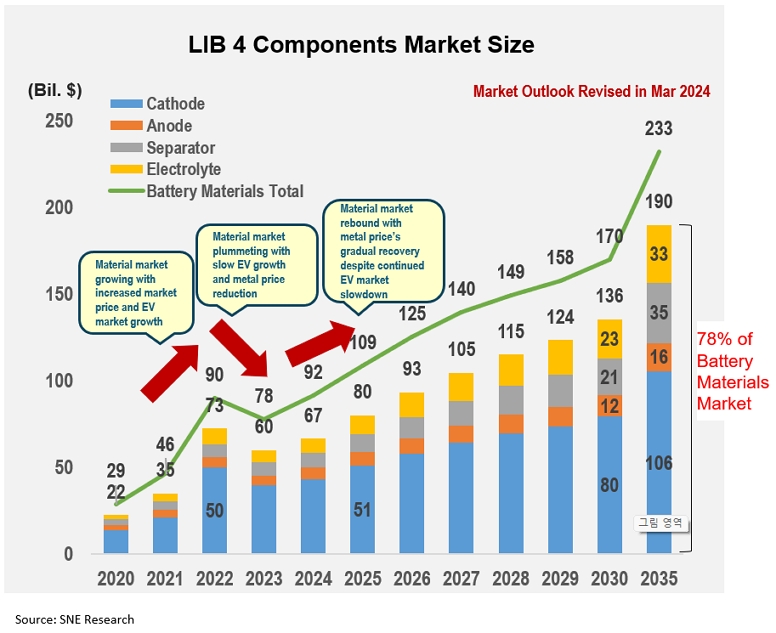

LIB 4 Components Market Saw 17% Degrowth in 2023, Despite 33% Growth in EV Market

- LIB 4 components market dropped 18% despite the EV market posting 33% growth in 2023

- EV battery price dropped more than 10%, giving the battery material companies a hard time, but the material market is expected to get better this year

Last year, the electric vehicles market posted over 30% of growth despite a demand slowdown in the second half. On the other hand, the LIB material companies had to weather through hard times, posting a degrowth due to the reduction in battery selling price as well as lithium and metal prices.

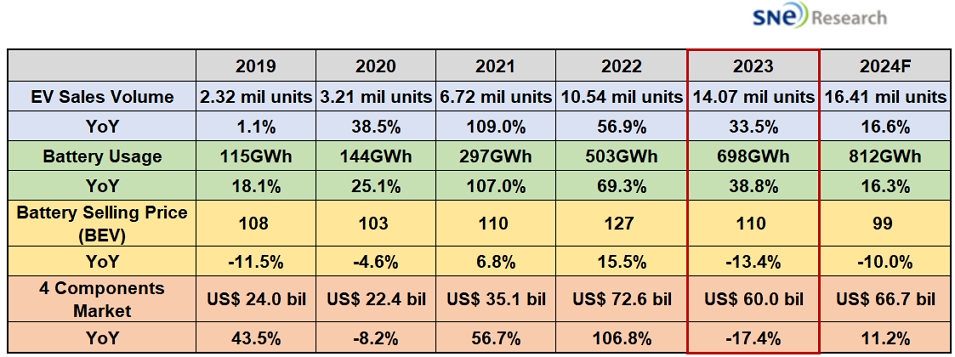

According to the press release by SNE Research on March 15, the number of electric vehicles sold in 2023 was 14.07 million units, a 33.5% growth from the previous year, and the battery usage for electric vehicles recorded 698GWh, a 38.8% growth from 503GWh. In comparison with 109% in 2021 and 57% in 2022, the EV market saw a significant drop in growth because of a demand slowdown, economic downturn due to high interest rates, and the Chasm phase (accompanying a temporary demand slowdown at the point when the penetration rate reaches around 16%) in the EV market development. Despite such drop in growth and several unfavorable circumstances, the EV market has achieved to post 38.8% growth.

On the other hand, the battery selling price reduced 13%, while the 4 components market including cathode material also saw almost 17% decline and a significant drop in profits in the 2nd half of last year. Particularly in comparison with the downtrend in battery price, reductions in material and metal prices were striking, meaning that most of the battery material companies posted a degrowth and had difficult times in the latter half of last year. Even in the 1st half of this year, they are expected to struggle as the stocks increases and the slowdown in EV market growth continues.

Those material companies, who anticipated to grow together with the EV and battery markets, had to suffer from a degrowth again since their hard times during the pandemic in 2020. In order to rebound, this year, they have to deal with two tasks at the same time; one, to reduce their cost and recover profits, and two, to improve their technical capabilities to compete with low-priced counterparts in China.

In addition to that, the Korena companies have to find a way to lessen their dependence on Chinese raw materials by diversifying the suppliers, expanding their in-house production ratio, achieving technical capabilities through M&A and technology MOUs, and developing next-generation technology in advance. All these efforts to break through the crisis with competitive products are the only way they can survive from such a fierce competition in the market.

The recent upward trend in lithium and nickel prices continuing for a month or so, though, is regarded as a glimmer of hope for those material companies who, thus, anticipate for a recovery in performance. Also, as it seems that the K-trio would keep their investments in production facilities, it is expected that the material companies would be able to finally see a way through.

SNE Research holds ‘The 7th Next Generation Battery Seminar and 1st Tutorials 2024’ for 4 days from March 21st to 26th (except weekends) to further discuss the current market status and outlook as well as to create an opportunity for industry experts to share their thoughts and expand their network.