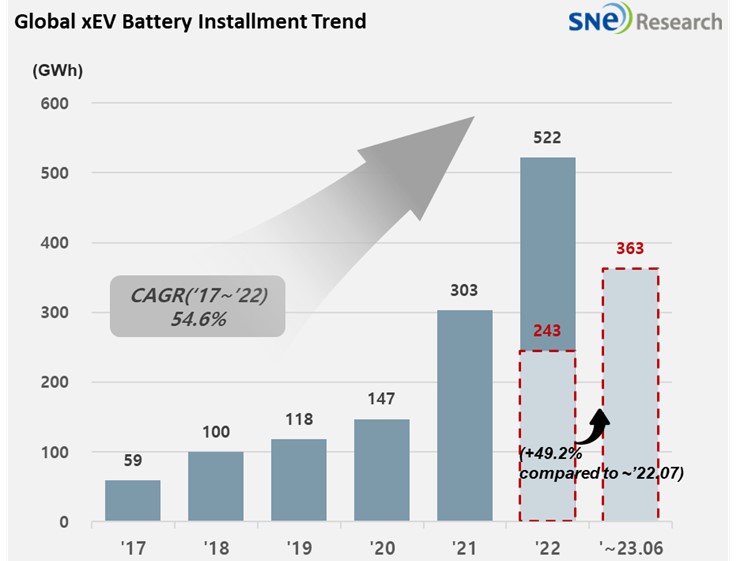

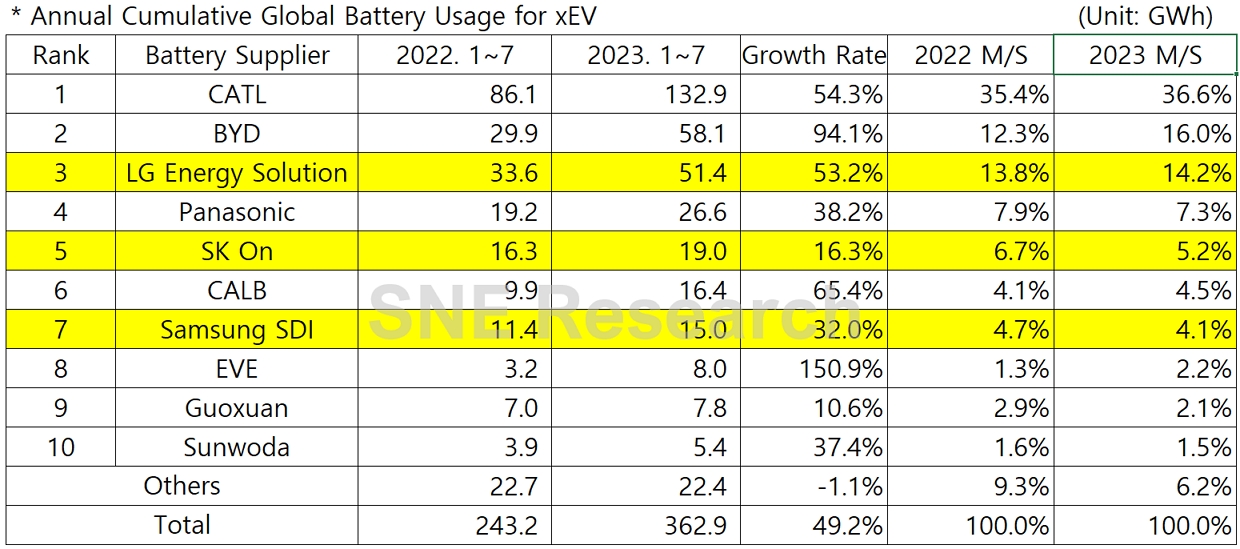

From Jan to July in 2023, Global[1] EV Battery Usage[2] Posted 362.9GWh, a 49.2% YoY Growth

