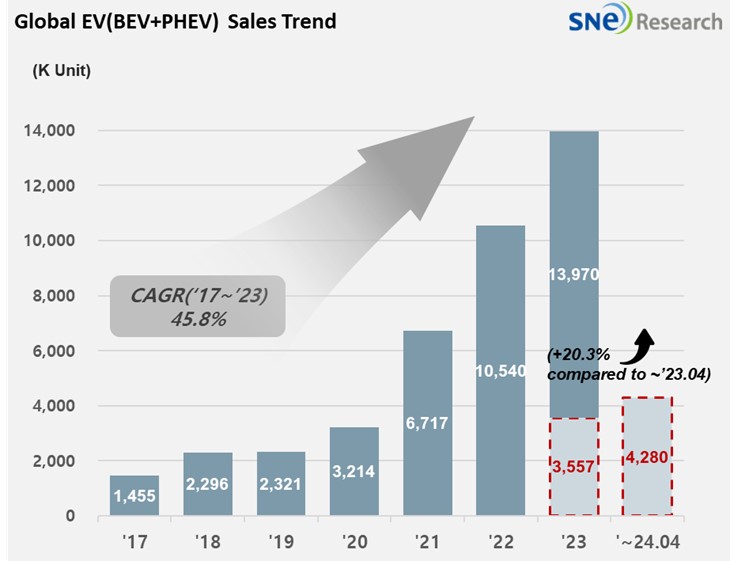

From Jan to Apr 2024, Global[1] Electric Vehicle Deliveries[2] Posted Approx. 4.280 Mil Units, a 20.3% YoY Growth

- BYD maintained the top position; Tesla posted a degrowth

From

Jan to Apr 2024, the number of electric vehicles registered in countries around

the world was approximately 4.280 million units, a 20.3% YoY increase.

(Source: Global EV and Battery Monthly Tracker – May 2024, SNE Research)

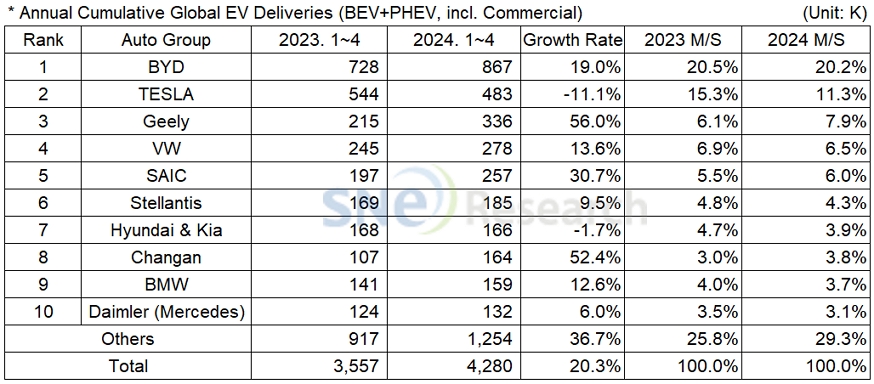

If we look at the global EV sales by major OEMs from Jan to Apr 2024, BYD maintained its top position in the global EV market, recording a 19.0% YoY growth. BYD’s growth was led by favorable sales of Song(宋), Seagull (海鸥), and Dolphin (海豚). BYD has continuously expanded its market share by offering a broad range of options to customers especially in the Chinese market. The number of BYD’s BEV sold, excluding PHEV, was approximately 410k units, and BYD showed a noteworthy, rapid growth in Southeast Asia, South America, and Europe.

Tesla ranked 2nd, posting a 11.1% YoY degrowth with reduced sales of its main line-ups. Major reasons for such reduced sales are as follows: production issues faced during the initial stage of Model 3 Highland at the Fremont Factory in the US; delivery delays due to the Red Sea crisis; and the shutdown of Berlin gigafactory due to after arson attack.

The 3rd place was captured by Geely Group. Its light EV model, Panda (熊猫) MINI saw more than 32k units sold, and the mid/high-end model, ZEEKR (银河) 001 saw more than 30k units sold. Including the new electric vehicle model, EX30, Volvo’s other models have been gradually expanding their shares mainly in Europe.

(Source: Global EV and Battery Monthly Tracker – May 2024, SNE Research)

Hyundai Motor Group recorded a 1.7% YoY degrowth. It was the result of declining sales of IONIQ 5/6 and EV6, but the global sales of new KONA Electric (SX2 EV) and EV9 has expanded, and the overseas sales of Tucson and Sportage PHEV has increased, instead. KIA announced that it has a plan to keep the momentum by successfully launching EV6 facelift and EV3 new model in the latter half of this year. Particularly in the North American market where the growth potential of electric vehicles is huge, Hyundai Motor Group has been growing over 50%. However, as the group postponed its EV launching plan for a year in response to a slowdown in the entire EV market, it is forecasted that the group would keep the portion of hybrid in its portfolio high till 2025 and the portion of electric vehicles would significantly increase later.

