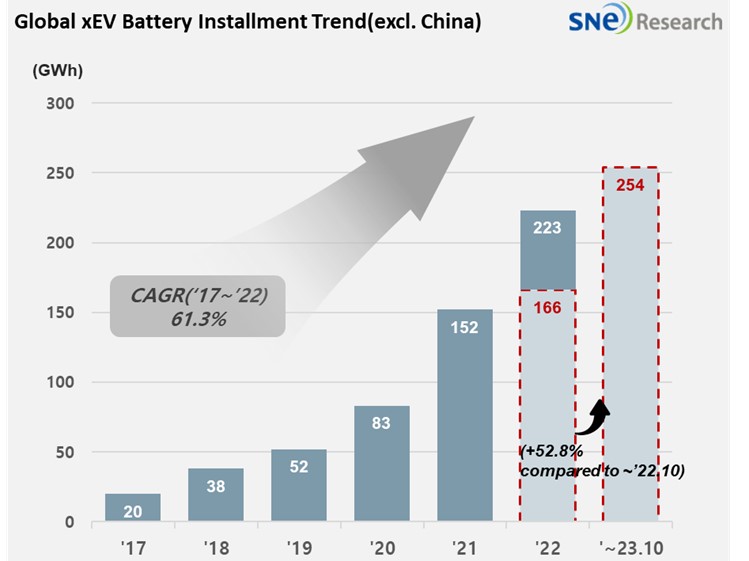

From Jan to Oct in 2023, Non-Chinese Global[1] EV Battery Usage[2] Posted 254.5GWh, a 52.8% YoY Growth

- K-trio accounted for 48.4% M/S

Battery installation for

global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from

January to October 2023 was approximately 254.5GWh, a 52.8% YoY growth.

(Source:

Global EV and Battery Monthly Tracker – Nov 2023,

SNE Research)

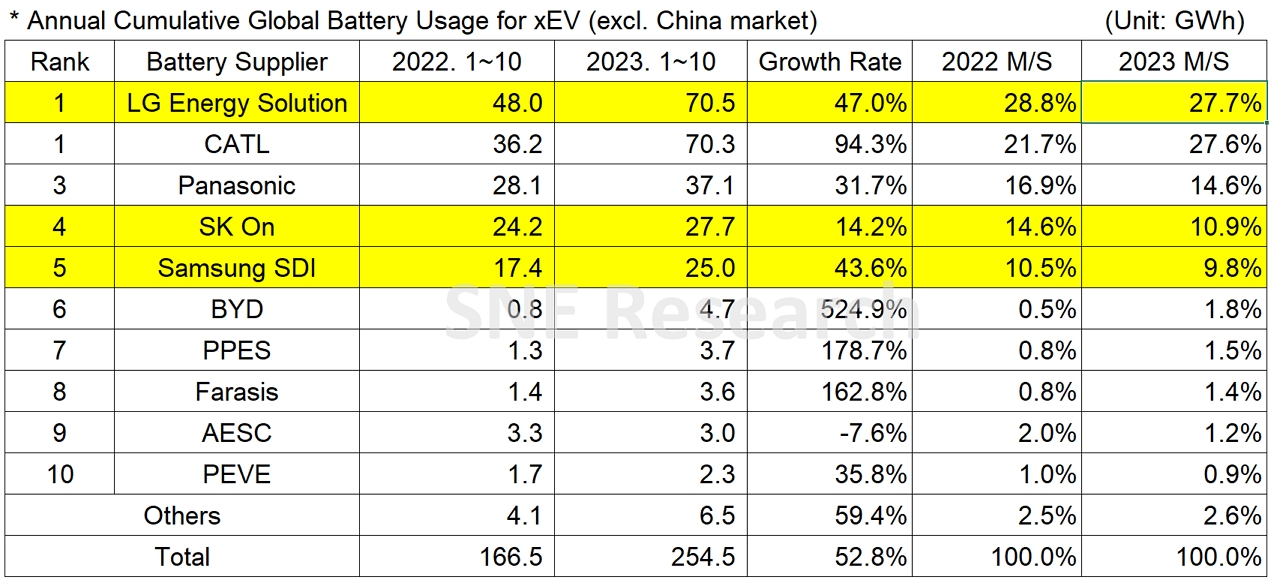

In the ranking of battery

usage for electric vehicles, the K-trio battery makers all ranked within the

top 5. LG Energy

Solution kept the top position with a 47.0%(70.5GWh)

YoY growth. SK on ranked 4th with 14.2%(27.7GWh),

while Samsung SDI ranked 5th with 43.6%(25.0GWh).

CATL from China rapidly expanding its market share, keeping a high growth momentum

with a 94.3%(70.3GWh) growth.

