Global LiB for ESS Sales in 2023

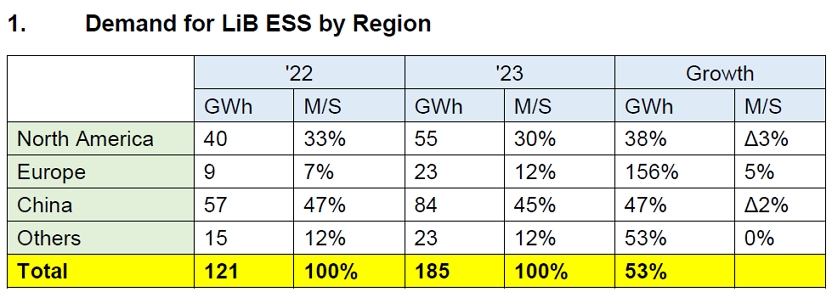

In 2023, the global LIB for ESS shipment posted 185GWh, 53% up from 121GWh in 2022.

By region, 45% of the entire LIB for ESS demand was from China with the largest figure – 84GWh. While North America took up 30% with 55GWh, Europe and Other regions accounted for 12% each with 23GWh respectively.

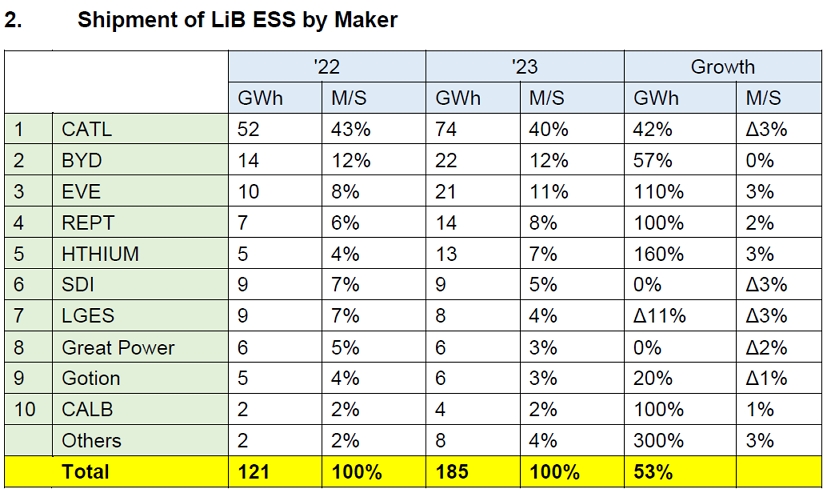

If we look at the sales record by battery maker, the Chinese battery manufacturers reaped massive growth based on their LFP batteries. In particular, EVE, REPT, and HTHIUM ranked high with more than 100% of high growth.

Recently, the Chinese battery makers offered their BESS container solution at $100/kWh and lower based on the price of arrival in the US (CIF), which exhibits a huge gap compared to the price offers by the Korean companies.

As ESS is not subject to the IRA’s Foreign Entity of Concern regulations, battery made in China can be exported / shipped to the US without worrying about the IRA regulations. In such circumstances, those batteries from China, which obviously have higher price competitiveness than others, have dominated the global LIB for ESS market including the US and Europe.

CATL stayed on No. 1 position in the ranking, followed by BYD and EVE on 2nd and 3rd places. When it comes to shipment volume, those Chinese companies have got ahead in the race with Samsung SDI and LG Energy Solution.

Although Samsung SDI and LGES ranked 6th and 7th, they failed to make a growth from 2022. The reason for such stagnation was that although the global market has already turned their eyes to LFP battery, those Korean battery makers have not started yet to mass produce LFP battery. In fact, the combined market shares of Korean battery makers dropped from 14% in 2022 to 9% in 2023.

To break through the current stagnation, the battery manufacturers in Korea decided to mass produce LFP battery in North America from 2026, trying to rebound in the ESS market. Of course, there should an advantage that they would enjoy if they locally produced batteries. Many customers in North America also want their batteries to be manufactured and supplied within the region. However, to compete with the Chinese batteries with price competitiveness, the Korean makers should be able to have their competitive edge in cost comparable to their Chinese counterparts.