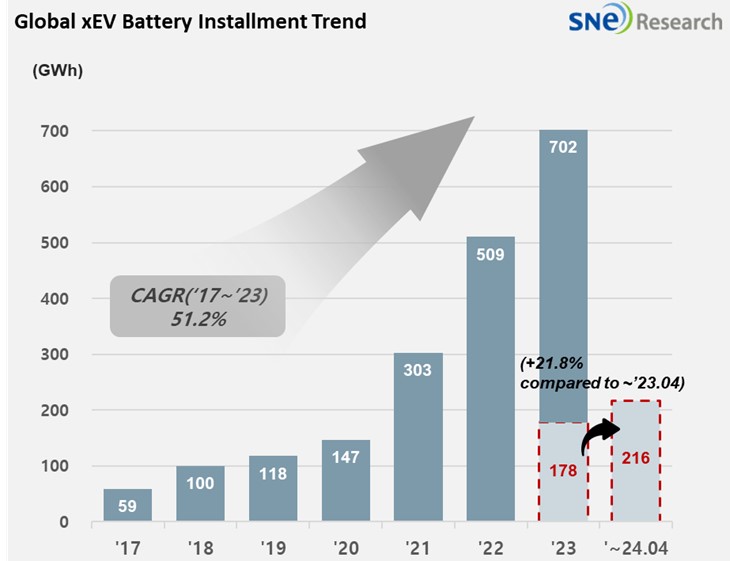

From Jan to Apr 2024, Global[1] EV Battery Usage[2] Posted 216.2GWh, a 21.8% YoY Growth

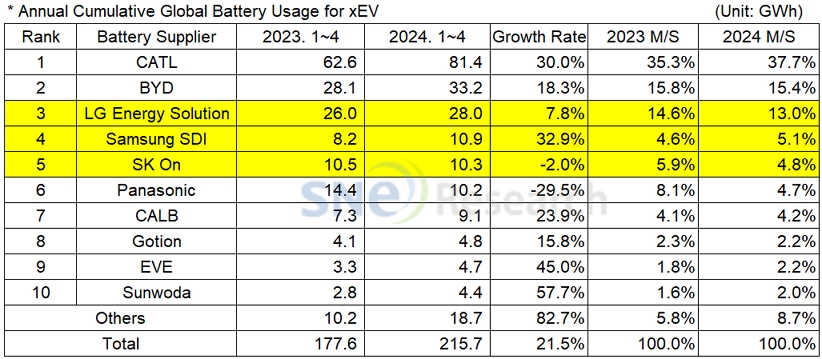

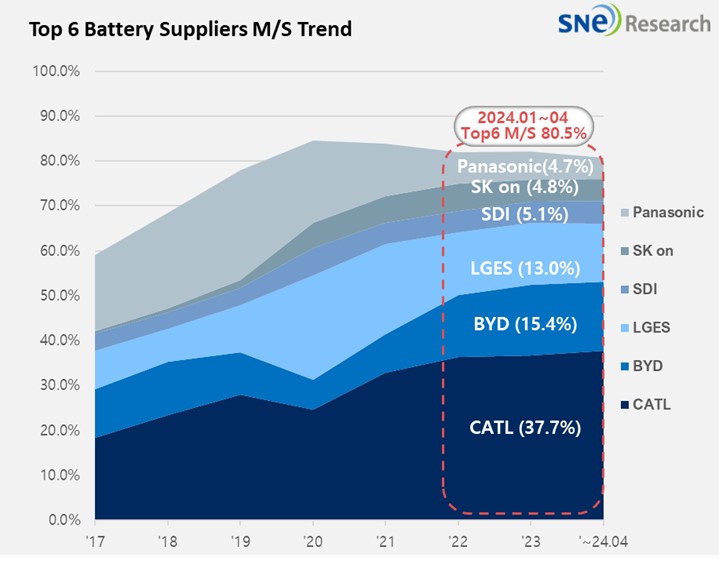

- From Jan to Apr 2024, K-trio’s M/S recorded 22.8%

From

January to March 2024, the amount of energy held by batteries for electric

vehicles (EV, PHEV, HEV) registered worldwide was approximately 216.2GWh, a 21.8%

YoY growth.

(Source: 2024 May Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of K-trio companies were 22.8%, declined by 2.4%p compared to the same period of last year. LG Energy Solution ranked 3rd with a 7.8% (28.0GWh) YoY growth, while Samsung SDI posted the highest growth of 32.9% (10.9GWh) among the K-trio companies. On the other hand, SK On exhibited a degrowth -2.0% (10.3GWh).

