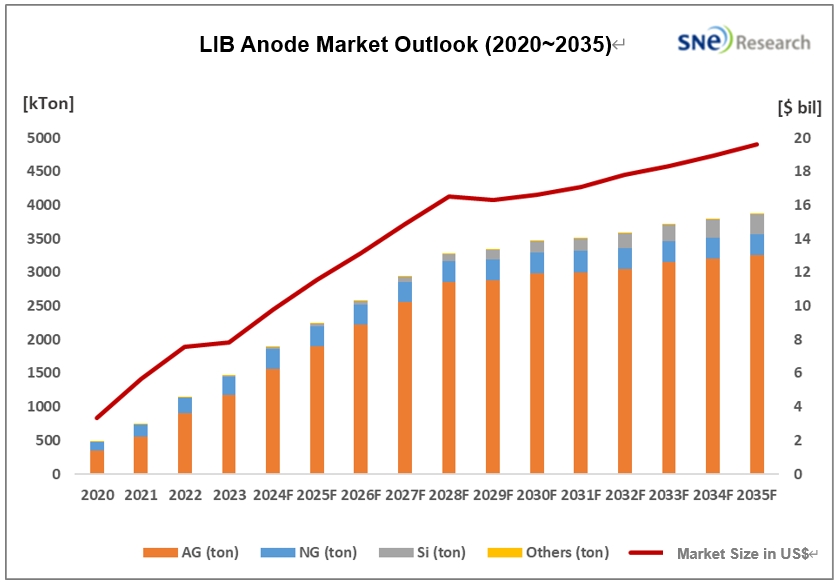

In 2035, LIB Anode Market Expected to Be 2.5 Times Bigger Than Current Level, Reaching 3.9 Million Ton, US$ 19.6 Billion

- LIB anode market was 1.68 million ton in 2023 and is forecasted to reach 3.4 million ton in 2030 and 3.87 million ton in 2035

- LIB anode material market in terms of dollar amount was US$ 7.8 billion in 2023, and is expected to reach US$ 16.6 billion in 2030 and US$ 19.6 billion in 2035.

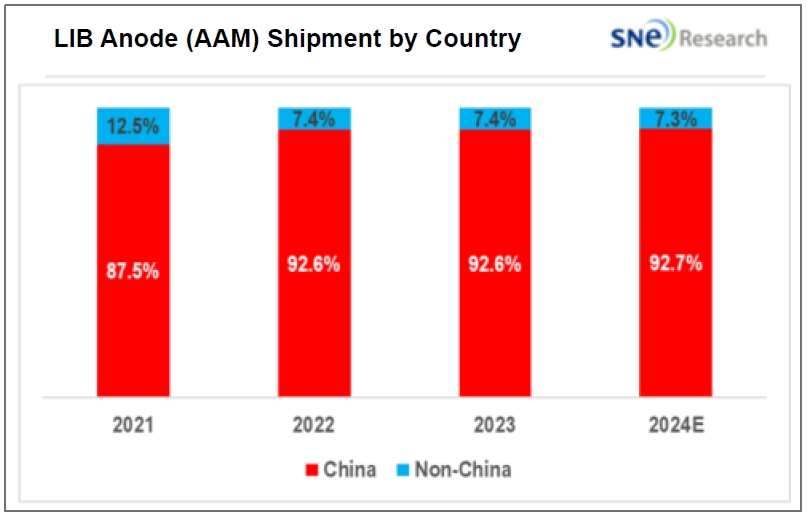

- The market share taken by anode materials produced by China was 87.5% in 2021 and 92.6% in 2023, and is expected to be 92.7% in 2024, continuing to capture a leading position in the market.

(Source: <2024> Technology Trends and Market Outlook of Lithium-ion Secondary Battery Anode Materials published by SNE Research in May 2024)

According to the <2024> Technology Trends and Market Outlook of Lithium-ion Secondary Battery Anode Materials report published by SNE Research, the LIB anode market is expected to grow more than 2.5 times from 1.6 million ton (10 trillion won) in 2023 to 3.9 million ton (25 trillion won) in 2035.

By 2028 or 2029, the growth of anode market is forecasted to center on artificial graphite(AG), and from 2030, silicon anode material, currently taking up 1~2% of the entire anode market, is expected to see an increase in its market share up to 7~10%. Later in 2029 or 2030, demand for graphite anode is projected to slow down and ultimately reach a market saturation point.

The market of artificial graphite, which helps to increase the speed of battery charging as well as the battery life compared to natural graphite anode material, is anticipated to continuously grow along with the expansion of the electric vehicle market. In the artificial graphite market, those Chinse makers have been maintaining their strong positions based on their price competitiveness earned from low electricity cost, labor cost, and environmental investment.

(Source: <2024> Technology Trends and Market Outlook of Lithium-ion Secondary Battery Anode Materials published by SNE Research in May 2024)

If we look at the anode material shipment by companies, the Chinese makers took up 87.5% of the market share in 2021 and almost 92.6% in 2023. In the ranking of anode material shipment, all the places from 1st to 9th are held by the Chinese suppliers. Among them, those big 3 players – BTR, Shanshan, and Zichen – have their combined market shares reach almost 45%, showing a high concentration ratio (CR3). POSCO Future M is the only non-China supplier in the top 10 ranking, taking the 10th place, followed by the Japanese suppliers – Resonac and Mitsubishi Chemical ranked 11th and 12th.

The US government recently released the final rules on the clean vehicle provisions of the Inflation Reduction Act (IRA). The final rules suggested that the US Treasury and Internal Revenue Service (IRS) identified certain battery minerals that are impracticable to trace, including graphite, and would delay the restrictions on those materials until the end of 2026. Despite the 2-year, temporary exemption on graphite-related anode products, as the LIB anode market is more than 90% dominated by the Chinese suppliers, it is an imminent issue for battery material suppliers to build an ex-China supply chain sooner or later.

The IRA rules, which ban Chinese graphite in batteries, may act favorably towards non-China LIB makers, but it will be quite a challenge to find ex-China suppliers in such a short period of time to replace the existing Chinese suppliers of 90+% market dominance. The K-trio battery makers have a plan to expedite the establishment of ex-China supply chains to secure their graphite supply from around the world in cooperation with suppliers in North America and Australia until the end of 2026 when the exemption on Chinese graphite anode material is valid. POSCO Future M also has been striving for securing their graphite production of 370k ton till 2030.

SNE Research forecasts that a major gamechanger in the anode market will be whether market players would be able to secure their supply chain by developing graphite anode material sources other than China, developing high-capacity, high-performance Si-anode and lithium metal for next-generation battery (sodium-ion battery and all-solid-state battery), and securing the technology for hard-carbon anode material for sodium-ion battery.