<2024.H1> LIB 4 Major Materials Market and SCM Analysis

1. Introduction

Report

Overview

This report aims to analyze the

lithium-ion secondary battery (LIB) market and supply chain management (SCM)

status by quarter in 2024 and comprehensively review the market trends of the

four major materials (cathode material, anode material, electrolyte, and

separator).

LIB Overview

Lithium-ion secondary batteries

(LIBs) are energy storage devices widely used in various fields such as

portable electronic devices, electric vehicles (EVs), and energy storage

systems (ESS). The core components of LIBs are cathode materials, anode materials,

electrolytes, and separators, and the quality and performance of these four

materials determine the efficiency and lifespan of the battery.

Importance of

4 Major Materials

Cathode materials, anode materials,

electrolytes, and separators each directly affect the storage and movement of

lithium ions, electrical characteristics, and stability, and the performance

and price of the battery vary depending on the composition and characteristics

of each material. Therefore, understanding the market trends and supply chain

status of these materials is essential to establishing a successful strategy

for the LIB industry.

2. LIB Market

Overview in H1 2024

Market Size and Growth Rate

The LIB market in the first half of

2024 grew by about 23% year-on-year in terms of shipments, reaching $51.5

billion in packs. Although the growth of demand for electric vehicles slowed,

the expansion of the energy storage system (ESS) market was a major growth

factor.

Key Market

Trends

During the first half of the year, major companies focused on reducing production costs and technological innovation to overcome the electric vehicle chasm, and in particular, BMS technology and fast charging technology received attention due to safety issues. In addition, the adoption of relatively inexpensive LFP batteries increased due to the demand for cost improvement and price competitiveness, and there were changes such as LG Energy Solution, a representative ternary battery player, signing an LFP battery supply contract with Renault.

LIB Major Companies Status

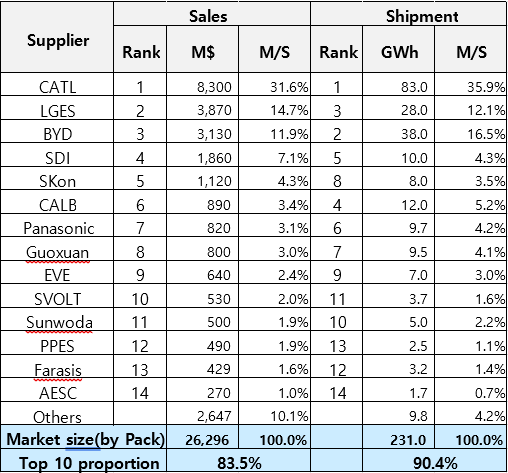

K-Battery (domestic 3 companies) recorded 14.7% market share (M/S) based on sales, LGES ranked 2nd, SDI 4th with 7.1%, and SK on 5th with 4.3%, with all 3 companies settling into the top 5. China's CATL maintained its lead with 31.6% M/S, and BYD ranked 3rd with 11.9% M/S.

In terms of shipment volume,

China's CATL (35.9%) and BYD (16.5%) ranked 1st and 2nd. K-Battery ranked 3rd

with LGES (12.1%), 5th with SDI (4.3%), and 7th with SK on (3.5%), with the

three domestic battery companies taking 19.9% of the market share.

Panasonic ranked 7th in terms of

sales and 6th in terms of shipment volume, focusing on sales of cylindrical

battery cells to Tesla.

While the rankings of the three

Korean companies, CATL, and BYD were solid, China's CALB showed rapid growth as

it began to supply volumes in earnest to major OEMs such as Geely Automobile,

Xpeng, and NIO.

Global Market

Changes and Outlook

In US and Europe, where rapid

expansion is expected due to the implementation of the IRA Act and the European

CRMA(Critical Raw Materials Act), the four major material companies are also

entering the market together with Korean, Chinese, and Japanese battery

companies or entering the market in the form of joint ventures. In addition,

direct contracts with global automobile OEMs are also emerging. It is expected

that the material companies that dominate this market in the future will

reorganize the industry structure.

3. Report

Configuration

LIB and 4 Major Materials Market Analysis in 2024

This report is largely divided into

three sections. The first covers the analysis of the lithium-ion secondary

battery market for the first half of 2024 and the annual outlook. It includes

the global lithium-ion secondary battery market status, including small IT

batteries, mid/large electric vehicles (xEVs), and energy storage systems

(ESS), as well as the annual outlook for 2024 from SNE's perspective.

The second section provides a

detailed analysis of manufacturers related to lithium-ion secondary battery

materials in Korea, China, and Japan. It covers the production capacity and

supply volume of global manufacturers, and includes detailed information on the

supply chain (SCM) for each material. It also analyzes the price trends for

each material and raw material from 2020 to the first half of 2024, and

provides an annual outlook and insights for 2024.

Finally, it analyzes the business

history and status, product information, etc. of representative companies for

each material by dividing them into Korea, China, and Japan, and covers issues

that emerged in the market in the first half of 2024.

4. Strong

Points of This Report

(1) Understanding recent market status

and trends:

You can understand global market

trends and major trends, including demand for the four major LIB materials and

performance by company.

(2) Analysis of major suppliers and

demand:

You can understand the supply

status of materials by major suppliers in the LIB 4 major materials market,

demand by secondary battery company, material price trends, and annual outlook.

In addition, it provides detailed quarterly status of major material

manufacturers in Korea, China, and Japan.

(3) Understanding SCM status:

You can understand the supply SCM

status of the four major materials of major LIB manufacturers.

(4) Analysis of changes in material

usage:

You can see detailed changes in the

usage of each material by major LIB companies by quarter from Q1 2023 to Q2

2024.

This report will help to provide an

overall understanding of the lithium-ion secondary battery market and materials

market and will serve as important data for predicting future markets.

