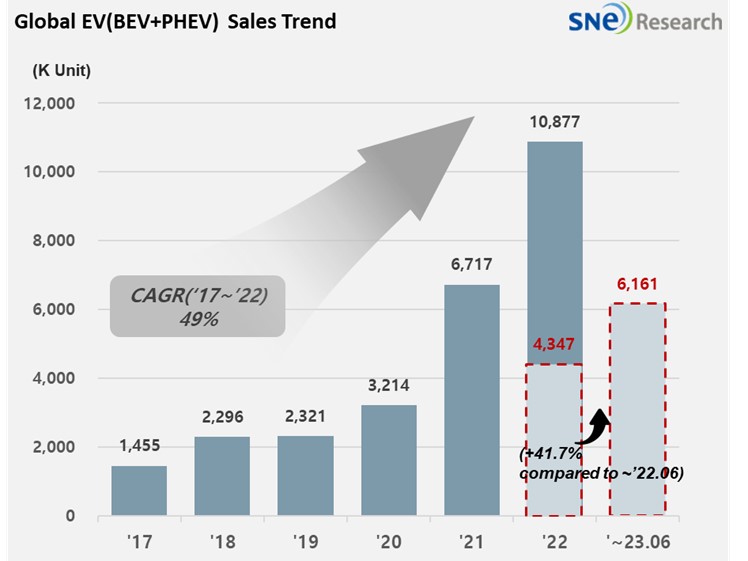

From Jan to June in 2023, Global[1] Electric Vehicle Deliveries[2]

Recorded 6.161 Mil Units, a 41.7% YoY Growth

- Global No. 1 BYD and No. 2 TESLA account for 35.3% M/S combined

From

Jan to June in 2023, the total number of electric vehicles registered in

countries around the world was approximately 6.161 million units, a 41.7% YoY

increase.

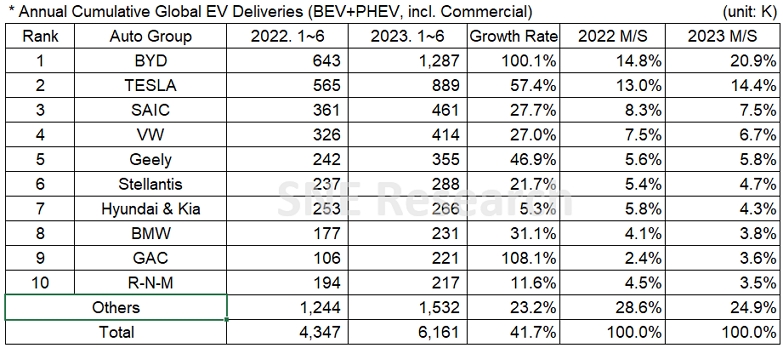

If we look at the EV sales

from Jan to June in 2023, the global top EV seller, BYD, has continued to see

an explosive growth with a 100.1%

YoY growth. In the 1st half only, it sold 1.287 million units,

taking up 20.9% of the market share. Following BYD, Tesla on the 2nd

position posted a 57.4% YoY growth propped up with its aggressive price

reduction strategy and the tax credit offered to Model 3/Y under the Inflation

Reduction Act (IRA) by the US government. SAIC

recorded a 27.7% YoY growth thanks to a favorable sale of relatively

low-capacity EVs such as Hongguang

MINI EV, MG-ZS, and Bingo.

(Source: Global EV and Battery Monthly Tracker – July 2023, SNE Research)

Hyundai-KIA

Group recorded a 5.3% YoY growth, led by IONIQ 5, EV6, and Niro. With the group

boasting a record-high profit earned in the 2nd quarter, it is

expected that the group may keep its growth momentum down the road based on the

launch of KONA (SX2) Electric and EV9 as well as the global sale expansion of

IONIQ 6. It seems possible for the group to break its record in profit again in

the 3rd quarter of this year.

(Source: Global EV and Battery Monthly Tracker – July 2023, SNE Research)

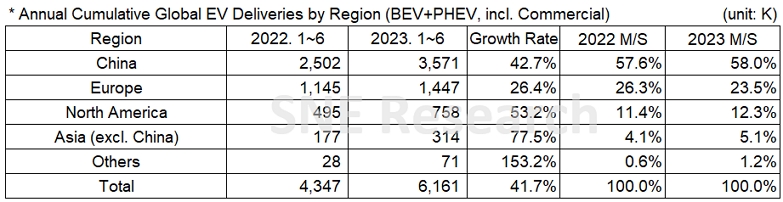

While

an upward trend was found in China and North America during 2023 1H, the growth

rate of EV and battery industry in Europe was relatively low at 26.4%. This can

be attributed to the reduction in benefits for electric vehicles in Europe and the

increase in energy cost due to the Russia-Ukraine War. An upward trend in the

Asian region and other regions, except China, Europe, and North America, was noticeable,

which is a sign that the Chinese companies started to enter into overseas market

in earnest. It seems necessary to keep an eye on proactive overseas market

entrance by the Chinese EV makers, based on their solid domestic market and supply

chain, and also possible changes in the protectionist policies by the US and

Europe.

[1] The xEV sales of 80

countries are aggregated.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period