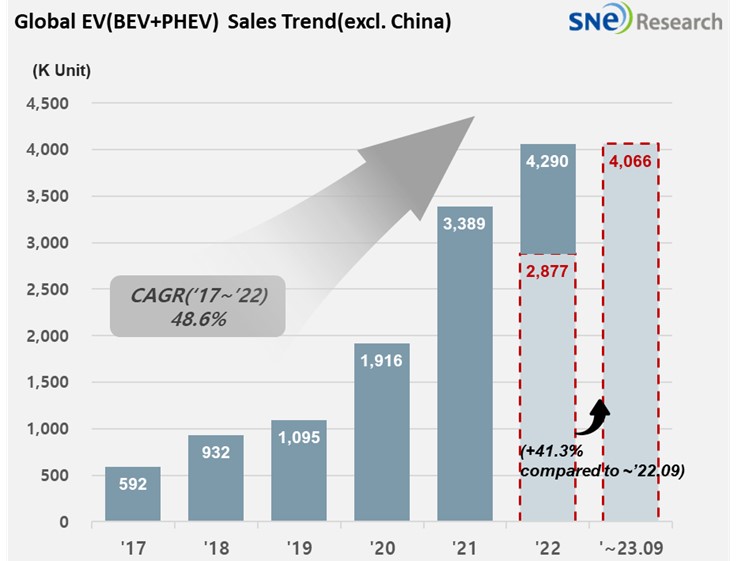

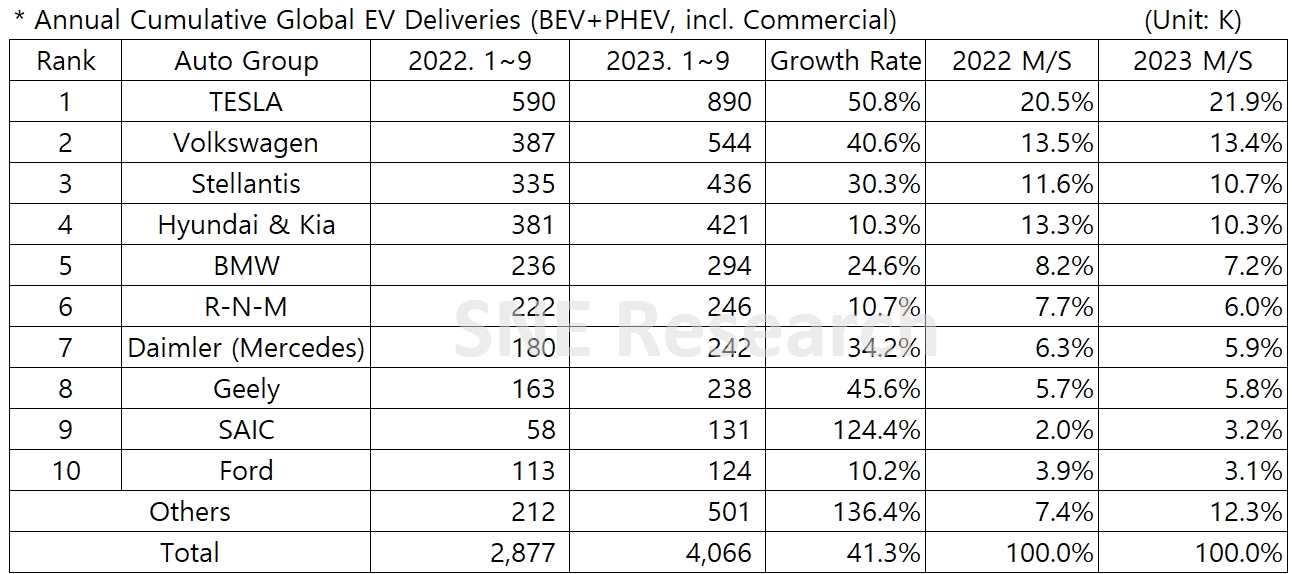

From Jan to Sep in 2023, Non-China

Global Electric Vehicle

Deliveries Posted 4.066 Mil

Units, a 41.3% YoY Growth

- Tesla top the

list while Hyundai-KIA ranked 4th in the non-China EV market

From

Jan to August in 2023, the total number of electric vehicles registered in

countries around the world except China was approximately 4.066 million units,

a 41.3% YoY growth.

(Source: Global EV & Battery Monthly

Tracker – October 2023, SNE Research)

