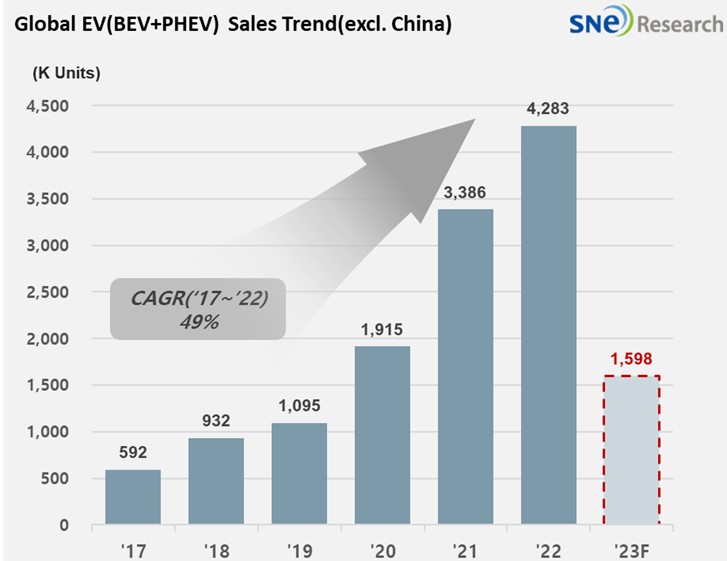

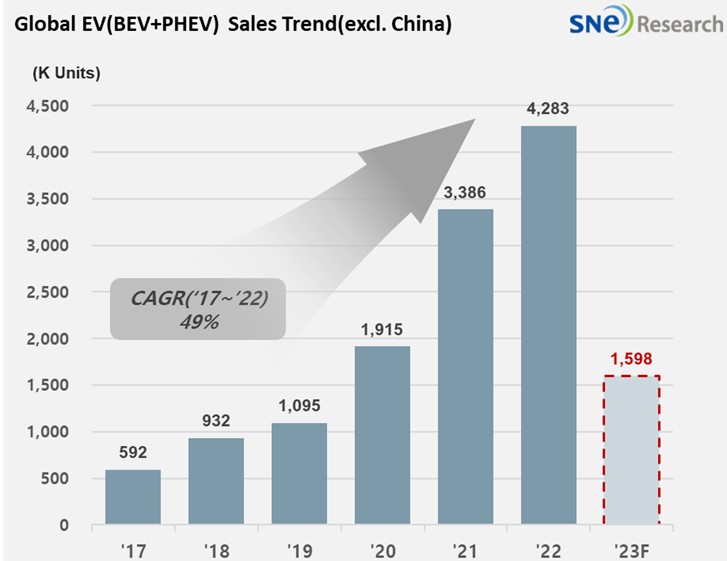

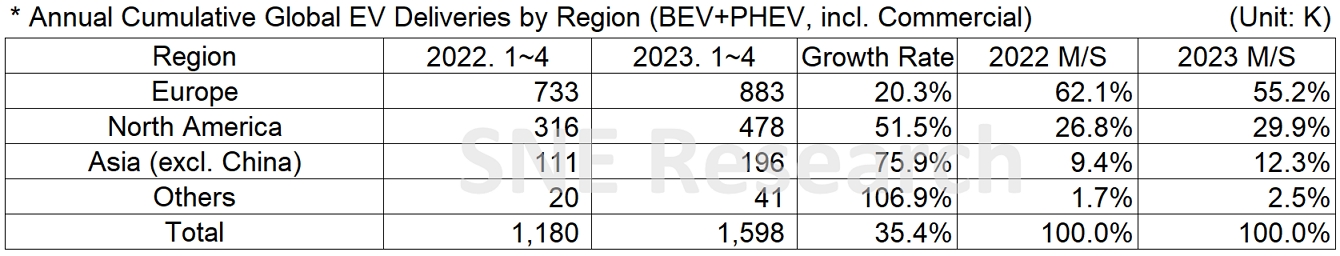

From Jan to Apr

in 2023, Non-China Global Electric Vehicle

Deliveries

Recorded 1.598

million units, a 35.4% YoY Growth

- Tesla ranked top and

Hyundai-KIA ranked 4th in the non-China EV market

From

Jan to Apr in 2023, the total number of electric vehicles registered in

countries around the world except China was approximately 1.598 million units,

posting a 35.4% YoY growth.

