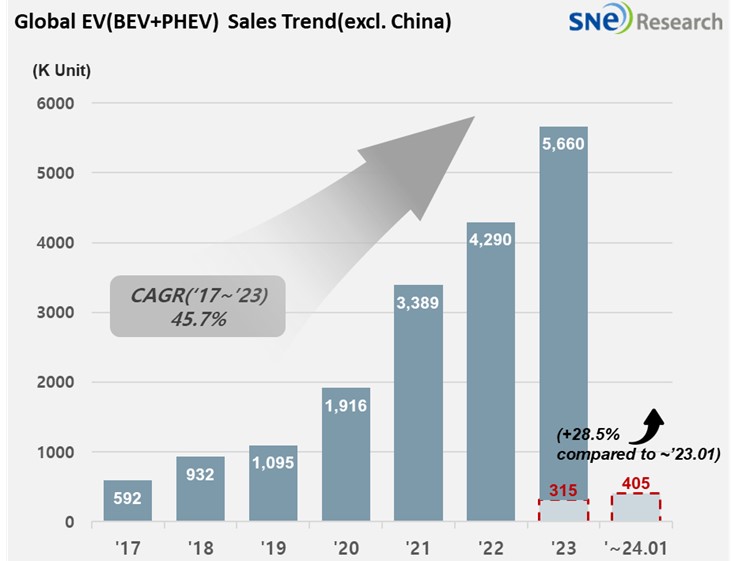

In January 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Posted 405k units, a 28.5% YoY Growth

- Tesla took No. 1 position while Hyundai-KIA ranked 4th in the non-China EV market

In January 2024, the total number of electric vehicles

registered in countries around the world except China was approx. 405k units, a

28.5% YoY growth.

(Source: Global EV & Battery Monthly Tracker – Feb 2024, SNE Research)

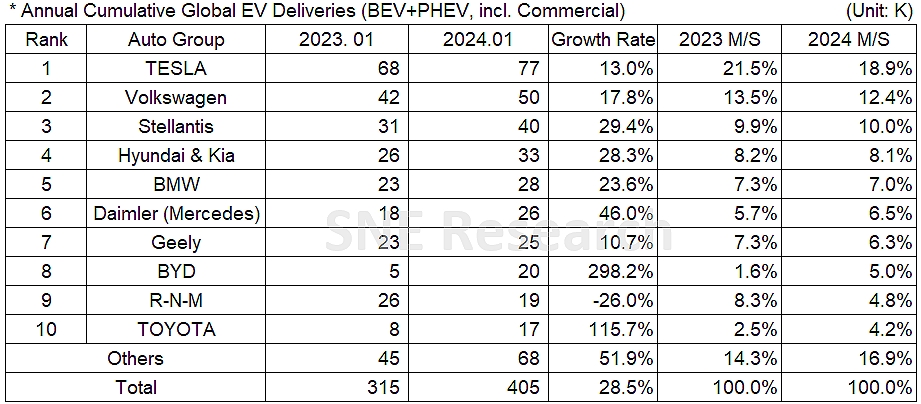

If we look at the number of electric vehicles sold by OEM groups in the non-China market In January 2024, Tesla kept the top position with a 13.0% YoY growth propped up with steady sales of Model Y, one of its main vehicle models. Tesla is expected to remain at the top on the list when the delivery of Highland, the facelifted Model 3, begins in earnest. The Volkswagen Group, to which Volkswagen, Audi, and Skoda belong, ranked 2nd with a 17.8% YoY growth. The Volkswagen Group continued to be in a growth trend with favorable sales of ID Series, Audi Q4, Q8 E-Tron, and Skoda ENYAQ. The 3rd place was taken by Stellantis Group with a 29.4% growth, of which BEV and PHEV models, including FIAT 500e, Peugeot e-208, Jeep Wrangler 4xe, and Grand Cherokee 4xe kept their solid sales.

(Source: Global EV & Battery Monthly Tracker – Feb 2024, SNE Research)

Hyundai Motor Group posted a 28.6% YoY growth. Although the sales of IONIQ 5/6, Niro, and EV6 was sluggish, the global sales of new KONA Electric (SX2 EV) and EV9 expanded and the overseas sales of Sportage and Tuscan PHEV increased, too. On March 4, Hyundai Motors unveiled ‘2024 Kona Electric,’ ‘IONIQ 6 Black Edition’ and ‘The New IONIQ 5’ of which overall commercial value was heightened with battery performance enhanced and user-friendly features added. The car maker announced that, by offering various options of electric vehicles to customers, it would firmly capture its leading position in the Korean EV market. KIA was reported that it would focus on taking the leadership in the eco-friendly vehicle market by starting the overseas sales of EV9 and selling mid- and small-size EVs – from EV3 to EV5 with price competitiveness. It was known that KIA also wants to increase the profitability through the expansion of car sales.

(Source: Global EV & Battery Monthly Tracker – Feb 2024, SNE Research)

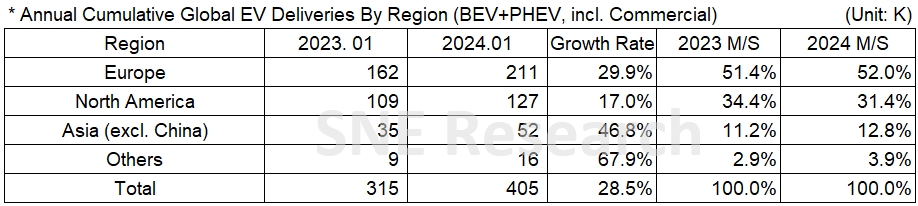

By region, the European market posted 29.9% of growth, taking up over 50.0% of share in the non-China market. Such growth was mainly driven by the favorable sales of local OEMs such as Volkswagen, BMW, and Mercedes. In North America, the growth was led by the sales of Tesla. To be specific, among the entire EV sales of 127k units in North America, 57k units were Tesla, taking up approx. 45%. In Asia (except China), BYD and SAIC groups saw a significant increase in their sales in Thailand, and the overall EV sales in Asia increased 46.8% compared to the same period of last year. As it has been reported that, from 2024, the Chinese companies such as BYD, MG, and Great Wall plan to start operation of their local plants mainly in Thailand, the ASEAN market is expected to see a fiercer competition for the leading position in the EV sector with the Chinese auto makers’ expanding their market shares in the ASEAN 5 nations.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period