(Source: Global EV and Battery Monthly Tracker – May 2024, SNE Research)

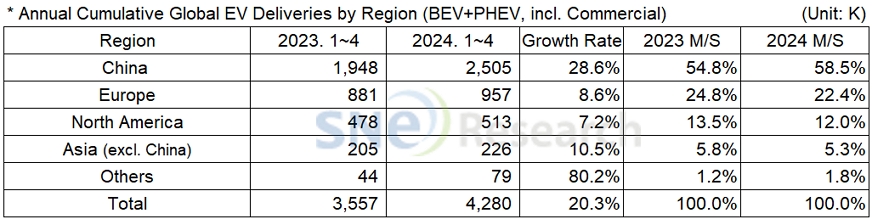

By region, China firmly captured the top position as the world’s biggest EV market, accounting for 58.5% of the entire market share. Unlike the beginning of last year when the EV sales dropped due to the subsidy-related issues, it seems that electric vehicles have been popularized in earnest among the Chinese consumers. The popularity of electric vehicles is built on several factors: the increasing sales of light electric vehicles with price competitiveness, the expansion of customer options with the launch of sub-brands by major OEMs, and the China’s New Energy Vehicle (NEV) mandate policy. Last April, in line with the ‘Buy New Products’ Campaign, the Chinese government set the subsidy amount for electric vehicles higher than that for ICE vehicles, which has brought about positive impacts on the electric vehicle market in China.

Europe took up 22.4% of the global EV deliveries, declined by 2.4%p compared to the same period of last year. Europe used to see a high growth in the EV market mainly driven by BEV in the past. However, due to a slowdown in demand for EV following the termination of government subsidy in major European countries, the growth of BEV in Europe was found to be significantly dropping. In addition, as those local car makers, who have advantages in traditional ICE vehicles and hybrid models, opposed to carbon emission regulations and led those regulations to be slightly eased, a slowdown in the European electric vehicle market is expected to continue till 2025.

In North America, the growth of EV market was mainly led by the sales of Tesla, Stellantis, and Hyundai-Kia. However, the sales of EV in North America, where the upward trend was maintained thanks to tax credits offered under the IRA, was less than expected, posting a relatively low growth at 7.2%. With the next presidential election scheduled soon, the Biden administration has been reviewing the revision of emission regulations as part of slowing down the transition to electric vehicles. Former US president Donald Trump rebuked the green policy by the incumbent government and expressed his opinion that the US should focus more on vehicles with internal combustion engine.

(Source: Global EV and Battery Monthly Tracker – May 2024, SNE Research)

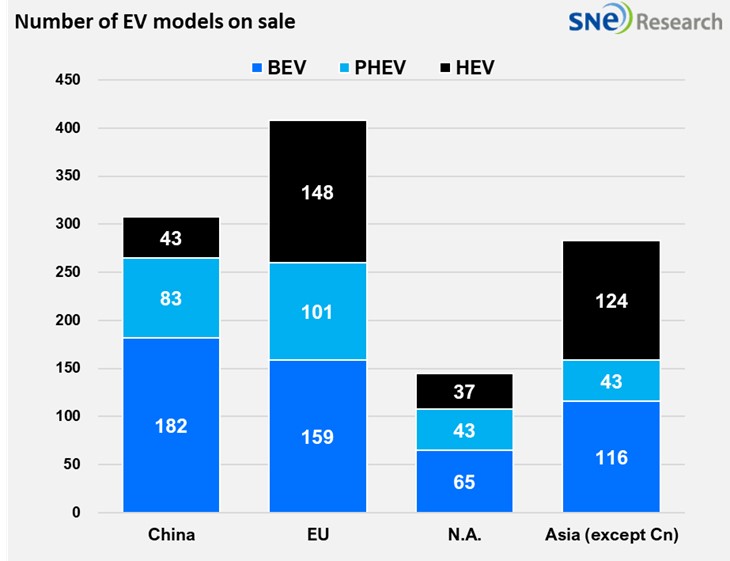

(The number of EV line-ups sold more than 50 units from Jan to Apr 2024 according to Global EV and Battery Monthly Tracker, excl. commercial vehicles)

Except China, the biggest EV market, other major countries all witnessed their EV markets turning bearish. The biggest hurdle for the growth of EV is the United States preventing China from growing in the EV industry. While other global innovative industries have all been led by the US, the electric vehicle industry is currently spearheaded by China. To hold China in check, the US decided to increase tariffs on EVs, and Europe is now considering a similar measure. However, ruling out China, who has outpaced others in terms of price competitiveness, may have a significant impact on the electric vehicle industry by delaying the proliferation of EVs in the world. In addition, economic slowdown, shortage of charging infrastructure, expensive charging rates, concern of short driving range at low temperature, and limited options available among electric vehicle models are all regarded as reasons why the public – except those early adopters – hesitate to choose electric vehicles. If we look at the EV line-ups sold by region, the number of BEV and PHEV line-ups combined in China are more than those sold in the entire Europe. In addition, the range of options for BEV, PHEV, and HEV is all very limited in North America. The Chinese domestic market has been already taken by the Chinese makers for the most part, and based on their presence in the domestic market, those Chinese companies have been accelerating their entry into overseas markets. In the mid to long term, the global goal towards green car will not be changed, but for the time being, car OEMs are expected to focus more on hybrid cars and ICE vehicles in pursuit of profits, instead of persisting in electric vehicles.

[1] The xEV sales of 80

countries are aggregated.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.