Lithium-ion batteries (LIBs) are one of the

most promising energy storage devices to address the growing demand for energy

storage in electric vehicles and hybrid devices due to their high energy and

power density, and their use is increasing rapidly with the growing interest in

utilizing green energy for carbon reduction.

According to SNE Research, after the rapid

development of new energy storage devices and electric vehicles, the demand for

LIBs has been steadily increasing, and the electric vehicle battery market size

is expected to grow from $196B in '25 to $401B in '30, with a CAGR of 21%.

The characteristics of LIBs are highly

dependent on the electrodes, and optimizing the electrode structure is a top

priority to achieve superior battery performance. While the active materials of

the anode and cathode are currently being studied and examined with great

interest in commercialized LIBs as well as in research, the inactive binder,

which maintains the integrity of the electrode and supports the electrochemical

process at a low weight fraction (≤5wt%), occupies a critical position in the

performance of the electrode along with the active materials and conductors,

but has received less attention compared to its importance.

Although binders are a very small part of

the electrode, they play a critical role in determining the overall performance

of the electrode. The binder is responsible for the adhesion of the anode and

cathode active materials to the respective pole plates of the collector and for

their durability. The binder must be (1) electrochemically stable in the

electrolyte, (2) flexible and insoluble, and (3) resistant to corrosion by

oxidation, especially for cathode binders.

Therefore, a functional binder with high

bond strength and elasticity is required to effectively connect the active

material and the conductor to the collector and accommodate volume expansion to

ensure good electrode structure during charge and discharge. Recently, with

more insights into binder screening and design, the focus of research is

shifting from a mechanical stabilization perspective to multifunctionality that

provides electrochemical benefits as well as structural support.

Recently, with the increasing adoption of

silicon cathode materials, a new generation of research is underway, as studies

have shown that binders have a significant impact on the lithiation reaction,

helping to improve electrode capacity and cycleability. Conventional binders

mainly use PVDF (PolyVinyliDeneFluoride), a fluoroplastic, for the cathode and

SBR (Styrene-Butadiene-Rubber) and CMC (Carboxyl Methyl Cellulose) binders, a

synthetic rubber, for the anode, but they are not suitable for use in silicon anodes

due to large volume changes.

PTFE (PolyTetraFluoroEthylene) binders have

been used for cathode materials, and water-based binders such as PAA

(PolyAcrylicAcid) and PI (PolyImide) have been attracting attention for anode

materials.

Binders such as PAA and PI are water-based

binders, which are used in silicon anode materials that use water-based

solvents as electrolytes. Compared to conventional binders, these binders have

high tensile strength, high adhesion, and are resistant to volume expansion of

silicon anode materials and form a stable SEI (Solid Electrolyte Interphase)

layer by wrapping the active material.

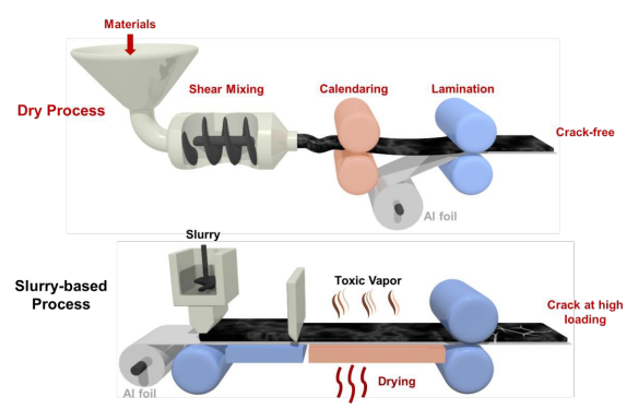

PTFE, a next-generation binder for cathode

materials, is a hydrophobic material with excellent chemical and heat

resistance and is expected to gain attention in dry electrode processes and

all-solid-state batteries.