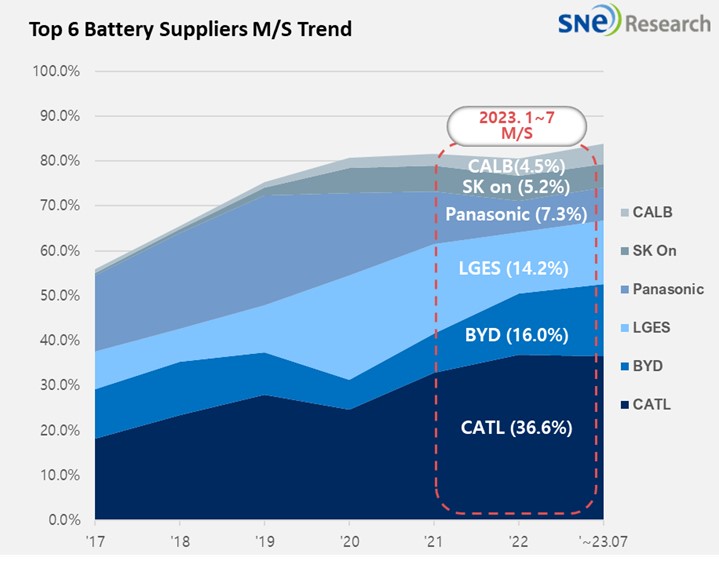

- From Jan to July in 2023, K-trio’s M/S recorded 23.5%

From January to June 2023, the amount of energy held by

batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was

approximately 362.9GWh, a 49.2% YoY growth.

(Source: 2023 August Global Monthly EV and Battery Monthly Tracker, SNE Research)

(Source: 2023 August Global Monthly EV and Battery Monthly Tracker, SNE Research)

The growth trend of K-trio was

mainly affected by strong sales of electric vehicle models equipped with

batteries of each company.

Samsung SDI continued to be in an upward trend

thanks to high sales of Rivian R1T, BMW iX/4, and Fiat 500e.

SK On recorded a growth based on solid sales of Hyundai IONIQ5, KIA EV6, and

Ford F-150. LG Energy Solution posted the highest growth among K-trio

companies, driven by favorable sales of global best-selling models such as

Tesla Model 3/Y, Volkswagen

ID. 3/4, and Ford Mustang Mach-E. As the overseas sales of

Hyundai IONIQ 6 and Kona (SX2), to which LGES batteries are installed, are

expected to expand, it seems LGES may safely stay in an upward trajectory in

future.

Panasonic,

the only Japanese company in the top 10 on the

list, recorded 26.6GWh, a 38.2% YoY growth. Panasonic, who is one of the major battery

suppliers to Tesla, has most of its battery usage installed in Tesla models in

the North American market. In particular, Tesla Model Y,

showing a sharp increase in sales compared to the same period of last year, was

a main drive behind the growth of Panasonic.

The sale of

Model 3 Long Range, which was temporarily halted, has resumed recently in the

States. As it has been reported that LGES battery is installed in the

Long-Range model, it becomes noteworthy whether there would be possible changes

in the market share of Panasonic.

CATL captured more than 30% of the global market share with a 54.3% YoY growth,

making it the only battery supplier in the world to take up such high market

share. It maintained its top position in the global

battery usage ranking. Particularly, as CATL has tried to penetrate overseas markets beyond

the Chinese domestic market, it has been showing a rapid growth in Europe and North

America. CATL’s battery has been installed in Tesla Model

3/Y as well as Chinese commercial vehicles and major electric passenger vehicle

models in the Chinese domestic market such as GAC Group’s Aion Y, and SAIC’s Mulan, leading to a continuous

high growth of the battery maker.

BYD showed a noteworthy growth nearly double from the same period of last

year in the Chinese market based on its high popularity. BYD achieved such popularity

based on its price competitiveness through vertical SCM integration such as

in-house battery supply and vehicle manufacturing. Recently, it has been

expanding its market share in Asia except China, Oceania, and Europe mainly

with its Atto 3(Yuan plus) model.

[2] Based on battery installation for xEV registered during the relevant period.