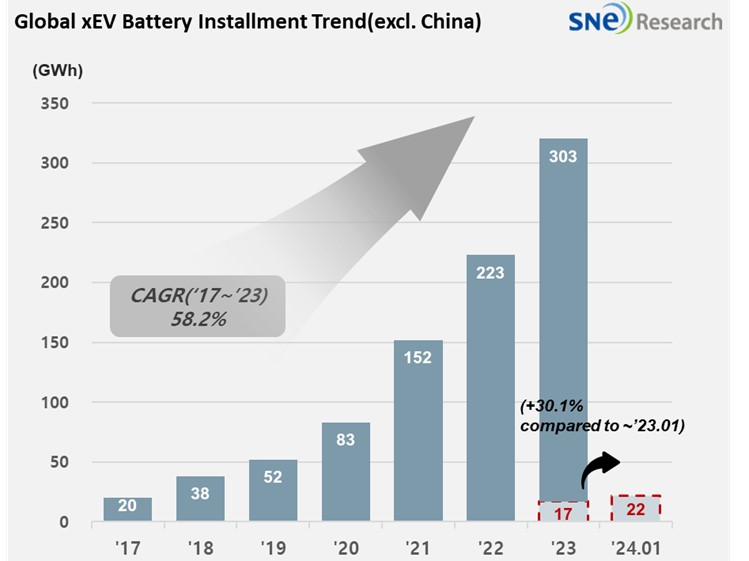

In January 2024, Non-Chinese Global[1] EV Battery Usage[2] Posted 22.2GWh, a 30.1% YoY Growth

- K-trio accounted for 44.7% M/S in Jan 2024

Battery installation for

global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from

January to December in January 2024 was approx. 22.2GWh, a YoY 30.1% growth.

(Source: Global EV and Battery Monthly Tracker – Feb 2024, SNE Research)

