to launch in the market, LG Energy Solution is forecasted to lead the battery sector in the North American market with its ternary battery meeting the IRA regulations.

Panasonic, the only Japanese company in the top 10 on the list, recorded 13.4GWh from Jan to May this year and ranked 6th on the list, but recording a 26.8% YoY degrowth. Major reasons for Panasonic’s degrowth were a slowdown in sales of Tesla Model 3 due to its partial change and the delayed release of Model 3 Performance trim to which Panasonic’s battery is installed. Currently, it is highly likely that Tesla would use Panasonic’s battery for specific trims to benefit from the US IRA regulations, but Panasonic, on the other hand, announced that it would turn to both North America and Japan rather than focusing on North America only. In fact, Panasonic lowered its forecast on the 2030 EV penetration rate from 50% to 30%, and it seemed to take a strategic withdrawal from its previous plan focusing on North America.

CATL, keeping the global top position, recorded a 31.1%(107.0GWh) YoY growth. By supplying its battery to major brands’ vehicles such as ZEEKR, AITO, and Ideal in the Chinese domestic market as well as to global major OEMs’ vehicles including Tesla Model 3/Y, BMW iX, Mercedes EQ series, and VW ID series, CATL was the only battery maker who accounted for over 30% market share among others.

BYD, which successfully maintained solid sales after a temporary drop in sales due to the influence of Chinse New Year holidays, captured the 2nd place on the list with a 21.1%(44.9GWh) growth. Amidst the increasing competition for hybrid technology among global OEMs, BYD released a new hybrid vehicle that can drive 2,100km per charge, effectively targeting the BEV and PHEV markets.

(Source: 2024 June Global Monthly EV and Battery Monthly Tracker, SNE Research)

While a slowdown in the growth of EV market has continued in regions other than China, there have been growing uncertainty in major regions such as Europe and the US. In case of Europe, the Chinese car makers are going to pay countervailing duties, and in the US, the upcoming Presidential election is looming as one of the biggest uncertainties in the industry. As Europe, following the US, started keeping China from the EV industry, those leading Chinese makers are expected to face hurdles in entering overseas markets, leading to a continuous slowdown in the market growth for a while. Panasonic, referencing the forecast made by the Boston Consulting Group (BCG), revised its projection on the 2030 EV penetration rate in North America from 50% to 30% and announced to transit to a so-called two-pillar strategy focusing both on North America and Japan. Against this backdrop, there have been growing concerns about the K battery makers whose local expansion plans in North America may lead to oversupply in the region. Although there are plans for new model releases, local production expansion, regulation reinforcement in the next few years, with the protectionism measures against the Chinese companies in different regions, the growth of EV industry in areas other than China is expected to be lower than previously forecasted before the supply chain and manufacturing plants are in full swing in Europe and the US.

[2] Based on battery installation for xEV registered during the relevant period.