(Source: Global EV & Battery Monthly

Tracker – May 2023, SNE Research)

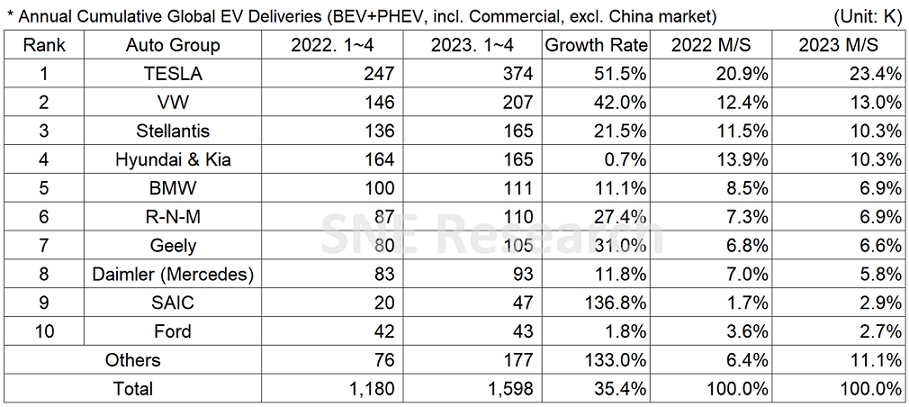

From

Jan to Apr 2023, in the non-China market, the sale of Tesla’s main models –

Model 3 and Y – led the growth of Tesla who kept the top position in the

ranking with a 51.5% YoY growth. The Volkswagen group, where Volkswagen, Audi,

and Skoda belong to, recorded a 42.0% YoY growth and ranked 2nd on

the list. The growth of VW group was driven by steady sales of Enyaq, Audi Q4

E-Tron, and ID series including ID.4, a first, non-American EV model qualified

for the EV tax credit offered by the US government. It is also noteworthy that

these VW group’s models are all based on MEB platform. The Stellantis group jumped

to the 3rd place based on solid sales of both BEV and PHEV such as Wrangler

PHEV and 500 electric.

(Source:

Global EV & Battery Monthly Tracker – May 2023, SNE Research)

The

4th place was taken by Hyundai-KIA Motor Group, which earned the

biggest operating profit in history as for Q1. Due to seasonal factors, such as

changes in EV subsidy policies, often found in Q1 that are unfavorable to

selling eco-friendly vehicles, the EV sales have seen a 0.7% YoY growth.

However, in the coming 2nd quarter, which is regarded as a seasonal

high season, the market is expected to be in an upward trajectory again as KONA(SX2)

Electric and EV9 are said to be released shortly and IONIQ 6 is likely to be

sold more in the global market.

The SAIC

group, focusing on the Chinese domestic market, safely entered the top 10 on

the list, propped up with a huge increase in its sale of MG brand’s MG-4, MG-5,

and MG-ZS models in Europe.

(Source: Global EV & Battery Monthly

Tracker – May 2023, SNE Research)

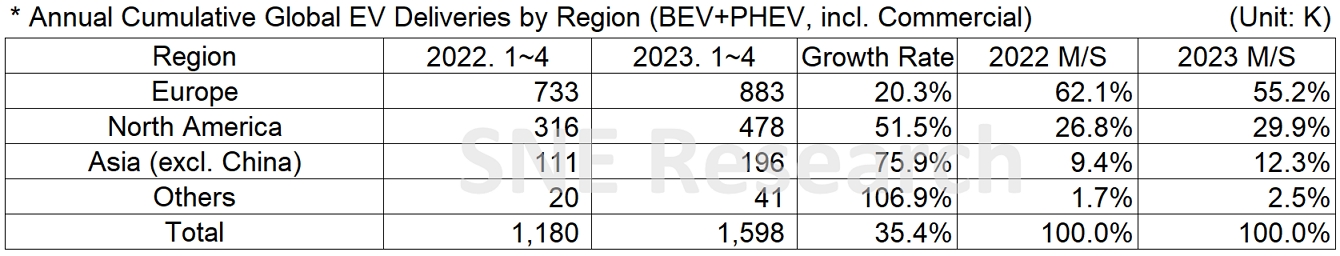

As the

Chinese electric vehicles such as BYD, SAIC’s MG, GWM (Great Wall Motor)’s ORA,

and HOZON’s NETA are trying to enter the global market by making inroads into

Europe and East Asia based on their safety and price competitiveness,

attentions should be paid to a possible sea change in the non-China EV market.

Based on electric

vehicles (BEV+PHEV) delivered to customers or registered during the relevant

period