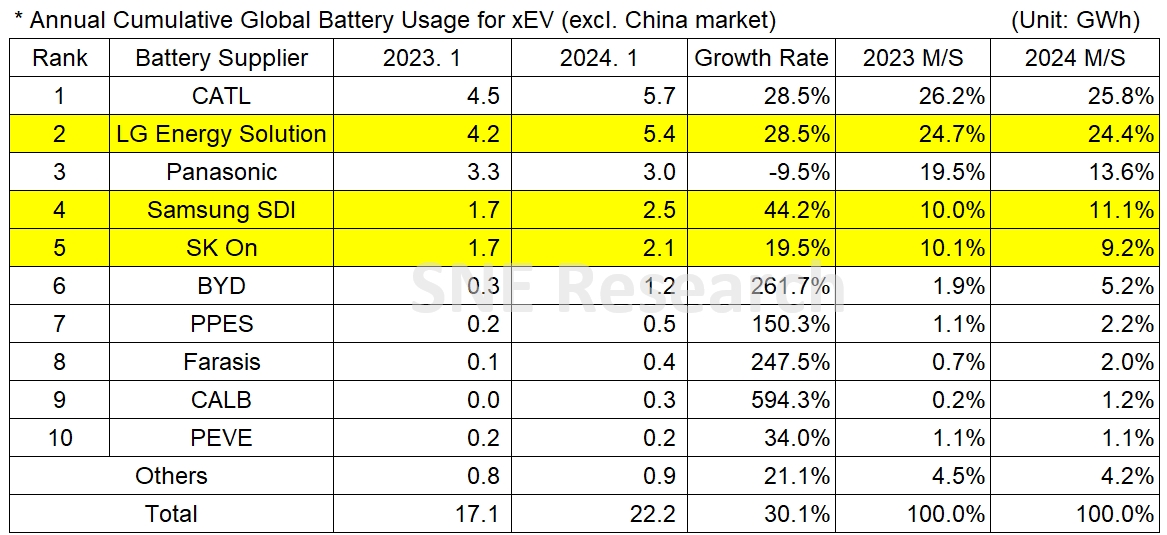

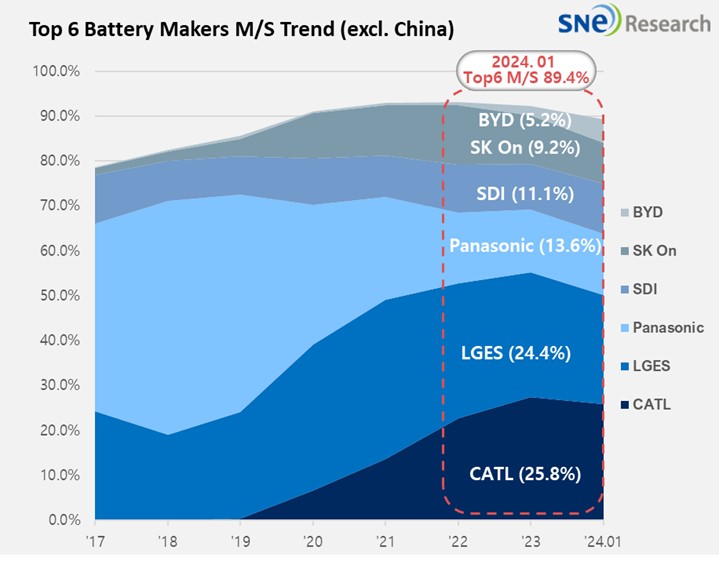

In the ranking of battery usage for electric vehicles, the K-trio battery makers all ranked within the top 5. LG Energy Solution ranked 2nd with a 28.5%(5.4GWh) YoY growth. Samsung SDI took the 4th position with a 44.2%(2.5GWh), while SK On ranked 5th with a 19.5%(2.1GWh) YoY growth. CATL captured No. 1 based on its consecutive high growth of 28.5%(5.7GWh).

(Source: Global EV and Battery Monthly Tracker – Feb 2024, SNE Research)

The combined shares of K-trio recorded 44.7%, a 0.1%p YoY decline, but the overall battery usage was still in an upward trend. Their growth was mainly affected by favorable sales of electric vehicle models equipped with batteries of each company. Samsung SDI continued to be in a growth trend based on the increasing sales of BMW i4/iX and Audi Q8 e-Tron as well as decent sales of Rivian R1T/R1S and FIAT 500. SK On also posted a growth thanks to solid sales of Hyundai IONIQ 5, KIA EV6/EV9, Mercedes EQA/B, and Ford F-150 Lightning. LG Energy Solution took the 2nd place thanks to favorable sales of Tesla Model 3/Y, Ford Mustang Mach-E, and GM Lyriq that are highly popular in Europe and North America.

Panasonic saw 3.0GWh of its battery used in Jan 2024, posting a 9.5% YoY degrowth. Panasonic, one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla Y in the North American market. As Panasonic has been reported to launch advanced 2170 and 4680 cells, it is expected to expand its market share mostly focusing on Tesla.

CATL, which has been rapidly expanding its share even in the non-China market, has its battery installed to Tesla Model 3/Y(made in China and exported to Europe, North America, and Asia) as well as vehicles made by major OEMs such as BMW, MG, Mercedes, and Volvo. Recently, CATL’s battery is installed to the new KONA model by Hyundai and KIA Ray EV model, meaning that the Chinese battery makers’ influence has been gradually expanding in the Korean market.

(Source: Global EV and Battery Monthly Tracker – Feb 2024, SNE Research)

In 2023, as the global EV market saw a slowdown in growth, talks about speed bumps in the road to vehicle electrification have been prevalent and sounded more plausible, making OEMs and battery makers closely watch what is happening in the US and Europe. In effect, Ford, GM, Renault, and VW all downsized their investments in electric vehicles or decided to postpone them. Then, it became inevitable for battery makers and battery material companies to joint their movements to hit the brakes and slow down their plans. OEMs, on the other hand, announced their new plans to increase the production of ICE vehicles, HEV, or PHEV models. Although the transition to electric vehicles is unavoidable in the mid to long-term, it is expected that hybrid vehicles such as HEV and PHEV may experience a short-term growth momentum.

[2] Based on battery installation for xEV registered during the relevant period.