(Source: 2024 May Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look the usage of battery made by the K-trio, Samsung SDI continuously showed a high growth thanks to solid sales of BMW i4/5/X, Audi Q8 e-Tron and PHEV in Europe. Rivian R1T/R1S also recorded strong sales in North America. Targeting the premium EV battery market for BEV and PHEV, Samsung SDI started supplying P6 along with its high-value-added battery P5, saying that it would be greatly helpful to enhance the overall profitability of its vehicle battery group from Q2 this year.

SK On posted a degrowth of 2.0% due to a slowdown in sales of Hyundai IONIQ 5 and EVE 6 compared to the last year. However, with SK On’s 4th-generation battery to be installed to the recent facelifted models of IONIQ 5 and EVE 6, it is expected that SK On may see a rebound in its battery sales from Q2. Other than them, Ford F-150 and Mercedes EQA/B to which SK On’s battery is installed also recorded solid sales. SK On has reportedly decided to retool its Ford-dedicated battery production line at Plant 1 in the state of Georgia for Hyundai. It also has a plan to start operating the Plant 3 in Hungary with 30GWh capacity. With all of these efforts, SK On is aimed to turning into profit making in the latter half of this year.

LG Energy Solution’s growth was led by solid sales of highly popular models in Europe and North America such as Tesla Model 3/Y, Ford Mustang Mach-E, and Hyundai IONIQ 6. Recently, new models to which batteries, produced by the joint ventures between LG Energy Solution and global OEMs, are installed, have released in the market. For instance, KIA’s compact SUV EV3 was officially launched with NCMA battery cell, manufactured by HLI Green Power – an Indonesia joint venture between LGES and Hyundai Motor Group, installed inside. In addition, KIA’s sedan EV4, slated for launching next year, is expected to have the battery produced by HLI Green Power inside. GM’s Cadillac LYRIQ, released in the Korean market last month, also has NCMA battery cell by Ultium Cells, a joint venture between LGES and GM. With a large 102kWh battery installed, Cadillac LYRIQ can drive up to 465km on a full charge. As the 2nd Ultium Cells plant is planned to increase its production and a new model on the Ultium platform is set to hit stores, LG Energy Solution is forecasted to lead the battery sector in the North American market with its ternary battery, satisfying the IRA regulations.

Panasonic, the only Japanese company in the top 10 on the list, recorded 10.2GWh from Jan to Apr this year and ranked 6th on the list, but posting a 29.5% YoY degrowth. Major reasons for Panasonic’s degrowth were a slowdown in sales of Tesla Model 3 due to its partial change and the delayed release of Model 3 Performance trim to which Panasonic’s battery is installed. As Panasonic is reported to unveil its advanced 2170 and 4680 cells, it is expected to rapidly recover its market share mostly focusing on Tesla.

CATL firmly stayed on the global top position with a 30.0% (81.4GWh) YoY growth. In the Chinese domestic market, regarded as the world’s biggest EV market, CATL was the only battery maker accounting for over 30% market share by supplying its battery to major Chinese brands such as ZEEKR, AITO, and Ideal as well as vehicles of global major OEMs including Tesla Model 3/Y, BMW iX, Mercedes EQ series, and VW ID series.

BYD, which successfully maintained solid sales after a temporary drop in sales due to the influence of Chinse New Year holidays, captured the 2nd place on the list with a 18.3% (33.2GWh) growth. Amidst the increasingly fierce competition for hybrid technology between global OEMs these days, BYD released a new hybrid vehicle that can drive 2,100km per charge, strategically targeting the BEV and PHEV markets.

(Source: 2024 May Global Monthly EV and Battery Monthly Tracker, SNE Research)

After pursuing a policy of expanding the

adoption of BEV, the United States, evaluated as a major market for Korean

battery companies, has recently added hybrid and plug-in hybrid vehicles to newly

released standards on vehicle emission in response to the growth of EV market

which has become slower than expected. Tesla’s EV charging team layoffs is a case

in point that indicates a slowdown in the popularization of electric vehicles

in the US. Consumers’ preference for hybrid vehicles has become more obvious

than expected not only in the US but also in the world. Prolonged high interest

rates, expensive electric vehicles, delayed releases of new models, and

shortage of charging infrastructure are pointed out as major causes, and negative

influence from all of these have trickled down to the battery industry. On the

other hand, as the metal prices, which greatly influence the price of cathode materials,

have rebounded from the low point and started turning to an upward trend, it is

expected that the battery makers may show a better performance after Q2 this

year.

[2] Based on battery installation for xEV registered during the relevant period.