(Source: Global EV and Battery Monthly Tracker – Nov 2023, SNE Research)

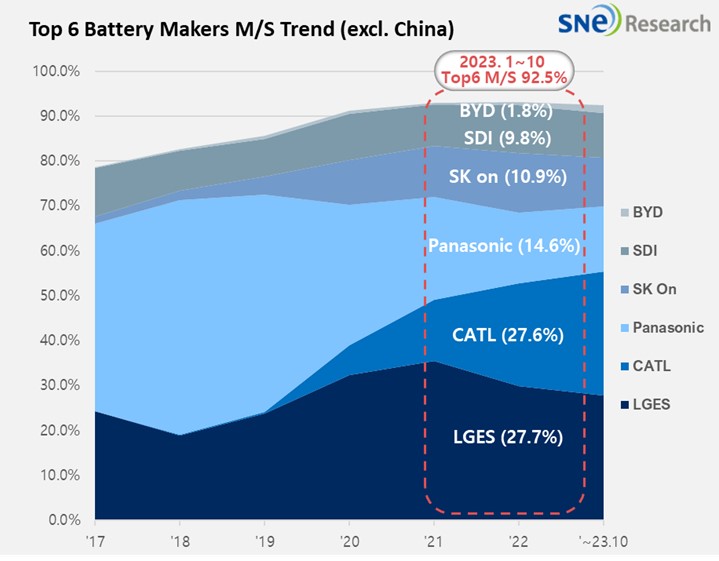

The

combined shares of K-trio recorded 48.4%, a 5.4%p YoY decline from the same

period of last year, but their overall battery usage was in an upward trend. Their

growth was mainly affected by favorable sales of electric vehicle models

equipped with batteries of each company. Samsung SDI

kept its growth momentum based on the increasing sales of BMW i4/i7 and Audi Q8

e-Tron as well as a decent sales of Rivian R1T/R1S/EDV and FIAT 500. Samsung SDI, who decided to target the premium EV battery

market, is expected to maintain stable performance based on continuous demands

and high profitability as the portion of high-value-added battery P5 is

increased even when the xEV market has recently been affected by concerns about

a possible slowdown in growth. SK On also recorded growth thanks to solid sales

of Hyundai IONIQ 5, KIA EV6, Mercedes EQA/B, and Ford F-150 Lightning.

Recently, as it has been reported that SK On reached a decent level of accomplishment

in developing prismatic and LFP battery, which is highly sought after in the

market, the company is expected to see a growth in its market share especially

focusing on the North American region. LG Energy Solution posted the highest

growth among the K-trio, propped up with favorable sales of Tesla Model 3/Y, VW

ID. series, and Ford Mustang Mach-E that are highly popular in Europe and North

America. These days, OEMs such as Tesla, Ford, and GM have been expanding the

installation ratio of LFP battery and uncertainties have risen due to concerns

about a slowdown of demand for EV. However, despite the current circumstances,

the launch of new models such as GM’s Blazer EV, to which Ultium platform is

adopted, is expected. This leads to an expectation that any uncertainties

facing SK On and Ultium Cells would be cleared off with the usage of battery

made by Ultium Cells increasing in future.

Panasonic registered the

battery usage of 37.1GWh, 31.7% up from the same period of last year. Panasonic, who is one of the major battery suppliers to

Tesla, has most of its battery usage installed in Tesla models in the North

American market. While the sale of Tesla Model 3 slowed down a bit as its

facelift model is about to be in the market soon, Tesla Model Y with a YoY

growth in sales has driven the growth of Panasonic.

Along

with CATL, some of the Chinese companies showed even higher growth in the

non-China market than in the domestic market of China, rapidly expanding their

presence in the global market. CATL’s battery is installed to Tesla Model 3/Y(made in China and exported to Europe, North

America, and Asia) as well as vehicles made by major OEMs such as BMW, MG, Mercedes and Volvo.

Recently, a new KONA model by Hyundai and Ray EV model by KIA have CATL’s

battery inside, proving that the Chinese battery giants have been gradually

influencing the domestic market in Korea.

(Source: Global EV and Battery Monthly Tracker – Nov 2023, SNE Research)

As recent

concerns about a slowdown in the global EV market have risen, subsequent concerns

about possible declines in demand for EV batteries have been aggravating, too. Some

of the reasons for such a slowdown in market growth are as follows: the global

economic downturn, continued high interest rates, early adapters’ EV purchases

at initial stages of EV development; and reduction in or termination of subsidy

policies. However, these factors are regarded as temporary hindrance factors,

and with the stabilization of battery and EV prices according to reductions in

mineral price, the market slowdown is expected to be eased.

[2] Based on battery installation for xEV registered during the relevant period.