<2024> Technology Development Trends and Prospects of Dry Battery Electrode Process for LIBs

Electric

vehicles themselves do not emit greenhouse gases, but the manufacturing process

of electric vehicles has been criticized for emitting carbon and destroying the

environment. A representative example is the battery, which accounts for about

40% of the manufacturing cost of electric vehicles.

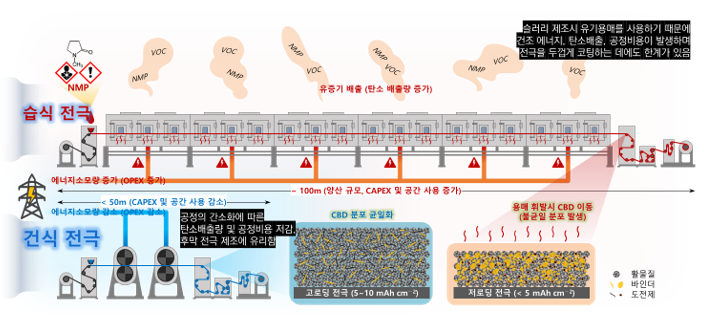

During

the battery manufacturing process, a considerable amount of electric energy is

consumed, especially in drying and recovering NMP, which is a cause of

greenhouse gas emissions. According to one research result, 42 kg of CO2 is

generated per kWh due to solvent drying in the wet manufacturing process, and

volatile organic compounds (VOCs), which are environmental pollutants, are also

emitted into the atmosphere. In contrast, dry electrodes do not have a solvent

drying and recovery process, so they consume less electric energy and do not

emit VOCs, making them an environmentally friendly process.

In

order to increase energy density, a thick film electrode of >100㎛ or more is

required. In the current wet process, it is difficult to make a thick film

electrode due to the layer separation phenomenon between the solvent and the

material. Since the specific gravity of each material such as the active

material, conductive material, and binder is different, if the coating is

thick, the binder and conductive material float to the electrode surface. In

the wet process, it is difficult to coat the electrode with a thickness of

about 100㎛ or more.

By

using a dry process, the active material-conductive material-binder can be

evenly distributed without this layer separation phenomenon, so a thick-film

electrode can be created, which can increase the capacity and energy density of

the battery.

In

2019, Tesla acquired Maxwell Technologies, a supercapacitor company with dry

electrode technology, and announced at Battery Day in September 2020 that it

would introduce dry electrodes. Tesla sold Maxwell to UCAP in 2021, two years

later, but was able to secure dry electrode technology. According to experts

who directly obtained and analyzed the Tesla 4680 battery, the battery applied

a dry electrode only to the anode, and the existing wet electrode was adopted

for the cathode.

It

is not known why Tesla has not yet applied the dry electrode process to the

cathode, but there is analysis that the yield of the dry electrode process is

low and cannot be mass-produced. There are also foreign media reports that the

low yield of the 4680 battery is affecting the production of the Cybertruck.

The

principle of the dry coating process is simple, but there are considerable

challenges at each stage in implementing it in practice. It is not easy to

evenly mix the active material, conductive material, and binder without using a

solvent. It is even more difficult to evenly apply the non-viscous powder to

the current collector. If the yield is low, the production cost increases. Dry

electrodes were introduced to reduce costs, but they can actually act as a cost

increase factor.

In

addition to Tesla, domestic and foreign companies are currently announcing that

they are developing a P/P scale dry process, but it is expected that all 46-phi

cylindrical batteries to be initially produced will be produced using a wet

process. The 4680 battery that LGES will produce in the fourth quarter of 2024

on a P/P scale will apply a wet process to both cathode and anode, and this

battery will be supplied to Tesla. Recently, LGES announced that it will

complete the construction of a dry electrode process P/P line in the Ochang

Energy Plant in the fourth quarter of 2024 and will apply it starting in 2028.

Samsung SDI, SK On, Panasonic, CATL, and Kumyang, which recently announced that

they are also developing dry electrode technology.