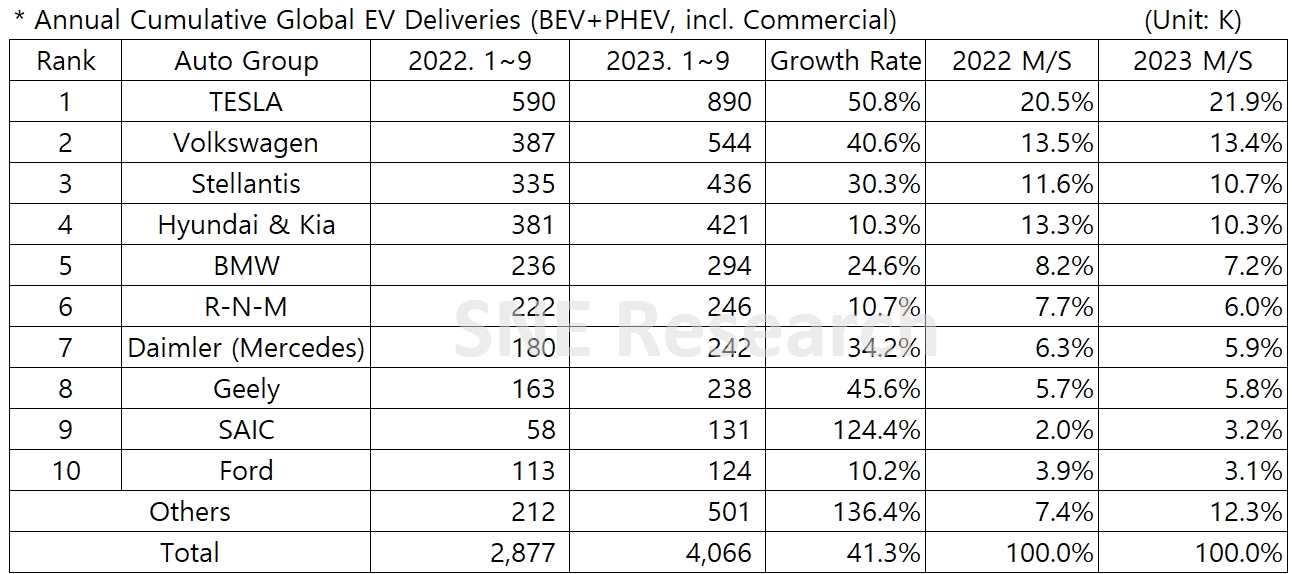

From

Jan to Sep 2023, if we look at the number of electric vehicles sold by OEM

groups in the non-China market, Tesla kept the top position with a 50.8% YoY growth.

Its growth was driven by the price-reduction strategy carried out from earlier

this year and the tax credit offered to Model 3/Y

by the US government as part of the US IRA. Tesla is going to launch the facelift

version of Model 3 which has attracted many EV consumers. The VW Group, where Volkswagen,

Audi, and Skoda belong to, recorded a 406% YoY growth, taking the 2nd

position on the list. The growth of VW Group was led by favorable sales of Audi

Q4 and Q8 E-Tron as well as ID.4, a first, non-American EV model qualified for

the tax credit offered by the US government. The 3rd place was taken

by the Stellantis Group boasting solid sales of both BEV and PHEV such as Fiat 500e,

Peugeot e-208, and Jeep Wrangler 4xe.

(Source:

Global EV & Battery Monthly Tracker – October 2023, SNE Research)

Hyundai-KIA

Motor Group posted a 10.3% YoY growth supported by sales of its main models

such as IONIQ 5/6 and EV6 as well as plug-in hybrid models like Tuscan and

Sportage that are highly popular in overseas markets. The group, breaking the

highest profit record, as profit in a third quarter, in Q3 this year, announced

that it would focus on expanding its market share by enhancing the global awareness

of its EV-dedicated brand, IONIQ, and increasing the sales of eco-friendly

vehicle through strengthening the hybrid line-up.

(Source: Global EV & Battery Monthly

Tracker – October 2023, SNE Research)

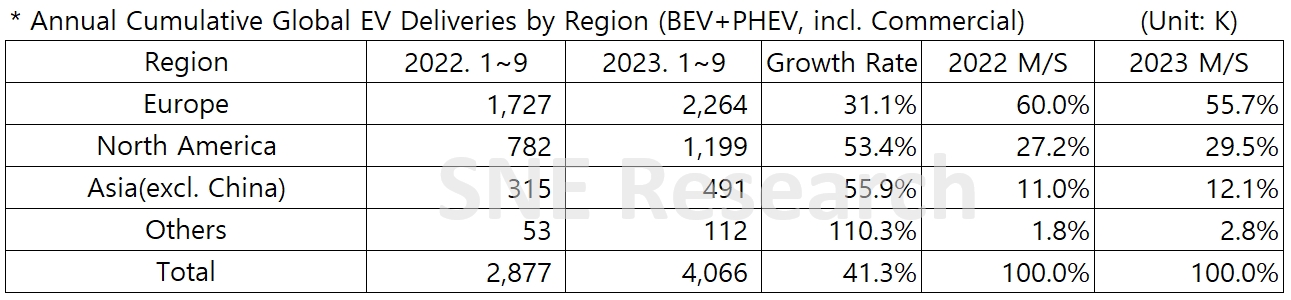

By

region, in the European market, favorable sales made by the VW Group and

Stellantis Group played a major role in leading the growth. At the same time, MG

(Morris’ Garage) under the SAIC’s umbrella sold approx. over 93k units in Europe

only within this year, proving that it has successfully settled down in the

European market. MG’s major model is MG-4, regarded as a competitor to VW’s

ID.3, a small-size, EV hatchback. It can be analyzed that MG’s strategy to

introduce electric vehicles at affordable prices has worked in the European

market, coupled with a shift in the trend of EV market from performance to cost-effectiveness.

The North American market has maintained its upward momentum based on the

increasing sales affected by an aggressive discount policy implemented by

Tesla. The Asian market had its growth led by solid sales made by Hyundai Motor

Group.

BYD,

successfully setting its image as a representative, high-end EV brand in the

China market, has secured its portion of market. Promoting its price

competitive advantage, quality, and safety – that is verified by customers in

China, BYD started to work on entering the global market. In particular, BYD’s

Yuan Plus (Atto 3) has been sold more than 30k units in the Asian market (excl.

China) till Q3 this year, proving that BYD has been gradually expanding its

shares in regions other than China.

Based on electric

vehicles (BEV+PHEV) delivered to customers or registered during the relevant

period