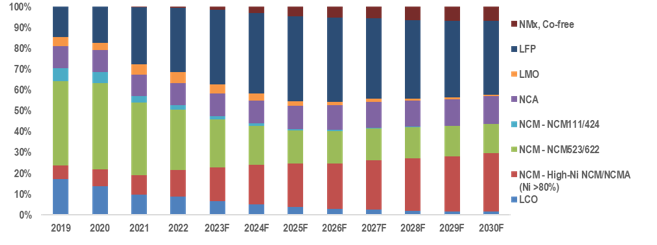

The year 2021 was a year of explosive interest in lithium iron phosphate (LFP, LiFePO4) batteries in China, and the trend has been strong through the first half of 2023. The share of LFP batteries in electric vehicles also increased from 17% in 2020 to 27% in 2021 and 36% in 2022.

The share

of LFP battery-powered electric vehicles sold in China has surpassed the share

of NCM (nickel-cobalt-manganese) or NCA (nickel-cobalt-aluminum) batteries

since September 2020.

Currently,

most LFP batteries are produced by Chinese companies, but Tesla, as well as

Volkswagen, Ford, and Stellantis, are also showing interest in LFP batteries.

Lithium

iron phosphate (LiFePO4) batteries are gaining attention for large-scale

applications due to their cost-effectiveness, safety, and extended service

life. Unlike traditional lithium-ion batteries, LiFePO4 batteries can be

produced inexpensively without using cobalt. They exhibit robust safety

features, maintaining performance even in high temperatures and during

overcharging. Furthermore, the expiration of key patents around 2022 eliminates

concerns about patent fees or infringement risks, paving the way for broader

adoption. To grasp the characteristics, advantages, and disadvantages of

lithium iron phosphate (LiFePO4) secondary batteries, a comprehensive

understanding of lithium-ion batteries and insights into the strengths and

limitations of LiFePO4 cathode materials is crucial. This knowledge forms the

foundation for anticipating the future development direction of LiFePO4

secondary batteries.

Lithium

iron phosphate batteries, like the ones in the 2021 Tesla Model 3, currently

offer a range of about 400 kilometers, with the Model 3 achieving 407

kilometers. Their cost advantage, stemming from the use of inexpensive iron, is

amplified amid rising prices of raw materials for ternary systems like cobalt

and nickel. The safety edge of lithium iron phosphate, with its olivine

structure, is evident in its resistance to fire or explosion reactions even at

300 degrees Celsius and 260% overcharging. This characteristic eliminates the

need for contingency funds to address safety incidents, benefiting battery

companies and automakers.

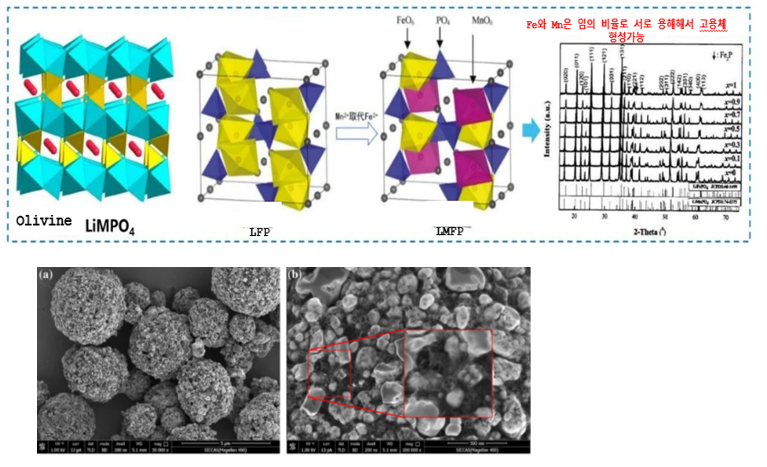

Although

there are still many challenges to be addressed, it is thought that another

breakthrough in olivine lithium iron phosphate is possible if the performance

of bulk lithium iron phosphate, effective compounding with graphene, and the

performance of LiMnPO4 are realized.

Recently,

LMFP batteries with manganese mixed have been attracting attention as a new

technology that can overcome these limitations. The energy density can be

increased by about 15-20% at a similar price. Chinese companies such as CATL,

BYD, and Guoxuan have also developed LMFP-based batteries with similar

technologies and entered the commercialization stage.

This

report delves into the types and traits of lithium-ion battery cathode materials,

focusing on the noteworthy lithium iron phosphate (LFP, LMFP) cathodes. We will

provide a detailed examination of their characteristics, alongside a discussion

on development status and manufacturing processes. Moreover, this report explores

the market outlook and major companies in lithium iron phosphate (LFP, LMFP)

cathode materials, providing insights into the current status of LFP-equipped

automakers and battery companies.

The

strong point of this report is...