In

addition, Volkswagen of Germany announced in June 2023 that it was developing a

dry electrode process with Koenig & Bauer, a German printing equipment

specialist. Volkswagen plans to start industrial production by 2027. It is not

known exactly how Volkswagen and Koenig & Bauer are developing the dry

electrode.

The

dry process can reduce energy costs by 30% because the drying process is

unnecessary, and the area required for drying can be reduced by 50%. The 4680

battery using the dry process can theoretically be cheaper than the LFP

battery, but the technology development has not been successful yet.

The

introduction of the dry process has great potential as a carbon-neutral process

for manufacturing lithium secondary batteries, and the commercialization of dry

electrode technology is expected to greatly contribute to reducing battery

manufacturing costs while improving performance. Although no company has

succeeded in mass production so far, it is very likely that the dry electrode

process will become a trend in the near future as major companies are spurring

technology development. In addition, the development of the dry electrode

process can be applied to the manufacturing process of all-solid-state

batteries, which are next-generation batteries. In fact, interest in

all-solid-state batteries is increasing both domestically and internationally,

and plans for mass production are being established.

This

report provides technical information such as the necessity of developing a

carbon-neutral process in the secondary battery industry, issues with the

existing wet process, and issues with the current dry process, as well as

information on recent development trends in dry electrode processes and

all-solid-state battery development by many companies, with the aim of

forecasting the current and near-future status of the dry process.

Strong

Points of This Report

① Includes rich technical content on the background and development

of the dry electrode process

② Includes detailed descriptions of the types of dry electrode

processes and electrode process issues

③ Includes detailed comparisons of the pros and cons of dry and wet

processes as well as battery applications

④ Includes detailed technical content on the application of the dry

electrode process to the next-generation battery, the all-solid-state battery

⑤ Includes detailed information on the development trends of

electrode processes, materials, and equipment companies in the domestic and

international industries

⑥ Includes a list of patents related to the dry electrode process of

domestic and foreign companies and an analysis of major patents

⑦ Includes research support projects and main contents by country

related to dry electrodes

⑧ Includes market outlooks from major research companies on the dry

electrode process

[Difference between dry and wet processes for electrode manufacturing]

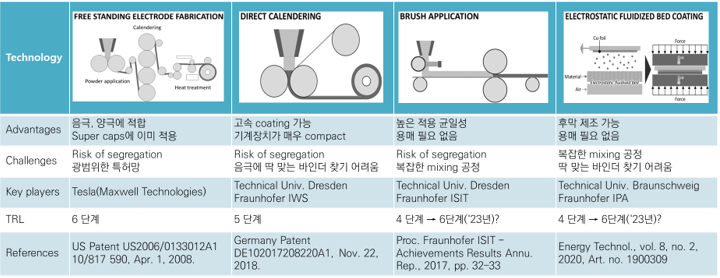

[Major Dry Coating Technology Types and Comparison]

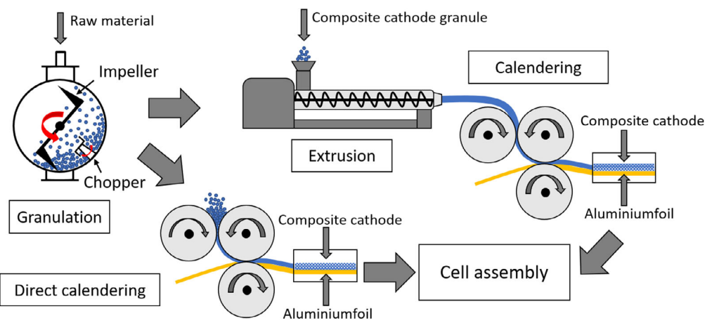

[Dry composite cathode manufacturing method]

