<2024> Copper Foil Technology Trend and Market Outllok (~2035)

Executive Summary

In electric vehicles, battery is one of the most critical components which determine the performance, cost, and safety of vehicle. The 4 major components in battery is cathode, anode, electrolyte, and separator. In order for these 4 major components to properly do their jobs, the use of current collector for both cathode and anode is necessary. For anode, copper foil is generally used as a current collector.

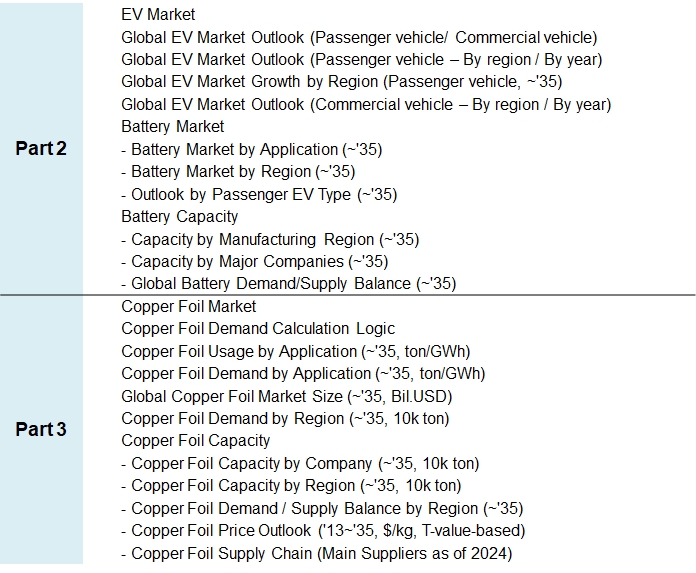

Battery is currently used for electric vehicles, energy storage system (ESS), and IT applications. If we look at the EV market, it is expected to grow at a CAGR of 19% from 2021 and 2035, leading the entire battery market. In accordance with the growth of battery market, the copper foil market is also expected to grow. Demand for copper foil in 2021 was approx. 210k ton and is expected to continuously grow at a CAGR of 15% to 1.76 million ton by 2035. Copper foil demand for electric vehicles in 2035 is expected to be around 1.38 million ton, taking up about 77% of the entire demand. Along with this, ESS would also demand more copper foil in future.

In case of copper foil, T value is defined a value by subtracting material costs (copper price, based on LME) from the selling price. T value continuously fluctuates depending on supply/demand. In 2024, the T value for 6 micron, wide-width copper foil was found to be 4.3 $/kg from our interviews with the industry players. It is the price formed from fierce competitions in the market. From the latter half of 2025, it is expected that T value would be maintained at around 6$/kg when supply/demand balance would be made. Based on this assumption, the copper foil market is expected to significantly grow to US$26.7 billion in 2035.

Due to different regulations in regions and regional block formation, China’s copper foil demand for electric vehicles and ESS is expected to drop to 44% in 2035 from over 50% in 2021. On the other hand, North America and Europe are expected to lead copper foil demand by expanding their local battery capacity.

As of 2021, China took up a large portion (72%) of global copper foil production, while Korea, Malysia, and other regions accounted for 23%. However, after 2025, there would be needs for copper foil from Europe and the US where continuous capacity ramp-up is expected.

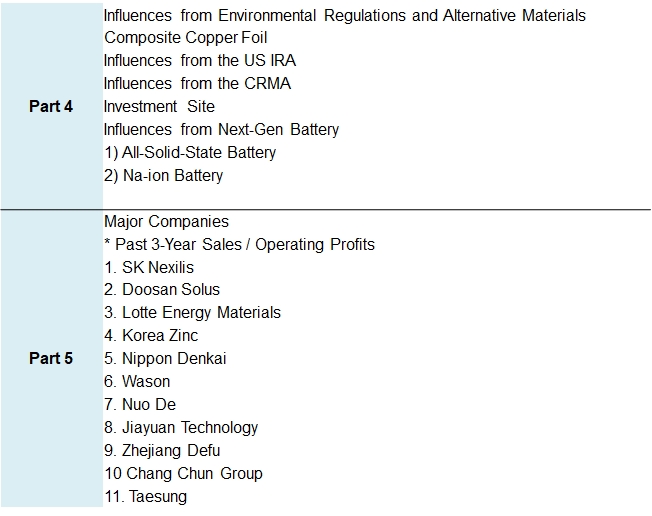

In terms of supply/demand balance, North America would continuously experience a shortage in the region, and in order to address the shortage, it is forecasted to receive supply from other regions or make local investment in the region. The existing copper foil companies in Korea and Japan have their capacity expansion plans in Europe, the US, and other regions such as Malaysia. Depending on the current market situations, their investment timing would change flexibly, though. Global battery makers are currently working on cooperation with 1 or 2 copper foil partners and trying to continuously increasing the number of partners they are working with. Following the needs to escape from the Chinese market and supply chain, where competitions for low cost and technology are fierce, copper foil makers have been trying to work closely with global battery manufacturers. Their cooperation may differ and vary depending on local regulations and quality requirements.

Copper foil takes up approx. 5% of battery cell cost. The level of difficulty in manufacturing copper foil is medium, but as it requires quite a lot of investment and technical prowess, the copper foil market is regarded as market where sellers have the whip hand over buyers.

Copper foil in the market is mostly electrolytic copper foil made by dissolving copper materials into copper sulfate solution and electrodepositing copper in the solution by using electrolysis machine. The purchase specifications of copper foil required by Korean and Chinse battery makers are similar to each other. If we look at the trend in copper foil specifications, it is required to be thinner, wider, and longer in rolls. Based on the cost structure of copper foil, competitiveness in copper foil business can be determined by labor cost, electric charges, and depreciation cost. Countries in the Southeast Asian region such as Malaysia, of which labor cost and electricity charges are lower than others, are regarded as places where investment for copper foil business would be lucrative as it has become relatively easy to secure the yield at the initial stages and the copper foil manufacturing technology has gone through standardization and stabilization. The copper foil product group can be categorized by mechanical property, thickness and width. Recently, battery makers tend to require copper foil of which tensile strength is higher than 50 kgf/mm2. With the increasing adoption of new anode active materials such as SiOx/SiC, there have been requirements on changes in physical properties of copper foil and surface treatment.

Copper foil patents are mostly registered in China, followed by Japan, Taiwan, and the US. The Korean, Japanese, and Chinese companies take a leading role in patent application. If we look at the patents related to copper foil manufacturing, patents about adjusting physical properties of copper foil by changing additives or controlling the quantity of additives during the process are prevalent. Copper foil manufacturers are mostly Chinese, Korean, and Japanese. SK Nexilis and Lotter Energy Materials are increasing their production capacity in Malaysia first and considering possible capacity ramp-up in Europe and the US. Chinse copper foil companies are trying to secure their production capacity and customers in other regions than China based on their established competitiveness.