①

Detailed explanation of the types and characteristics of lithium iron phosphate

and lithium-ion battery cathode materials

②

Technical feature comparison analysis between lithium iron phosphate material

and ternary materials

③ Summary

of the manufacturing process of lithium iron phosphate and the latest trends in

technological development

④ Lithium

iron phosphate production capacity and usage prospects for major companies

(approximately 50 companies)

⑤ Beneficial for companies or individuals looking to enter or conduct new studies in the lithium iron phosphate material market

Index

<2023

Edition> LFP Cathode Materials for Lithium-Ion Secondary

Batteries: Status and Market Outlook

1. Lithium-ion Battery Overview

1-1. History of Li-ion Batteries

1-2. Li-ion Battery Types and Features

1-3. The Operating Principle of Li-ion Batteries

1-4. Li-ion Battery Components

1-5. Applications of lithium-ion Batteries

2.

Types and Characteristics of Lithium-ion Battery Cathode Materials

2-1. Structure and Properties of Li-ion Battery Cathode

Materials

2-2. Oxide-based Cathode Material Structure and Electrochemical

Properties

2-2-1. Layered Oxide

2-2-2. Li and Mn-rich Oxide

2-2-3. Disordered Rock-Salt Oxides

2-2-4. Spinel Oxides

2.3. Structure and Electrochemical Properties of

Polyanion-based Cathode Materials

2.3.1 Olivine-type Polyanion Oxide

2.3.2 Other Polyanion-Based Cathode Active

Materials

3. Status of the development of lithium iron phosphate

(LFP/LMFP) cathode materials

3-1.

Directions for the development of LFP/LMFP cathode materials

3-2.

Development history of LFP/LMFP cathode materials

3-3.

Basic characteristics of LFP/LMFP cathode materials

3-3-1.

Crystal Structure

3-3-2.

Lithium migration and phase change mechanism during charge and discharge

3-3-3.

Electrical Conductivity

3-3-4.

Defects in the Structure

3-3-5.

Energy Density

3-3-6.

Temperature dependence

3-3-7.

Lifetime Characteristics

3-4.

LFP cathode material manufacturing process

3-4-1.

Synthesis

3-4-2.

Synthesis Materials and Heat Treatment

3-4-3.

Manufacturing Process of LFP precursor

3-5.

Trends in the development of LFP based cathode materials

3-5-1

Controlling Particle Shape

3-5-2.

Carbon-based composites

3-5-3.

Doping

3-5-4.

Increase in Energy Density through Manganese Substitution (LMFP)

3-5-5.

Other Olivine-based cathode material technology development trends

①

LiMnPO4 (LMP) ② LiCoPO4, LiNiPO4

(LCP, LNP)

3-6. Technological Developments in Lithium Iron

Phosphate (LMFP) Cathode Materials

3-6-1. Background of LMFP cathode material research

3-6-2. LMFP cathode material manufacturing method

3-6-3. Performance improvement strategy for LMFP

cathode materials

3-6-4. Overall Results and Outlook for LMFP Cathode

Materials

3-7. Future Research and Development Directions for

LFP Cathode Materials

4. LFP Market and Company Status

4-1. LFP-based secondary battery market status

4-2.

Major LFP Cathode Material Producers

4-2-1. Dynanonic

4-2-2. Guoxuan(Gotion)

4-2-3. BTR(Lopal)

4-2-4. Hunan Yuneng

4-2-5. Hubei Wanrun

4-2-6. BYD

4-2-7. Chongqing Terui

4-2-8. Pulead

4-2-9. Anda

4-2-10. Johnson Matthey

4-2-11. Tianjin STL

4-2-12. Valence

4-2-13.

RT Hi-Tech

4-2-14.

Changzhou Liyuan

4-2-15.

Shandong Fengyuan

4-2-16.

Chengdu Jintang Shidai

4-2-17.

YOUSHAN TECHNOLOGY

4-2-18.

HEFEI YOUNGY ENERGY MATERIALS CO.,LTD.

4-2-19.

Sichuan Langsheng New Energy Technology Co., Ltd.

4-2-20.

Hunan Pengbo New Materials

4-2-21.

Fujian Zijin Liyuan

4-2-22.

Jiangxi Zhili Technology

4-2-23.

Xiexin Lidian

4-2-24.

Others

(Shenghua(Fulin PM), Annada, CNNC, Yunxiang,

KTC, Haichuang New Energy, Zhongtian Xingcai Cylico, Yunnan Yeyang, Deyang

Weixu, Xiamen Xingrong, Yibin Tianyuan, Wanhua Chemical,CALB, Bangsheng New

Energy, Tinci, BASF, Dupont, Aleees, Tatung, Formosa, CAEC, ONE, RFsemi,

Zaigle, KPS)

4-3.

Status of Complete Vehicle Manufacturers Applying LFP Materials

4-4.

Status of LFP Battery Companies

5. References