1. Dry Electrode

Processes for Thick Film Electrodes in LIBs

1.1 The need for carbon-neutral processes in

the LIB industry------9

1.1.1 Increased demand for EV due to

carbon neutrality regulations-----------9

1.1.2 Plans to limit carbon emissions and

ban sales of ICE vehicles ----------10

1.1.3 EV transition plans and verticalized

secondary battery companies------11

1.1.4 Industry Issues related to carbon

neutrality regulations -----------------12

1.1.5 Secondary battery electrode process,

costs and energy consumption 13

1.2 The need for thick film electrodes in

Li-ion batteries ---------------14

1.3 Wet-based electrode manufacturing process

issues ---------------------15

1.4 Background on adopting dry

processes-------------------------------------16

1.4.1 Historical and technological

advances in dry electrode ------------------17

1.4.2 History of key technology

developments in dry film ---------------------18

1.4.3 Dry electrode technology: overcoming

the limitations of wet coatings -19

1.4.4 Dry process and binder development:

number of papers and patents -20

1.4.5 Dry process and binder development:

patent analysis -------------------21

1.4.6 Electrode manufacturing with

extrusion technology ---------------------22

1.4.7 Extrusion and melt processing

---------------------------------------------23

1.4.8 Melt extrusion: solvent vs.

solvent-free application differences ---------24

1.4.9 Dry electrode application: Tesla

anode ------------------------------------25

1.4.10 Dry electrode application: Tesla

cathode --------------------------------26

1.4.11 Dry electrode application:

composite cathode --------------------------27

1.4.12 Dry electrode application:

Pre-lithiation ---------------------------------28

1.4.13 Battery

binder characteristics: 7 types compared --------------------29

1.4.14 Types of binders used in dry

processes -----------------------31

1.4.15 Binder properties used in dry

processes -----------------------32

1.4.16 Water (PTFE, PAA) vs. oil (PVDF)

binders: Performance & tradeoffs--33

1.4.17 Applying PTFE binders

----------------------------------------------------34

1.5 Dry electrode process types

-------------------------------------------------35

1.5.1 Selection of a dry coating process

for dry electrodes-----------------35

1.5.2 Comparison and selection of dry

coating technologies----------------37

1.5.3 Dry mixing and coating

----------------------------------------------------40

1.5.4 Comparison of electrochemical

behavior of dry and wet electrodes----41

1.5.5 Features of Dry electrode process

technologies in LIB application------42

1.5.6 Free standing electrode technology

-------------------------43

1.5.7 Direct calendaring technology

---------------------------------47

1.5.8 Powder sheeting technology

----------------------------------50

1.5.9 Electrostatic spraying technology

---------------------------51

1.5.10 Melt deposition technology

------------------------------------54

1.5.11 Powder compaction technology

------------------------------------55

1.5.12 Melt extrusion technology

------------------------------------56

1.6 Issues with dry electrode process

------------------------------------57

1.6.1 Technical hurdles in dry process

technology ---------------------------57

1.6.2 Challenges of dry process in LIB

manufacturing -------------------------58

1.6.3 Electrical properties of PTFE -----------------------------------------------59

1.7 Comparison of

dry vs. wet processes------------------------------60

1.7.1 Comparison of wet and dry process

manufacturing technologies ------60

1.7.2 Comparison of cell characteristics

for dry vs. wet process technologies 61

1.7.3 Disadvantages of the wet process

-----------------------------------------62

1.7.4 Pros and cons of wet process

alternative options ------------------------63

1.7.5 Benefits of adopting dry process

technology -----------------------------64

1.7.6 Benefits of adopting dry process

technology (speed performance)----- 66

1.7.7 Benefits of adopting dry process

technology (ion channels) ------------67

1.7.8 Benefits of adopting dry process

technology (low cost) -----------------68

1.7.9 Benefits of adopting dry process

technology (Machine characteristics)-70

1.7.10 Dry vs. wet characteristics:

Applies to cathode, anode ----------------71

1.7.11 Cell performance of electrochemical

