K-Trio Battery Makers’ Demand for Separator Expected to Exceed USD 10 Bil in 2030

- Leading to Expectation for Rapid Growth of Korean Separator Makers

Amidst the ongoing explosive growth of K-trio LIB makers, two Korean separator makers – SKIET and WCP – are expected to lead the global separator market.

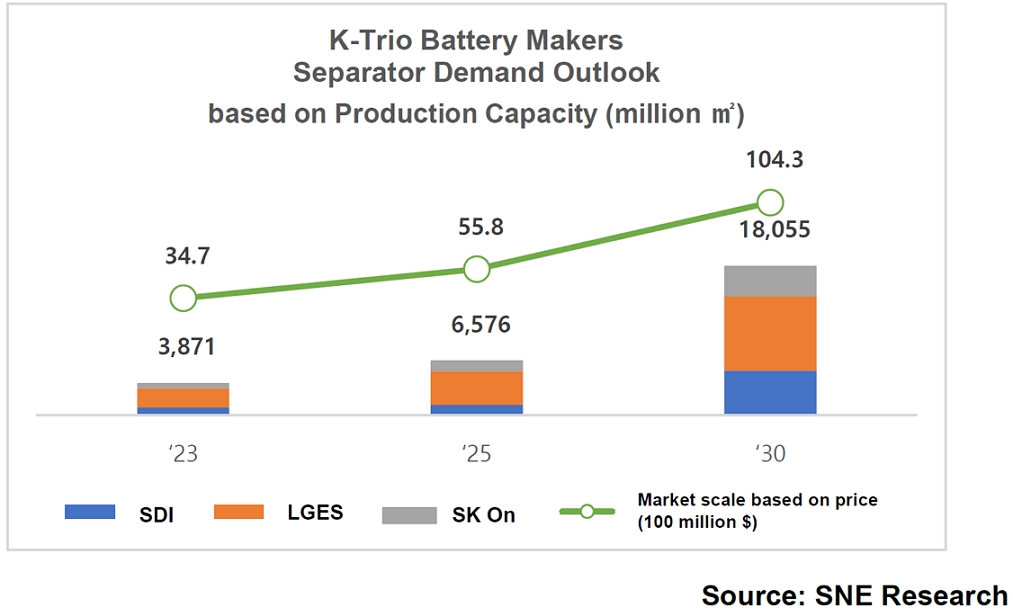

According

to the report recently published by SNE Research, titled <2023> LIB

Separator Market & Market Change Forecast ('20~'30): Future Evolution of

LIB Separator in the Era of Competition, the demand for separator from K-trio

battery makers are expected to grow at a CAGR of 17% from 2023 to 2030,

reaching USD 10 billion based on price. In addition, as it is highly likely

that SKIET and WCP would receive orders from overseas battery makers, the

growth of SKIET and WCP are expected to see a steep growth.

Separator

is one of the four major components in lithium-ion battery and is known to be

difficult for companies to enter the market. Separator, designed for preventing

the battery explosion, has a significant impact on safety. Given how important

it is, those who want to manufacture and sell separator to the market are all

required to go through a long, strict approval process to finally be accredited

as separator maker for EV. In case of changing a separator supplier, it takes

at least 4 years to receive an approval from OEMs. Under these circumstances,

it is no doubt that those who’ve already entered the market can generate

profits in a stable manner. What’s more favorable is that, unlike cathode,

anode, or electrolyte, separator is made of widely-used petrochemical resin –

polyethylene (PE) or polypropylene (PP) – and thus, is not sensitive to

fluctuations in raw material price. In fact, by utilizing ceramic or alumina

coating, it is even possible to create additional value and higher profit

compared to the raw material cost.

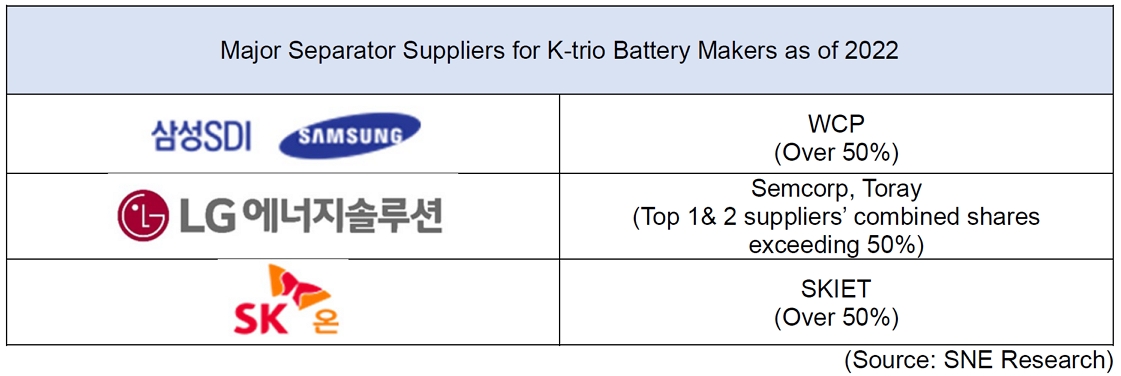

In

consideration of the characteristics of separator industry, battery

manufacturers usually select their major separator suppliers to secure the

stability in separator supply. Samsung SDI is supplied with separator mostly

from WCP. LG Energy Solution is in close connection with Toray from Japan,

while WCP supplies separators for small-size battery of LGES. SK On is supplied

with separator from SKIET, affiliated to SK Innovation.

Under the circumstances in which new separator makers are hard to emerge in the market due to such a high entry barrier, it is expected that battery manufacturers’ dependence on the Korean separator companies would increase at a rapid pace. The battery makers in Korea are reported to prepare for entering the North American and European markets based on the technical competitiveness. While expanding their production capacity, the K battery makers are also keen to follow the recently announced rules and conditions in those regions such as the US Inflation Reduction Act (IRA) and Europe’s Critical Raw Materials Act (CRMA). In accordance with these recent activities, SKIET and WCP have been continuously receiving requests for ramp-up from the market.

Even for those global battery makers, the Korean separator companies who can safely make inroads into overseas markets, have become their sole solution. SKIET and WCP have already started to build or operate their separator production lines in Poland and Hungary and are planned to decide whether to enter the North American market within this year.