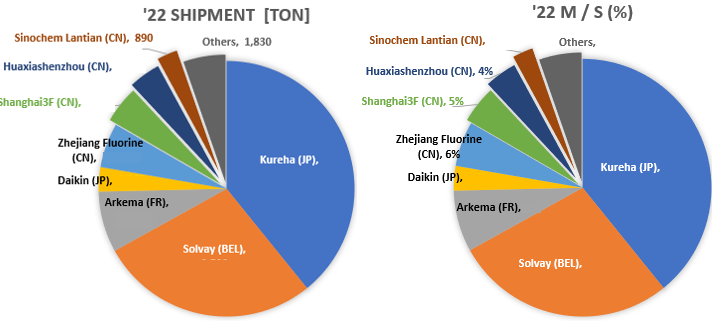

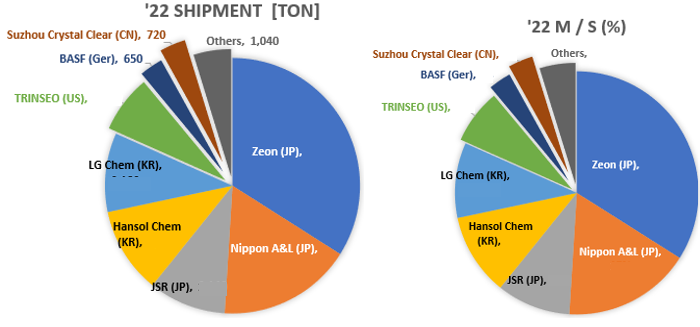

PVDF binders are produced by Kureha in

Japan, Solvay in Belgium, and Arkema in France, and SBR binders are produced by

Zeon in Japan, all of which are expensive items with a high proportion of

foreign production.

The cathode binder is produced by Korea's

Chemtros, and for the anode binder, Korea's Hansol Chemical has successfully

localized it and is supplying it to Samsung SDI and SK On, while LG Chem. and

Kumho Petrochemical are also supplying cathode binders.

Meanwhile, SNE Research's global demand

forecast for binders for lithium-ion batteries is expected to increase from

89,000 tons in 2025 to 232,000 tons in 2030, with a value of about KRW 4.4

trillion in 2030.

High-energy-density batteries are expected

to place higher requirements on high-performance binders, and from this

perspective, binder design should consider the following.

(1) The binder

content should be less than or equal to 3 wt% of the total electrode mass

without losing mechanical strength and adhesion.

(2)

Simplification of synthesis using water-based and dry-based polymers from the

perspective of low cost and sustainability.

(3)

Multifunctional polymer binders that can integrate all necessary functions into

one polymer.

(4) Deep insights

into polymer dispersion and degradation mechanisms, and more.

In this report, SNE has summarized in

detail the information available in the literature on the design, synthesis,

and application of binders for lithium-ion battery electrodes and forecasted

the demand and market for binders based on our forecasts for lithium-ion

batteries, and quoted market size and forecasts from external research

organizations in the appendix to help readers understand the overall scale.

Finally, by summarizing the status of

binder manufacturers and their main products, we hope to provide a holistic

insight for researchers and interested parties in this field, which will help

to improve the performance of batteries, including their energy density, fast

charging capability, and long-term life characteristics.

Strong points

of this report

① Provides a

general overview of the binder and contains rich technical content

② Includes key

points to consider in design and synthesis through examples of binder

development.

③ Summarizes the

development status and case analysis of binders not only for LIBs but also for

next-generation batteries such as Li-S and all-solid-state batteries.

④ Provides

objective figures on the binder market through objective binder market

forecasts based on SNE Research's battery forecasts.

⑤ Detailed

information on the development status and product status of major binder

companies.

[Shipments and M/S of PVDF binder manufacturers]

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

[Shipments and M/S of SBR binder

manufacturers].

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

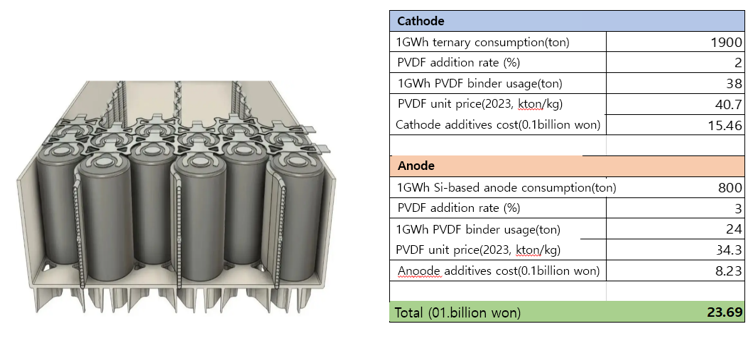

[Binder cost analysis for 4680 cells for Tesla].