electrodes -------------------------72

1.7.12 Fabrication and characterization of

dry electrodes for LIBs-------------73

1.7.13 Applying dry electrodes : (LFP +

CNT + PTFE) cathode ---------------74

1.7.14 Applying dry electrodes : (NCM622 +

PVDF) cathode -----------------75

1.7.15 A comprehensive comparison of dry

vs. wet process technologies ----76

1.8 PTFE

fiberization------------------------------------------77

1.8.1 PTFE fiberization

reaction--------------------------------------------------77

1.8.2 PTFE fiberization

process-------------------------------78

1.8.3 PTFE fiberization

application-------------------------------79

1.8.4 Factors affecting PTFE fibrillation

---------------------81

1.8.5 Side effects of PTFE binders

-------------------------------82

1.8.6 Blocking the adverse effects of PTFE

binders: Graphite surface coat-83

1.8.7 Preparation of graphite anodes by

PTFE fiberization method -----------85

1.8.8 Developing

PTFE modified materials ---------------------------------86

1.8.9 Innovative technologies and systems

for PTFE-based cells -------------87

2. Next Secondary

Battery (All-Solid-State Battery) Dry Electrode Processes

2.1 Global

development trends of solid-state batteries ------------------------89

2.1.1 Types and the system configurations

of solid-state batteries----------89

2.1.2 Design and solutions for high energy

density LIBs -------------------90

2.1.3 Dry composite cathode manufacturing

methods --------------------91

2.1.4 Overseas all-solid-state battery

development trends --------------------92

2.1.5 Korean all-solid-state battery

development trends---------------------93

2.2 The need for adopting dry electrode

process in solid-state batteries--94

2.3 Examples of dry electrode process

applications in solid-state batteries 95

2.3.1 Korean and international companies

-----------------------------------95

2.3.2 Korean and international papers

----------------------------------------96

2.3.3 Li-S batteries with PTFE

----------------------------------------------------97

2.3.4 Cobalt-free (LNMO) cells with PTFE

---------------------------------------98

2.3.5 Solid-state batteries with PTFE

(sulfide, oxide, halide) ----------100

2.3.6 Solid-state electrolyte membranes

for solid-state batteries with PTFE-101

2.3.7 Application of inorganic solid

electrolytes---------------102

2.3.8 Application of polymeric solid-state

electrolytes-------------104

2.3.9 Solid-state batteries with dry

process (400 Wh/kg)--------------------106

2.3.10 Solid-state batteries with dry

process (energy density comparison)--108

3. Development

Trends by Company

3.1 Dry electrode process development trends

in Korean and international industry 114

3.1.1 International dry process

development trends-------------114

3.1.2 Korean dry process development

trends --------------115

3.1.3 Challenges to dry electrode

processes ----------------119

3.1.4 Pros and cons of the dry electrode

process --------------120

3.2 Korean company development trends

---------------------------------121

3.2.1 LG Energy Solutions ----------------------------------121

3.2.2 Samsung SDI

--------------------------------------- 123

3.2.3 SK On

-----------------------------------------124

3.2.4 Cosmos Lab

---------------------------------------125

3.2.5 CNP Solutions

-----------------------------------127

3.3 Overseas company development trends

------------------------------129

3.3.1 TESLA

-----------------------------------------129

3.3.2 Sakuu

(USA)---------------------------------------132

3.3.3 Anaphite (UK)

------------------------------------135

3.3.4 LiCap Technology (USA)

-----------------------------138

3.3.5 AM Batteries

(USA)---------------------------------143

3.3.6 PowerCo

SE-------------------------------------146

3.3.7 Dragonfly Energy

(USA)------------------------------149

3.3.8

ZEON------------------------------------------150

3.3.9 Daikin

-----------------------------------------151

3.3.10 Chemours

(USA)-----------------------------------152

3.3.11 Huacai

Technology (China)----------------------------153

3.3.12 Baosheng Energy Technology

(China)--------------------156

3.3.13 Li Yuanheng

(China)---------------------------------157

3.4 Equipment manufacturer development trends

---------------------------158

3.4.1 Hanwha Momentum

---------------------------------------158

