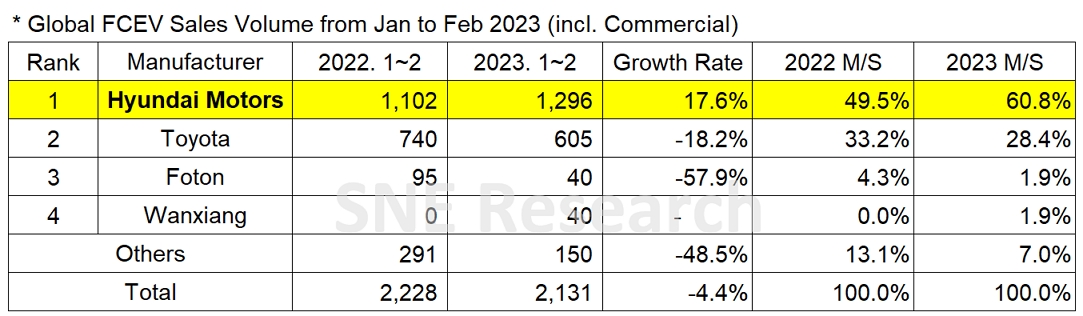

Global FCEV Market with 4.4% YoY Degrowth from Jan to Feb 2023

- In Feb 2023, NEXO from Hyundai Motor Group sold 953 units in the global market and saw sales recovery in the Korean domestic market.

A

total number of globally registered FCEVs sold from Jan to Feb 2023 was 2,131

units, recording a 4.4% YoY decline and ended up with a degrowth. On the other

hand, in February 2023, NEXO from Hyundai Motor Group sold 884 units in the

domestic market of Korea and 953 units in the global market, leading Hyundai

Motors to post a 17.6% YoY growth.

As the Korean government confirmed this year’s subsidy fund for FCEV 16,000 units, the sale of NEXO, which slightly halted last month due to a seasonal reason, multiplied again. Accordingly, Hyundai Motor Group took up 60.8% of the FCEV market and kept No.1 position. The sale of Toyota Mirai was steady with an upward tendency continuing from last month. However, the Japanese car maker experienced a 18.2% YoY degrowth and ended up with a 32.4%p gap with the Hyundai Motors. Given the fact that over 90% of NEXO’s global sale was made in the Korean domestic market, if the Korean and Japanese markets are excluded from calculation, the sale of Mirai is found to be more than 4 times greater than that of NEXO.

(Source: Global FCEV Monthly Tracker – Mar 2023, SNE

Research)

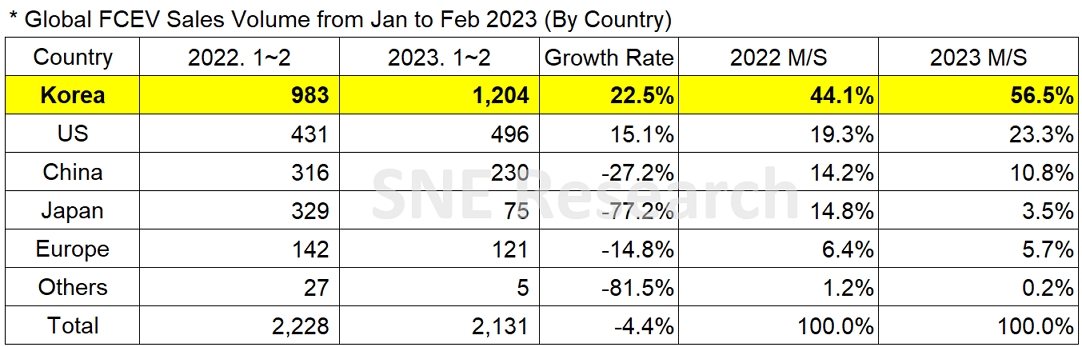

By country, Korea, posting a 22.5% YoY growth, accounted for more than half of the global FCEV market thanks to strong sale of Hyundai NEXO in the domestic market. The US, where Toyota Mirai is sold most, recorded 15.1% of growth and jumped to the 2nd place on the list. Except Korea and the US, other countries all experienced a degrowth. Particularly, China has seen a significant decline in its FCEV market share as the demand for hydrogen commercial vehicles in China has decreased since the latter half of last year. Despite these subsided activities in the China market, there is still a positive market assessment that it can always bounce back to the previous level as there is a huge domestic market in China and the government has a strong will to foster the hydrogen industry. In this regard, it is expected that there would be changes in strategies adopted by the Chinese companies to target the FCEV market after recent strong demands for electric vehicles are satisfied to some degree.

(Source: Global FCEV Monthly Tracker – Mar 2023, SNE Research)

During the year of 2022, the FCEV market has continued its gradual growth, with the global FCEV sale exceeding 20,000 units for the first time. At the Seoul Mobility Show 2023, BMW finally unveiled the prototype of iX5 Hydrogen after 4 years of development based on fuel cells also installed in Toyota Mirai. The German carmaker aims to mass produce iX5 hydrogen model before 2030 and achieve the max driving range (based on WLTP) of 504km. As Honda announced a joint development plan for next-generation fuel cell system with GM, the Japanese carmaker plans to mass produce a new hydrogen electric vehicle model, based on its CR-V, in 2024. Despite recent news on the development of new hydrogen models and related investment by major companies, the insufficiency of FCEV charging infrastructure and continuously increasing FCEV charging price are regarded as a hurdle for the market growth. Under this circumstance, many market players point out that charging infrastructure and related facilities for FCEV should be improved for further development of hydrogen vehicle in future.