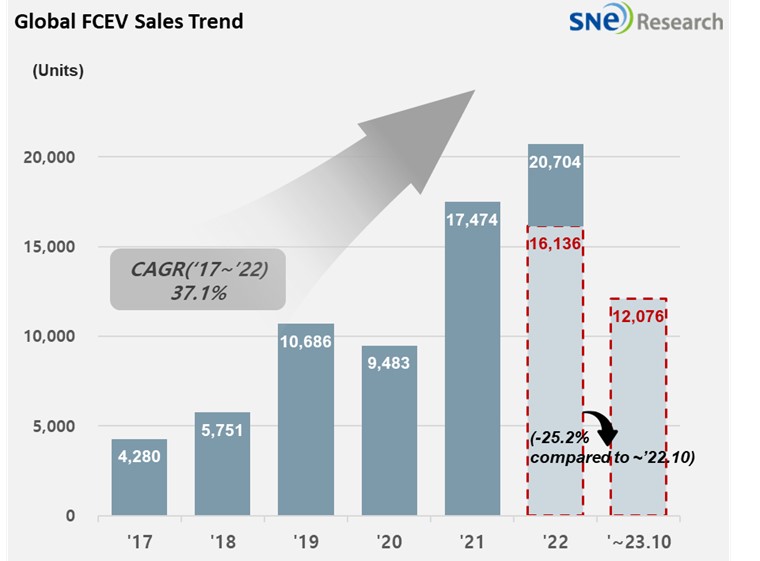

From Jan to October 2023, Global FCEV Market with a 25.2% YoY Degrowth

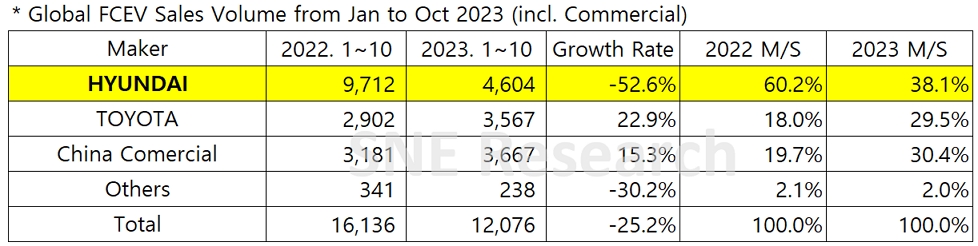

- Hyundai Motor Group took up 38.1% of global FCEV market share.

A total number of globally registered FCEVs sold from Jan to October 2023 was 12,076 units, recording a 25.2% YoY degrowth.

(Source: Global FCEV Monthly Tracker – November 2023, SNE

Research)

By company, Hyundai Motors sold 4,604 units of NEXO and ELEC CITY, accounting for 38.1% of market share and staying at the top of the list. Although Hyundai Motors took up an overwhelmingly high market share with 9,587 units of NEXO in the same period of last year, the group only saw 4,349 units of NEXO sold, a 54.6% YoY drop. On the other hand, the sale of Toyota’s Mirai has seen a 23.0% YoY growth from 2,899 units to 3,567 units. The Chinese companies have paving their ways for growth mainly focusing on the hydrogen commercial vehicles.

(Source: Global FCEV Monthly Tracker – November 2023, SNE Research)

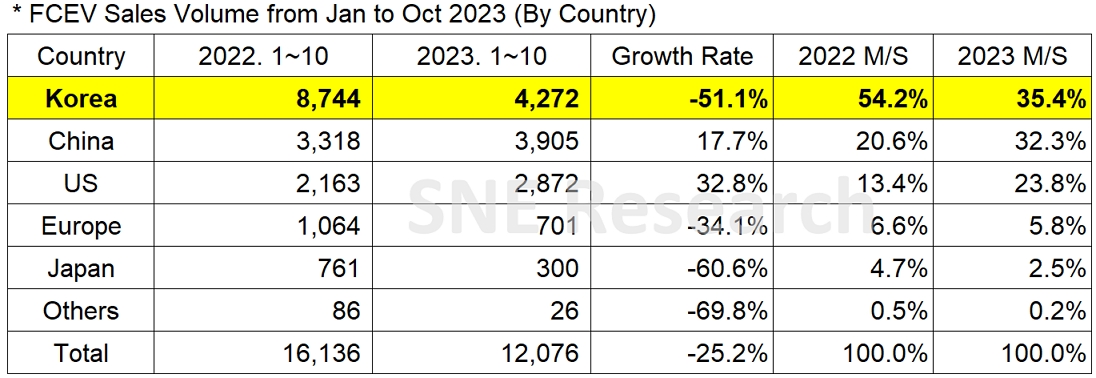

By country, due to the ripple effect from the declining sale of NEXO, Korea saw a 52.6% YoY decrease, but stilling taking up 35.4% of market share and keeping No. 1 position in the ranking. China recorded more than 30% of the market share based on its continuous growth mainly in hydrogen commercial vehicles. The US, where Toyota’s Mirai is sold most, also recorded a growth.

(Source: Global FCEV Monthly Tracker – November 2023, SNE Research)

Recently,

Hyundai Steel, one of the hydrogen producers in Korea, experienced a breakdown

in hydrogen production facilities, leading to a chaos in hydrogen vehicle

charging. Due to the breakdown responsible for supplying 20~30% of hydrogen in the

central region of Korea, some of the charging stations in the central part of

the country suffered from supply shortage, causing difficulties in using those

stations. After the breakdown, it seems that we all learned how vulnerable the overall

hydrogen car charging infrastructure in Korea is. With such an emerging difficulty

in hydrogen charging, even the hydrogen charging cost increased from approx.

8,800 Korean won per kg to approx. 10,000 Korean won. In addition to this,

possible pressures on customers who may need to pay for their own repair cost

after the expiration of guarantee have pushed the Korean customers to turn

their backs from hydrogen vehicles. As a result, the hydrogen market in Korea recorded

only half the growth of the previous. In addition to that, the Korean government decided to reduce

the Ministry of Environment’s 2024 budget for the distribution of hydrogen cars

and the installment of hydrogen charging station, taking the vitality from the

hydrogen industry which has already shrunken.

On the other hand, China targets to expand the distribution of hydrogen cars and establish the related infrastructure by implementing the China's Mid- and Long-Term Strategy for the Development of the Hydrogen Industry (2021-2035), accelerating the commercialization of hydrogen energy in China. It seems that a proactive approach from the Korean government to respond to such an intimidating growth of China, who wants to take the top position in the hydrogen car market, would be necessary.