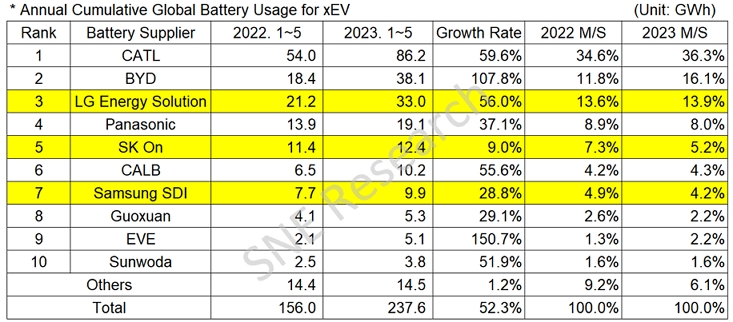

From Jan to May in 2023, Global

EV Battery Usage

Posted 237.6GWh, a 52.3% YoY Growth- K-trio’s M/S recording 23.3%, with LGES ranked 3rd

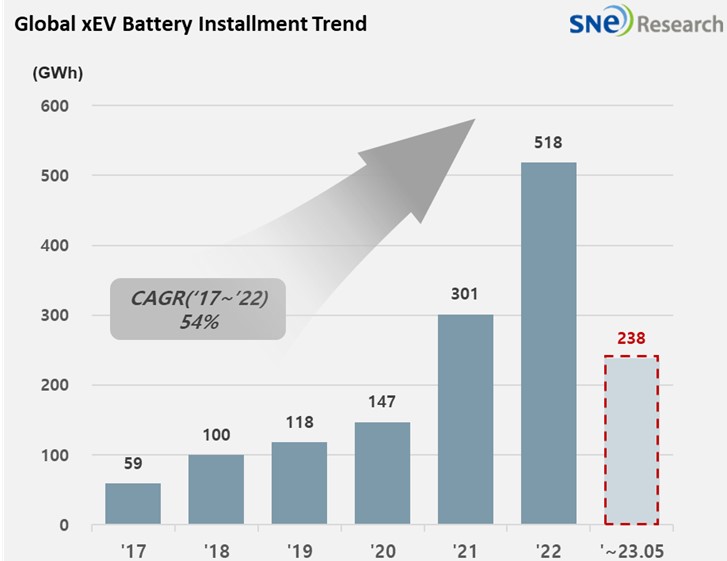

From January to May 2023, the amount of energy held by

batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was

approximately 237.6GWh, a 52.3% YoY growth. Driven by the increasing shares in

the Chinese domestic market, BYD continued to be ranked 2nd with a

triple-digit growth compared to the last year.

(Source: 2023

June Global Monthly EV and Battery Monthly Tracker, SNE Research)

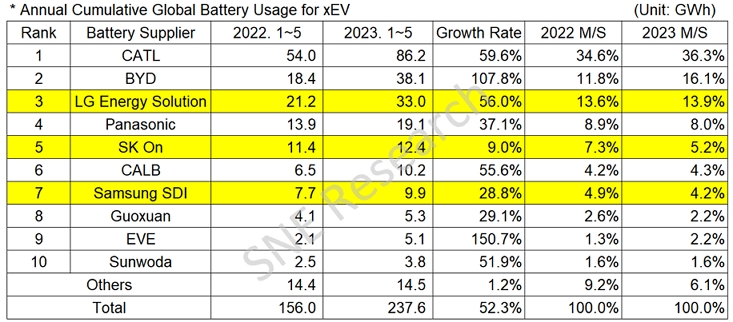

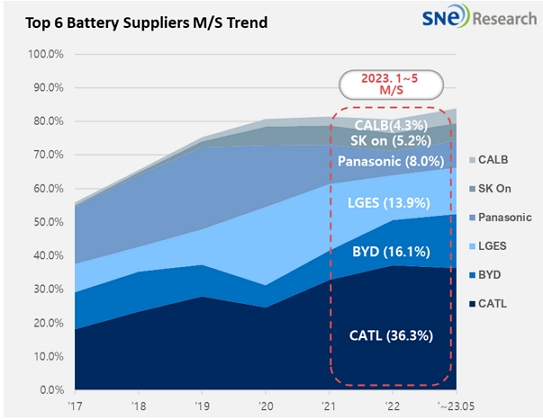

The combined

market shares of K-trio companies were 23.3%, declined by 2.5%p compared to the

same period of last year, but all of them witnessed an increase in terms of

battery usage. LG Energy Solution took the 3rd position, exhibiting

a 56.0%(33.0GWh) YoY growth, while SK-On ranked 5th

with a 9.0%(12.4GWh) growth and Samsung SDI ranked 7th

with a 28.8%(9.9GWh) growth.

(Source: 2023 June Global Monthly EV and Battery Monthly Tracker, SNE Research)

Such upward trend in the

growth of K-trio was mainly affected by strong sales of electric vehicle models

equipped with batteries of each company. Samsung SDI remained in an upward trajectory,

thanks to steady sales of Rivian’s pick-up truck R1T, BMW i4/X, and Piat 500electric.

SK On’s growth was mainly driven by the increasing sale of Hyundai Ionic 5, KIA

EV6, and Hyundai’s e-truck model Porter 2 Electric, and Ford F-150. KIA’s EV9,

whose pre-order exceeded 10k units after its official release, is reportedly to

have the 99.8kWh high-capacity battery from SK On, leading to an expectation for

SK On’s continuous growth. LG Energy Solution recorded the highest growth among

K-trio companies based on a strong sale of Tesla Model 3/Y, Volkswagen ID. 3/4,

and Ford Mustang Mach-E.

Panasonic,

the only Japanese company in the top 10 on the

list, recorded 19.1GWh,

a 37.1% YoY growth. Panasonic, who is one of the major battery suppliers to

Tesla, has most of its battery usage installed in Tesla models in the North

American market. The sale of Model 3 Long Range, which was temporarily halted, has

resumed recently in the States. As it has been reported that LGES battery is

installed in the Long-Range model, it becomes noteworthy whether there would be

possible changes in the market share of Panasonic.

With a 59.6% YoY growth, CATL from China accounted

for more than 30% of market share, making it as the only battery supplier in

the world to take up such high market share. It still remained at the top

position in the global battery usage ranking. CATL’s battery has been installed

in Tesla Model 3/Y as well as Chinese commercial vehicles and major electric

passenger vehicle models in the Chinese domestic market such as SAIC’s Mulan, GAC

Group’s Aion Y, and NIO’s ET5, fueling the continuous growth of the battery

maker. BYD has been very popular in the Chinese domestic market based on its

price competitiveness through vertical SCM integration such as

in-house battery supply and vehicle manufacturing. Recently, BYD has been

enjoying an explosive growth by expanding its market share in Europe and the Asian region

except China with its Atto3

model.

(Source: 2023 June Global Monthly EV and Battery Monthly Tracker, SNE Research)

In 2023, in preparation for a possible

gradual decline in the growth of Chinese domestic market, which is the world’s

largest EV market, the Chinese battery suppliers are expected to enter overseas

markets such as Europe. Especially, Europe – regarded as the 2nd

largest EV market next to China – is highly likely to become the most

competitive area for battery and EV companies as the region has been active in

adopting and implementing the green policy. In addition, as there are less volatile

political issues in Europe compared to the US, the region has drawn an attention

from key market players as a strategic base to start the diversification of

battery supply chain. Furthermore, with the Chinese battery makers entering the

European market in earnest, the installation rate of LFP battery in Europe is

also expected to increase in future.

Based

on battery installation for xEV registered during the relevant period.