• Cathode: NCM811, Anode: Si series

• PVDF cathode binder consumption and

cost for a 1 GWh cell: Approx. 38 tons, KRW 1.546 billion

• PAA anode binder consumption and cost

for a 1 GWh cell: Approx. 24 tons, KRW 0.823 billion

![]()

[A schematic of the dry and wet processes for electrode

fabrication].

1.1. Introduction

1.2. Definition,

Role, and Requirements

1.2.1.

Role and Features

1.2.2.

Requirements

1.3. Categories

and Types

1.3.1.

Types

1.4. Operation

Mechanism

2. Types of binders and

R&D practices

2.1. Binders for Cathodes

2.1.1. Non-Aqueous Binders

2.1.2.

Industry Status of PVDF Cathode Binders

2.1.3. (CMC+SBR)

Industry Status of Anode Binders

2.1.4. Water-based

Binders

2.1.5. Other binders

2.2. Binders for Anodes

2.2.1. Insertable Anode Binder

2.2.1.1. Binders for Graphite Electrodes

2.2.1.2. Anode Binder for LTO

2.2.2. Alloy Anode Binders

2.2.2.1. Linear Polymer Binders

2.2.2.2. Crosslinked Polymer Binders

2.2.2.3. Branched and Extra-Large Polymer Binders

2.2.2.4. Conductive Polymer Binders

2.3. Binder for Next-Generation Batteries (1)

2.3.1. Binders for Lithium-Sulfur (Li-S) Batteries

2.3.2. Binders for Dry Process

2.4. Binder for Next-Generation Batteries (2)

2.4.1. Binders for Solid Electrolytes

2.4.1.1. Overview of All-Solid-State

Batteries

2.4.1.2. Sulfide-based All-Solid-State Battery

Technology

2.4.1.3. Manufacturing of All-Solid-State Cells and

the Purpose of Binders

2.4.1.4. Binder Technology for Cathodes

2.4.1.4.1. Binder Technology for Wet Processes

2.4.1.4.2. Binder Technology for Dry Processes

2.4.1.5. Binder Technology for Electrolyte Layers

2.4.1.6. Binder Technology for Anodes

2.4.1.6.1. Binder Technology for Graphite-Based Anodes

2.4.1.6.2. Next Generation Binder Technology for

Anodes

3. Binder Market

3.1. Overall Outlook for the Binders Market

3.2. PVDF Market Outlook for Global LIBs

3.2.1. Global Battery Market Demand

3.2.2. Global LIB Battery Binder Demand Outlook

3.2.3. LIB Battery Binder Price Outlook

3.2.4. LIB Battery Binder Market Size Outlook

3.2.5. Global LFP Battery Demand and Cathode Material

Demand Outlook

3.2.6. PTFE for LFP Batteries Price and Market Outlook

3.2.7. PTFE Binder Usage for LFP Batteries

3.2.8. Market Outlook for Binders for Silicon-based

Cathodes

3.2.9. Silicon-based Anode Material Market Outlook

3.2.10. PAA Binders for Silicon Anode Market Outlook

3.2.11. Binder cost analysis for 4680 batteries for

Tesla

3.2.12. Shipments and M/S of PVDF Binder Manufacturers

3.2.13. Shipments and M/S of SBR Binder Manufacturers

3.2.14. Shipments and M/S of CMC Binder Manufacturers

4. Binder Manufacturer Status

[1] Arkema

[2] BASF SE

[3] Solvay

[4] Kureha

[5] ZEON

[6] JSR

[7] Fujian Blue Ocean Black Stone

[8] Dupont

[9] Ashland Inc

[10] MTI Corp.

[11] TRINSEO

[12] Xinxiang Jinbang Power Technology

[13] Lihong Fine Chemical

[14] Chemtros

[15] Hansol Chemical

[16] Kumho Petrochemical

[17] Daikin Industry

[18] Nanografi Nano Technology

[19] Nippon

Paper Group

[20] APV Engineered Coatings LLC

[21] Sichuan Indigo Materials Science & Technology

[22] Guangzhou

Songbai Chemical Co

[23] Nippon A&L Inc

[24] Daicel Miraizu Ltd

[25] Sinochem Group Co

[26] Ube Corp.

[27] AOT Battery Equipment Technology

[28] Shanghai 3F New Materials

[29] GL Chem

5. Appendix [For reference]

6. References