<2025> Cobalt-free Cathode Technology Development Trends and Market Outlook

As the EV and ESS markets grow rapidly,

battery demand is surging. However, the nickel–cobalt–manganese (NCM) cathode

materials that have been predominantly used so far face a critical issue of

high cobalt dependency.

From a performance perspective, the main

reason for using cobalt in cathode materials is its role in enhancing battery

stability and performance. Nevertheless, its price is highly unstable,

production is concentrated in specific countries, and more than 70% of global

cobalt production comes from the Democratic Republic of Congo, where human

rights issues are also involved. Moreover, cobalt prices have fluctuated

sharply in recent years, adding uncertainty to battery manufacturing costs.

Against this background, the battery

industry is accelerating the development of so-called cobalt-free cathode

materials that reduce or completely eliminate cobalt dependency. The goal is to

maintain or improve performance without using cobalt, thereby achieving

advantages such as price stability, reduced supply chain risks, and

strengthening of eco-friendly and ethical image.

Cobalt-free cathode materials are not

simply a matter of being a "low-cost material," but rather a

strategic solution to address complex issues such as supply chain stability,

energy density, and safety. Going forward, the EV market will rely not on a

single material but on a diversified material portfolio tailored to vehicle

purposes and price ranges. Accordingly, cobalt-free cathode materials are at

the center of this trend and are expected to become one of the most important

areas of technological competition over the next five years.

• NMx is rapidly gaining attention for mid- to high-end EVs, with

SVOLT taking the lead.

• LMR has the highest potential energy density, but a significant

hurdle of voltage fade remains.

• LMFP complements the safety and low cost of LFP with improved

performance, making it the fastest-expanding field for commercialization.

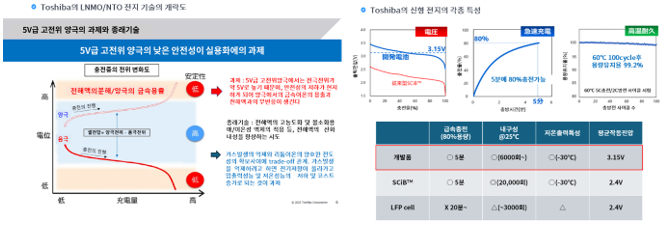

• LNMO is characterized by high voltage and high power output, but

stabilization of the electrolyte is the key to commercialization.

NMx has representative compositions such

as LiNi₀.₅Mn₀.₅O₂ and LiNi₀.₈Mn₀.₂O₂. It is a

cobalt-free cathode material derived from the conventional nickel–cobalt–manganese

(NCM) system, with an increased manganese ratio. Removing cobalt significantly

reduces cost, but it also lowers structural stability, which can lead to

capacity fading and degradation. To address these issues, various approaches

such as single-crystal particle design, doping, and surface coating are under

active investigation.

LMR, represented by Li₁.₂Mn₀.₆Ni₀.₂O₂, is a

cathode material rich in lithium and manganese. Its major advantage lies in the

ability to significantly increase energy density. Compared to conventional

materials, it can utilize much more lithium, theoretically achieving capacities

above 250 mAh/g. However, repeated charge–discharge cycles

cause a gradual voltage fade, and considerable irreversible loss occurs during

the initial charge. As a result, commercialization has been relatively slow,

but numerous companies and research institutes are developing technologies to

suppress voltage fade.

LMFP is a material that retains the

stability and long cycle life of LFP while incorporating manganese to raise the

average voltage and thereby enhance energy density. However, it has inherent

drawbacks such as low conductivity and slow lithium diffusion. To address these

limitations, techniques such as carbon coating, nanostructuring, and

optimization of the Fe/Mn ratio are being applied. A notable example is CATL’s

M3P, which is widely recognized as an LMFP-based technology.

LNMO, typically represented by LiNi₀.₅Mn₁.₅O₄, is a

spinel-structured cathode material with a high voltage of 4.7 V. It contains no

cobalt and only a small amount of nickel. Thanks to its high voltage and 3D

spinel framework, it delivers excellent power performance and is well-suited

for fast charging. However, the high voltage can cause electrolyte oxidation

and manganese dissolution, leading to rapid performance degradation at elevated

temperatures. To address these challenges, efforts are being made in areas such

as developing high-voltage electrolytes, applying surface coatings, and

adopting solid electrolytes.

For NMx cathode materials, China’s SVOLT

became the world’s first company to mass-produce cobalt-free NMx cells in 2021

and installed them in actual vehicles (GWM ORA Cherry Cat), serving as a

representative case that demonstrated the commercialization potential of

cobalt-free technology. In Korea, Samsung SDI also unveiled NMx-based

technology at international exhibitions, showcasing its R&D achievements.

While it has not yet reached large-scale mass production, the technology is

included in its next-generation roadmap. SK On has likewise gained recognition

with its cobalt-free batteries, announcing that it has addressed performance

degradation issues through single-crystal and doping technologies.

Ultium Cells, the joint venture between

GM and LG Energy Solution in the United States, is developing large-format

prismatic cells based on LMR, with commercialization targeted for 2028. The

project specifically aims to deliver high-energy batteries suitable for large

vehicles such as SUVs and trucks.

CATL has been mass-producing its

LMFP-based M3P battery since 2023, leading the market. Gotion High-Tech also

plans to begin mass production of LMFP-based products in 2024, while BYD has

hinted at the potential application of LMFP in its second-generation Blade

battery. Chinese material suppliers such as Dynanonic and Easpring are

investing in large-scale production facilities to prepare for market expansion.

In Korea, Samsung SDI has showcased LMFP at exhibitions, demonstrating a strong

commitment to actively respond to market demand.

In Europe, companies such as Topsoe and

Morrow are preparing for the commercialization of LNMO-based batteries.

However, electrolyte stability remains a key challenge for LNMO, making it

necessary to drive innovation in both materials and electrolytes simultaneously.

This report provides an overview of

developments in cobalt-free cathode materials. More specifically, it analyzes

the global lithium-ion battery market and the EV market, as well as the market

status of cobalt-free cathode materials and EV adoption. It also examines

development trends and future outlooks, with a particular focus on the

technological progress and prospects of cobalt-free cathode materials. In

addition, the report expands its scope to include technology and patent

analyses of Chinese and Korean companies that are leading in cobalt-free

development and application, aiming to identify the key technologies essential

to cobalt-free cathodes.

We sincerely hope that this report by

SNE Research will not only provide valuable insights to those interested in

cobalt-free technologies and markets, but also serve as a significant aid in

understanding the industry surrounding them..

Strong Points of This Report

① Provides an in-depth spotlight on cobalt-free cathode materials,

centering on key chemistries such as NMx, LMR, LMFP, and LNMO.

② Includes detailed analyses of the limitations, strengths,

weaknesses, and mitigation strategies of cobalt-free cathode materials.

③ Provides detailed coverage of companies’ R&D trends and

production plans for cobalt-free cathode materials.

④ Analyzes the latest and key patents from leading developers and research institutes related to cobalt-free cathode materials.

[

Analysis of LMR Coating Mechanisms and Microstructural Characteristics ]

Contents

2. Current

Status of Cobalt-free Cathode Development

3. Current

Status of LNO Cathode Development

4. Current

Status of LMO/LNMO Cathode Development

5.

Development Status of NMx Cathode Materials

6.

Development Status of LMR Cathode Materials

7.

Development Status of LMFP Cathode Materials

8.

Development Status and Market Outlook by Company

9. Patent

Analysis of Cobalt-Free Cathode Materials

|