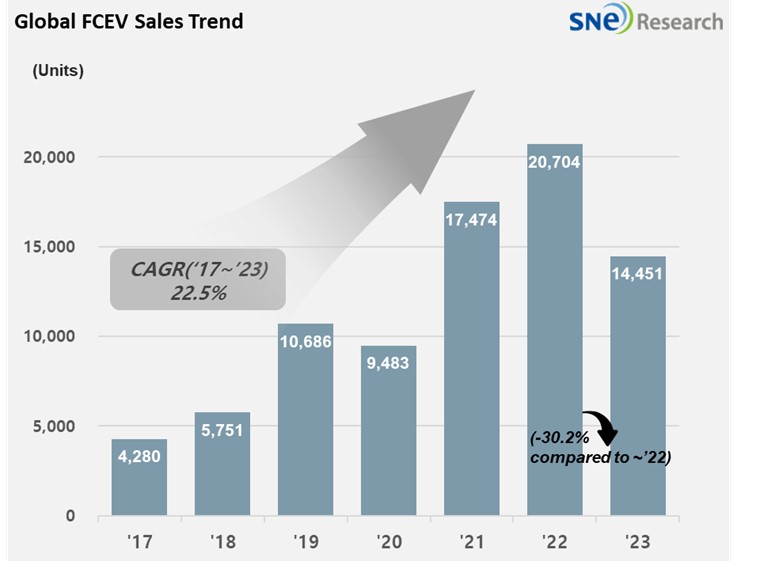

From Jan to Dec 2023, Global FCEV Market with a 30.2% YoY Degrowth

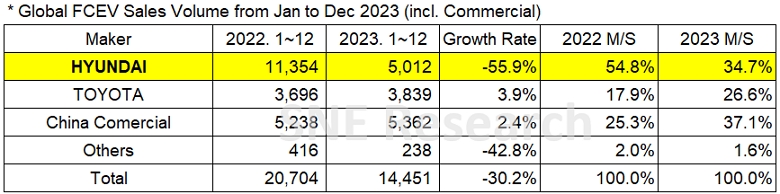

- Hyundai Motor Group accounted for 34.7% of the global FCEV market.

A total number of globally registered FCEVs sold from Jan to December in 2023 was 14,451 units, recording a 30.2% YoY degrowth.

(Source: Global FCEV Monthly Tracker – January 2024, SNE Research)

By company, Hyundai Motors sold 5,012 units of NEXO and ELEC CITY, keeping the top position on the list with its market share of 34.7%. While Hyundai sold 11,179 units of NEXO in the same period of last year, boasting an overwhelmingly high market share, but in 2023 it only sold 4,709 units of NEXO, a 55.9% YoY decline. On the other hand, Toyota Mirai saw 3,737 units sold in 2023, a 3.9% YoY increase from 3,694 units in the same period of last year. The Chinese companies have been in an upward trend, mostly focusing on the commercial vehicle market.

(Source: Global FCEV Monthly Tracker – January 2024, SNE Research)

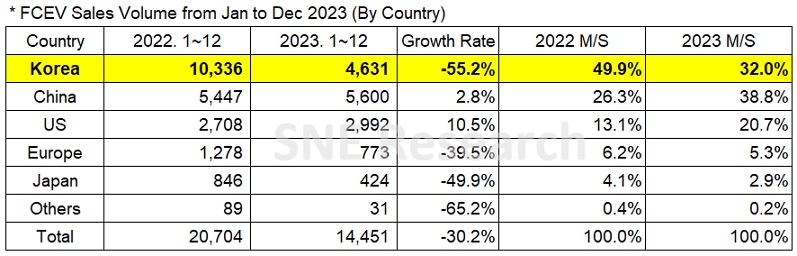

By country, due to the impact from sluggish sales of NEXO, Korea saw a 55.2% YoY decrease in sales. China posted a continuous growth mainly focusing on hydrogen commercial vehicles, taking the top position not only on the list of global EV market share but also the FCEV vehicle one. The US, where Toyota’s Mirai with a YoY growth was sold most, also recorded a growth.

(Source: Global FCEV Monthly Tracker – January 2024, SNE Research)

Since 2018 when Hyundai first unveiled NEXO, the global FCEV market continues to be in an upward trend with the global annual sales exceeding 20,000 units, but the 2023 FCEV market closed with a 30.2% degrowth. The major reason for such degrowth is found to be plummeted FCEV sales in Korea, whose FCEV market share ranked No. 1 before, dropped more than half the sales made in the same period of last year. Since 2018, the NEXO model only had two facelift models in 2021 and 2023, offering a limited option to consumers. In addition to that, due to the increasing charging cost of hydrogen car, defective hydrogen incidents, and hydrogen charging infrastructure shortage, it has become inevitable for FCEVs to lose its lusters in the eco-friendly vehicle market. On the other hand, the Chinese government has been accelerating the commercialization of hydrogen energy in China by actively expanding the distribution of hydrogen cars and establishing the related infrastructure through the China’s Medium and Long-Term Strategy for the Development of the Hydrogen Industry (2021-2035). The Chinese government has rapidly expanded its FCEV market share by taking advantage of its hydrogen commercial vehicle market.

Although the global FCEV market experienced a major decline in 2023, attentions should be made to whether the market may rebound as new FCEV models are expected to launch in the market. In November 2023, Toyota launched Crown FCEV, which saw a total of 102 units already sold in 2023. Crown FCEV also has the same hydrogen fuel cell system with Mirai. In addition to that, Honda is planning to launch a hydrogen fuel cell vehicle based on its SUV model, CR-V in Japan and North America within 2024. Honda, who terminated the manufacturing of Clarity in 2021 and withdrew from the hydrogen car market, apparently decided to join the competition again based on the popularity of CR-V. Hyundai Motors also has a plan to unveil a new NEXO in 2025.