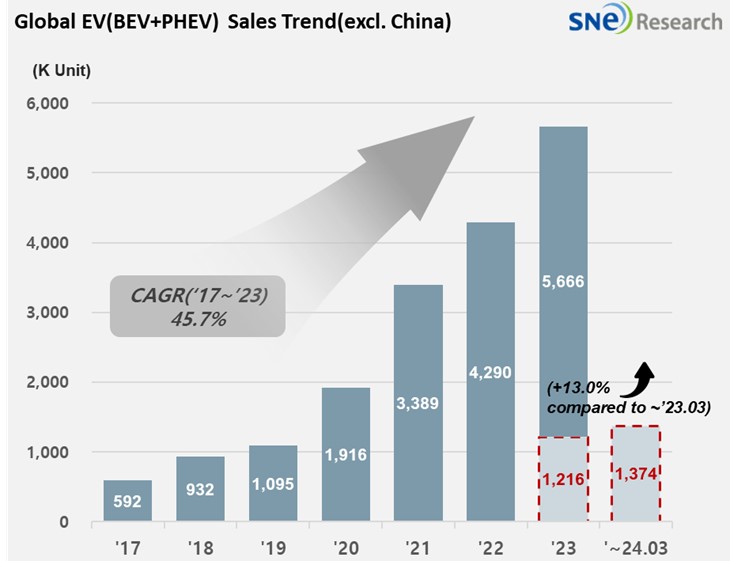

From Jan to Mar in 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Posted 1.374 Mil Units, a 13.0% YoY Growth

- Tesla ranked No. 1 and Hyundai-KIA ranked 4th in the non-China EV market

From

Jan to Mar in 2024, the total number of electric vehicles registered in

countries around the world except China was approx. 1.374 million units, a 13.0%

YoY increase.

(Source: Global EV & Battery Monthly Tracker – April 2024, SNE Research)

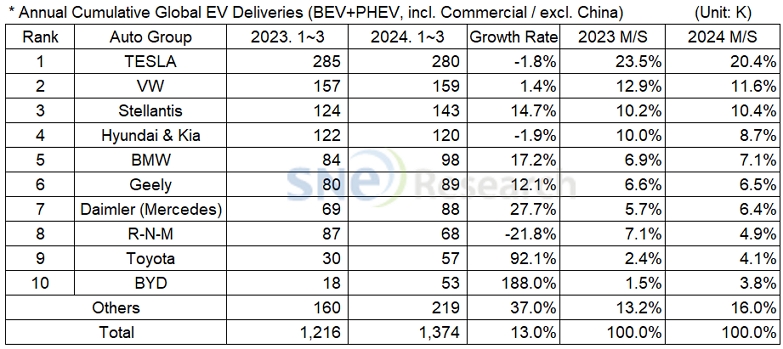

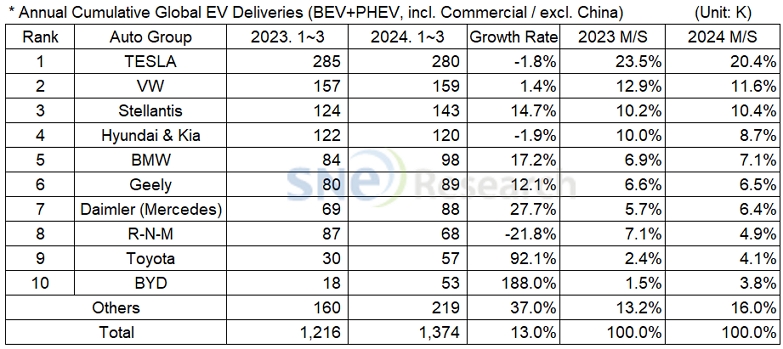

If we look at the number of electric vehicles sold by OEM groups in the non-China from Jan to Mar in 2024, Tesla took No.1 position despite of posting a degrowth. Except one of its main models, Model Y, Tesla recorded a 1.8% YoY degrowth with the sales of other line-ups declined. Tesla pointed out some of the reasons for such decrease in sales of Q1 2024 as follows: production issues during the initial stage of Model 3 Highland production at its Fremont factory, deliveries postponed due to the Red Sea Crisis, and shutdown of Berlin gigafactory after arson attack.

The Volkswagen Group, where Audi and Skoda belong to, posted a 1.4% YoY growth and ranked 2nd on the list. The Group continued to be in an upward trajectory thanks to favorable sales of Volkswagen ID series, Audi Q4, Q8 E-Tron, and Skoda ENYAQ.

The 3rd place was captured by Stellantis Group with a 14.7% growth, of which BEV and PHEV models, including Peugeot e-208, Jeep Wrangler 4xe, and Grand Cherokee 4xe, were all steadily sold.

(Source: Global EV & Battery Monthly Tracker – April 2024, SNE Research)

(Source: Global EV & Battery Monthly Tracker – April 2024, SNE Research)

Hyundai Motor Group recorded a 1.9% YoY degrowth. While the sales of its main models such as IONIQ 5/6 and EV6 were both sluggish, the global sales of new KONA Electric (SX2 EV) and EV9의 expanded and the overseas sales of Sportage and Tuscan PHEV increased, though. KIA announced that it would keep the momentum in sales by successfully launching EV6 facelift model and new EV3 in the latter half of this year. Hyundai Motors was reported to focus on having more shares in the eco-friendly car market, which is expected to grow in mid-to-long term, by maximizing its sales based on IONIQ line-up expansion and optimization of production and sales.

(Source: Global EV & Battery Monthly Tracker – April 2024, SNE Research)

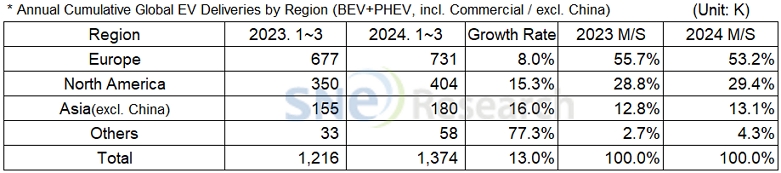

By region, the European market posted 8.0% of growth, accounting for more than half of the non-China market share. This was mainly driven by the favorable sales of local OEMs such as Volkswagen, BMW, and Mercedes. The North American market recorded 15.3% of growth led by the EV sales of Tesla, Stellantis, and Hyundai-KIA. Tesla took up approx. 41.2% of the North American market by selling approx. 166k units among the total number of EVs sold, 404k units, in North America. In Asia (excl. China), BYD and SAIC Group saw their YoY sales increasing to 81.7% and 94.1% respectively based on a rapid increase in their EV sales in Thailand and South America. Toyota from Japan saw its EV sales gradually increasing, mainly centered on PHEV, based steady sales of Prius and successful launch of new Crown.

As the slowdown in BEV market has recently become obvious, OEMs look like hitting speed bumps in their growth. In addition, those bans on ICE vehicles were relaxed to some degree, forcing traditional OEMs, who realized that the EV industry has entered the chasm phase, to postpone or withdraw their electrification plans in order to keep the short-term profits and sales performance. Furthermore, the continued high interest rate, the shortage of charging infrastructure, and high electric vehicle price all led to the expansion of demand in HEV market. However, from the mid-to-long term perspective, electrification is inevitable for the car industry. In this regard, it is expected that, in the short term, it would be important to establish a strategy to respond to demand from the existing ICE vehicle market as well as hybrid market but also to secure the capability to target the BEV market.