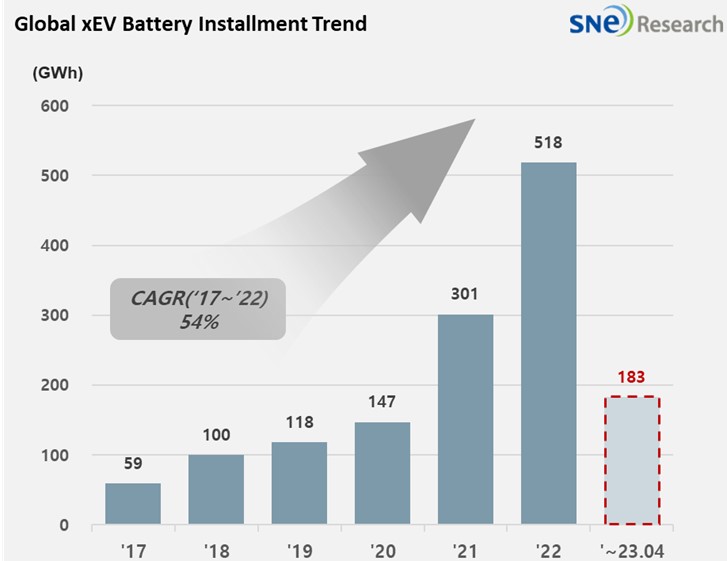

From Jan to Apr in 2023, Global[1] EV Battery Usage[2] Posted 182.5GWh, a 49.0% YoY Growth

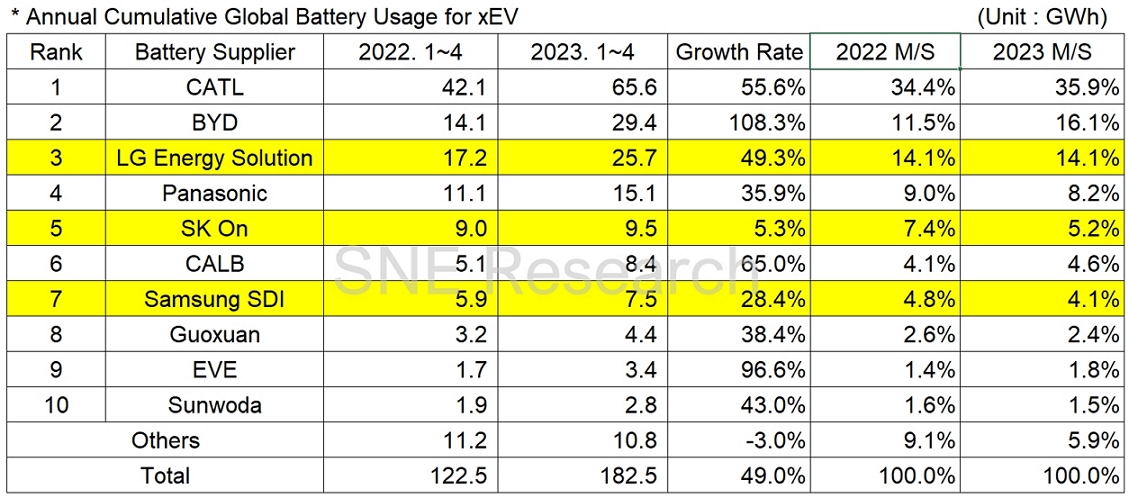

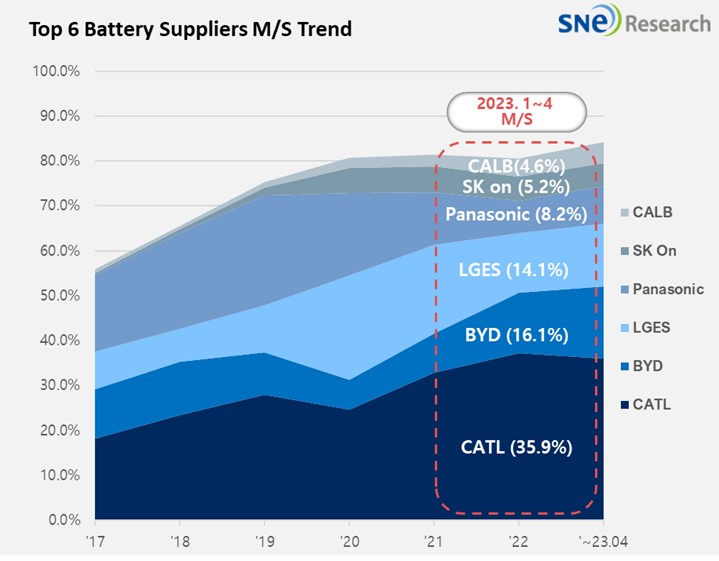

- K-trio’s M/S posting 23.4%, with LGES ranked 3rd

From January to April 2023, the amount of energy held by batteries for

electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 182.5GWh,

a 49.0% YoY growth. BYD kept the 2nd position on the list, propped

up with the expanded shares in the Chinese domestic market and its triple-digit

growth compared to the last year.

(Source: 2023 May Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares

of K-trio companies were 23.4%, declined by 2.8%p compared to the same period

of last year, but, in terms of battery usage, all three companies saw an increase.

LGES ranked 3rd based on its 49.3%(25.7GWh) YoY growth, while SK-On took the 5th position with a 5.3%(9.5GWh) growth

and Samsung SDI ranked 7th with a 28.4%(7.5GWh) growth.

Panasonic, the only Japanese company in the top 10 on the list, recorded 15.1GWh, a 35.9% YoY growth. Panasonic, who is one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla models in the North American market. The sale of Model 3 Long Range, which was temporarily halted, has resumed recently in the States. As it has been reported that LGES battery is installed in the Long-Range model, attentions have been drawn to possible changes in the market share of Panasonic.

With a 55.6% YoY growth, CATL from China accounted for more than 30% of market share, making it as the only battery supplier in the world to take up such high market share. No doubt, the global No. 1 place was taken by CATL. CATL’s battery has been installed in Tesla Model 3/Y as well as major electric passenger vehicle models in the Chinese domestic market such as SAIC’s Mulan, GAC Group’s Aion Y, and NIO’s ET5, fueling the continuous growth of the battery maker. BYD has drawn a great popularity in the Chinese domestic market based on its price competitiveness through vertical SCM integration such as in-house battery supply and vehicle manufacturing. Recently, BYD succeeded in expanding its market share in Europe and the Asian region except China with its Atto3 model, showing an explosive growth.

(Source: 2023

May Global Monthly EV and Battery Monthly Tracker, SNE Research)

In 2023, in preparation for a possible gradual decline in the growth of Chinese domestic market, which is the world’s largest EV market, the Chinese battery suppliers are expected to make inroads into overseas markets such as the US and Europe. Among those prospective markets, the European EV market has drawn an attention from major market players as the market has comparatively less volatile political issues compared to the US and thus, it has been regarded as a strategic point to start the diversification of battery supply chain. In addition, with the Chinese battery makers entering the European market in earnest, the installation rate of LFP battery in Europe is also expected to increase down the road.

[2] Based on battery installation for xEV registered during the relevant period.