3.4.2

CIS--------------------------------------------------------------159

3.4.3

PNT-------------------------------------------160

3.4.4 Yunsung F&C

-------------------------------------161

3.4.5

NainTech----------------------------------------162

3.4.6 GITech

(Korea)--------------------------------------163

3.4.7 KATOP

(China)--------------------------------------164

3.4.8 Shanghai Lianjing Automation

Technology--------------165

3.4.9 TOB New

battery---------------------------------166

3.4.10 TMAX Battery

Equipment-------------------------167

3.4.11 Shenzhen Tsingyan Electronic

Technology-------------170

3.4.12 Huacai

Technology-------------------------------171

3.4.13 ATEIOS System

(USA)------------------------------172

3.4.14 EIRICH

(Germany)-------------------------------------174

3.4.15 Fraunhofer

IWS---------------------------------175

3.5 Development trends in academic and

research institutions -------------177

3.5.1 Korea Institute of Energy Technology

-------------------------------177

3.5.2 Yonsei University ------------------------------------------180

3.5.3 Korea University

------------------------------------------183

3.5.4 Ulsan Institute of Science and

Technology ----------------------------186

3.5.5 Sungkyunkwan

University ----------------------------------189

3.5.6 Gacheon University

------------------------------------------190

3.5.7 Fraunhofer ISIT

-----------------------------------------------------193

3.5.8 Karlsruhe Institute of Technology

(KIT) --------------------------194

3.5.9 Dry Coating

Forum---------------------------------------------------195

4. Patent Analysis

4.1 Overseas dry process development patents

-------------------------198

4.1.1 Overseas dry process development

patent list----------------------198

4.1.2 Maxwell Technologies

----------------------------------------------199

4.1.3 Fraunhofer

IWS-----------------------------------------------204

4.1.4

TESLA----------------------------------------------------------206

4.1.5 Licap New Energy Technologies

------------------------------------213

4.1.6 Dragonfly

Energy-------------------------------------------------216

4.1.7 Anaphite Ltd

-------------------------------------------------------218

4.2 Korean dry process development

patents---------------------------------219

4.2.1 LG Chem, LG Energy Solution patents

----------------------------------219

4.2.2 Samsung SDI---------------------------------------------------------------233

4.2.3 SK On

-----------------------------------------------------------------237

4.2.4 Hyundai Kia

-------------------------------------------------------------240

4.2.5 Yunsung F&C

--------------------------------------------------------------244

4.2.6 Cosmos

Lab----------------------------------------------------------------245

4.2.7 Korea Ceramic Technology Institute

-------------------------------------248

5. Research Projects

by Country

5.1 US DOE projects

------------------------------------------------------------252

5.1.1 Oak Ridge National

Lab------------------------------------------252

5.1.2 NAVITAS Systems

----------------------------------------------------255

5.2 EU projects

----------------------------------------------------------257

5.2.1 ELIBAMA program

-----------------------------------------257

5.2.2 HORIZON Europe : NOVOC project

------------------------------ 258

5.2.3 Horizon Europe : BatWoMan

------------------------------------259

5.3 Korean national projects

------------------------------------260

5.3.1 Ministry of Trade and Industry

--------------------------------260

5.3.2 Ministry of Education

----------------------------------------------264

5.3.3 Ministry of Science and Technology

-----------------------------------265

5.3.4 Ministry of Economy and Finance

---------------------------------266

6. Market outlook

(research outlook)

6.1 SNE Research

------------------------------------------------------------267

6.2 EV Tank

----------------------------------------------------------------271

6.3 ESP Analysis --------------------------------------------------------273

6.4 Industry ARC

-------------------------------------------------------274

6.5 QY Research

-------------------------------------------------------------275

6.6 Verified Market Reports

-----------------------------------------------------277