[Contents] – 263

Page in total

1. EV / LIB

Market Dynamics

1-1. Review of EV (BEV+PHEV) sales and battery

usage in 2023

1-2. Outlook of battery usage for EV in 2024

1-3. Quarterly shipments of battery (xEV/ESS)

by major LIB companies

1-4. Yearly trends and outlook of battery

(xEV/ESS) by major LIB companies (2019~2024)

2. Cathode

Market Dynamics & Issues

2-1. Global cathode material market review in `24.H1

2-2. Quarterly cathode material usage trend

(by cathode material type)

2-3. Quarterly cathode material usage trend

(by region)

2-4. Cathode material usage trend by year (by

region)

2-5. Quarterly cathode material usage trend

(by application)

2-6. Quarterly cathode material usage trend

(by cell maker)

2-7. Analysis and forecast of cathode material

usage by major LIB companies (`23~`24F)

2-8. SCM analysis by cathode material supplier

(`23~`24F) – NCM, LFP

2-9. Shipment analysis by cathode material

supplier (`23)

2-10. Production capacity status and outlook

by cathode material supplier

2-11. Analysis of shipment volume by cathode

material supplier (`24.H1)

2-12. Cathode material price trend and

short-term outlook (`20.Q1~`24.Q4) - LMO, LFP, NCM, NCA, LCO

2-13. Price trend and short-term outlook of

precursor for cathode materials (`20.1Q~`24.4Q)

2-14. Price trend of cathode raw materials

(lithium, nickel, cobalt) (`20.Q1~`24.Q2)

2-15. Cathode materials (NCM/NCA) export scale

and ASP trends in Korea

2-16. Analysis of business status of major

cathode material companies (EcoPro, LGC, XTC, Ronbay, Hunan Yuneng (LFP),

Sumitomo Metal Mining, Nichia)

2-17. Business performance trends

of major cathode material companies

2-18. Major issues of cathode

material market in `24.H1

3. Anode

Market Dynamics & Issues

3-1. Global anode material market review in `24.H1

3-2. Quarterly anode

material usage trend (by anode material type)

3-3. Quarterly anode

material usage trend (by region)

3-4. Anode material usage

trend by year (by region)

3-5. Quarterly anode

material usage trend (by application)

3-6. Quarterly anode

material usage trend (by cell maker)

3-7. Analysis and

forecast of anode material usage by major LIB companies (`23~`24F)

3-8. SCM analysis by

anode material supplier (`23~`24F) – artificial graphite, natural graphite,

silicon anode material

3-9. Shipment analysis by

anode material supplier (`23)

3-10. Production capacity

status and outlook by anode material supplier

3-11. Analysis of

shipment volume by anode material supplier (`24.H1)

3-12. Anode material

price trend and short-term outlook (`20.1Q~`24.4Q) – Artificial graphite,

natural graphite by grade

3-13. Price trend of

anode raw materials (Normal Cokes, Needle Cokes) (`20.Q1~`24.Q2)

3-15. Anode material

(artificial graphite) export scale and ASP trend in Korea

3-16. Analysis of

business status of major anode material companies (Posco Future M, Daejoo, BTR)

3-17. Business performance trends of major anode material

companies

3-18. Major issues of anode material market in `24.H1

4. Separator

Market Dynamics & Issues

4-1. Global separator market review in `24.H1

4-2. Quarterly separator

usage trend (by separator type)

4-3. Quarterly separator

usage trend (by region)

4-4. Separator usage

trend by year (by region)

4-5. Quarterly separator

usage trend (by application)

4-6. Quarterly separator

usage trend (by cell maker)

4-7. Analysis and

forecast of separator usage by major LIB companies (`23~`24F)

4-8. SCM analysis by

separator supplier (`23~`24F) – wet, dry separators

4-9. Shipment analysis by

separator supplier (`23)

4-10. Production capacity

status and outlook by separator supplier

4-11. Shipment analysis

by separator supplier (`24.H1)

4-12. Separator price

trend and short-term outlook (`20.Q1~`24.Q4) – wet, dry separators

4-13. Separator

(artificial graphite) export scale and ASP trend in Korea

4-14. Analysis of

business status of major separator companies (SK IET, W-Scope, SEMCORP, Senior,

Asahi Kasei, Toray)

4-15. Business performance trends of major separator companies

4-16. Major issues of separator market in `24.H1

5. Electrolyte

Market Dynamics & Issues

5-1. Global electrolyte market review in `24.H1

5-2. Quarterly

electrolyte usage trend (by electrolyte type)

5-3. Quarterly

electrolyte usage trend (by region)

5-4. Electrolyte usage

trend by year (by region)

5-5. Quarterly

electrolyte usage trend (by application)

5-6. Quarterly

electrolyte usage trend (by cell maker)

5-7. Analysis and

forecast of electrolyte usage by major LIB companies (`23~`24F)

5-8. SCM analysis by

electrolyte supplier (`23~`24F)

5-9. Shipment analysis by

electrolyte supplier (`23~`24.H1)

5-10. Production capacity

status and outlook by electrolyte supplier

5-11. Electrolyte price

trend and short-term outlook (`20.Q1~`24.Q4) – Electrolyte for LFP, ternary,

LCO, LMO

5-12. Price trend by

electrolyte component material (additives, lithium salt, solvent)

(`20.Q1~`24.Q2)

5-13. Electrolyte

(artificial graphite) export scale and ASP trend in Korea

5-14. Analysis of

business status of major electrolyte companies (Enchem, Dongwha Electrolyte,

Tinci, Mitsubishi Chemical, Central Glass)

5-15. Business performance trends of major electrolyte companies

5-16. Major issues of electrolyte market in `24.H1