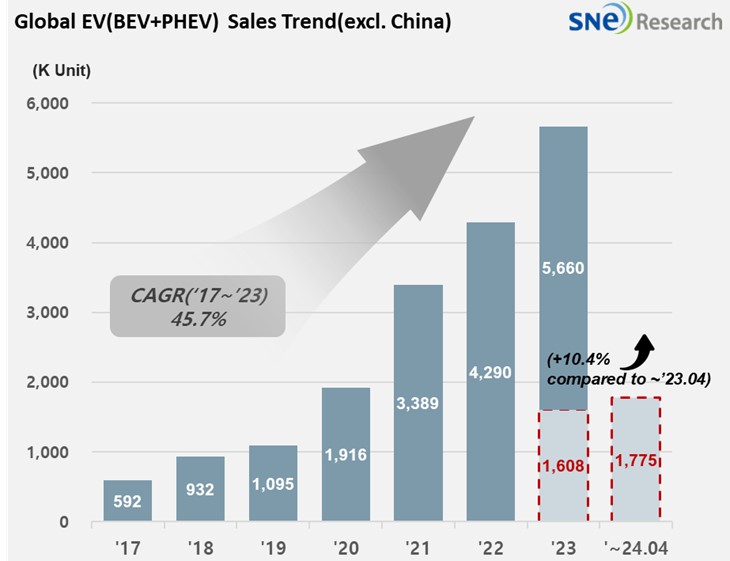

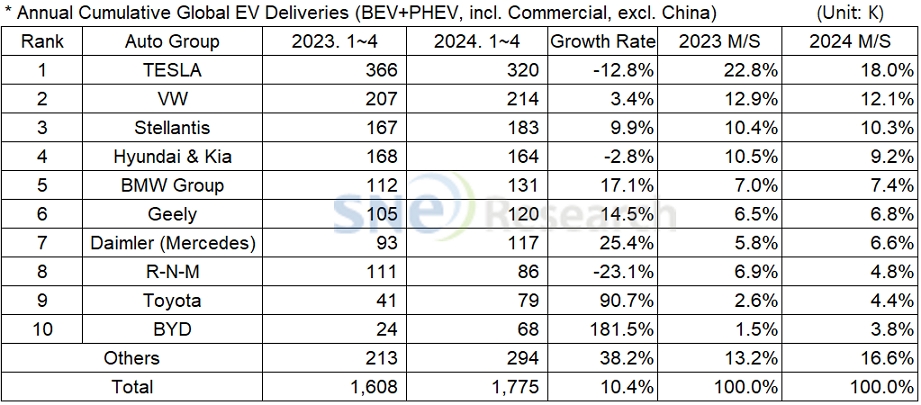

From Jan to Apr 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded 1.775 Mil Units, a 10.4% YoY Growth

- Tesla ranked No. 1 and Hyundai-KIA ranked 4th in the non-China EV market

From

Jan to Mar in 2024, the total number of electric vehicles registered in

countries around the world except China was approx. 1.775 million units, a 10.4%

YoY increase.

(Source: Global EV & Battery Monthly Tracker – May 2024, SNE Research)

In the non-China market from Jan to Apr in 2024, Tesla captured the top position despite of posting a degrowth of 12.8% YoY due to a decreased sale of its main models. Tesla’s degrowth was caused by the following reasons; production issues during the initial stage of Model 3 Highland production at its Fremont factory; an overall slowdown in the non-China market.

The Volkswagen Group, where Audi and Skoda belong to, posted a 3.4% YoY growth and ranked 2nd on the list. The Group continued to be in an upward trend thanks to favorable sales of Volkswagen ID series, Audi Q4 and Q8 E-Tron, and Skoda ENYAQ.

The 3rd place was taken by Stellantis Group with a 9.9% growth, of which BEV and PHEV models, including Peugeot e-208 and Fiat 500e in Europe and Jeep Wrangler 4xe and Grand Cherokee 4xe in North America, were all steadily sold.

(Source: Global EV & Battery Monthly Tracker – May 2024, SNE Research)

Hyundai Motor Group recorded a 2.8% YoY degrowth. While the sales of its main models such as IONIQ 5/6 and EV6 were both sluggish, the global sales of new KONA Electric (SX2 EV) and EV9 expanded and the overseas sales of Sportage and Tuscan PHEV increased, though. KIA announced that it would keep the momentum in sales by successfully launching EV6 facelift model and new EV3 in the latter half of this year. It is noteworthy that Hyundai Motor Group exhibited over 50% of growth in North America where the growth potential of electric vehicles is huge. However, with the entire EV market witnessing a slowdown in growth, the Group delayed its plan to launch EV models about a year, meaning that it would keep the portion of hybrid models in the portfolio high till 2025 and increase that of electric vehicles after 2025.

(Source: Global EV & Battery Monthly Tracker – May 2024, SNE Research)

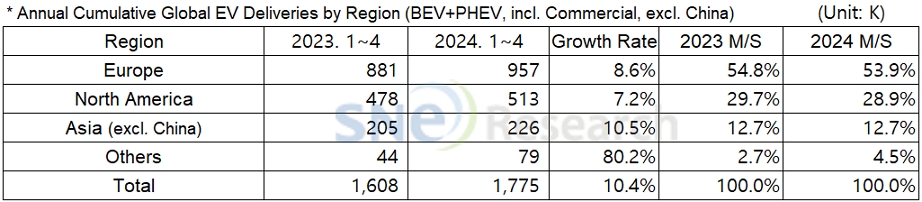

By region, the European market posted 8.6% growth, taking up more than half of the non-China market share. This was mainly led by the favorable sales of local OEMs such as Volkswagen, BMW, and Mercedes. The North American market recorded 7.2% growth driven by the EV sales of Tesla, Stellantis, and Hyundai-KIA. Tesla accounted for 35.7% of the North American market by selling approx. 183k units among the total number of EVs sold, 513k units, in North America. In Asia (excl. China), where 12.7% of global EV sales was made, BYD and SAIC Group saw a rapid increase in their sales in the Southeast Asian region such as Thailand. On the other hand, Hyundai Motor Group experienced a significant drop in their EV sales in Korea, resulting in BYD selling more EVs than Hyundai. Toyota from Japan enjoyed an increase in its EV sales, mainly centered on PHEV, based on successful launch of new Crown and sales of Prius.

As the slowdown in EV market has recently become apparent, OEMs are trying to take alternative strategies related to ICE vehicles and hybrid models instead of persisting in their EV-centered business. On the other hand, those Chinese companies have been accelerating their entry into the global EV markets except North America. BYD has a plan to enter the electric passenger car market in Korea where entry barriers against the Chinese companies are regarded relatively lower than those in the US and India. After the initial demand from early adopters has terminated, the public take a cautious attitude towards electric vehicles considering the price and convenience of electric vehicles. Against this backdrop, the Chinese makers, with high price competitiveness and variety in vehicle line-up, are expected to speed up their entry to overseas markets for the time being.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.