< 2023>Development Trends and Market Outlook for Cobalt-free Cathodes for Lithium Secondary Batteries

Lithium rechargeable batteries began to be applied to electric vehicles (EVs) around 2010, and now, in what can be described as an "electric vehicle revolution," the EV industry is exploding around the world, and the market for lithium rechargeable batteries is growing rapidly.

Unlike other lithium secondary battery materials, cathode materials use expensive metals such as Ni and Co, which can cause price problems. It is possible to reuse expensive metals through the implementation of recycling technologies, but the larger the market, the more additional metals are required, which can be a barrier to market expansion.

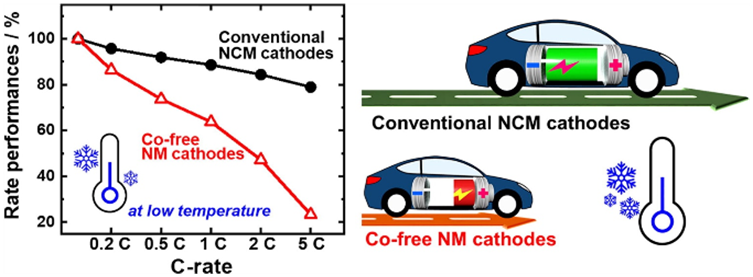

The driving range, which is the most important performance of an electric vehicle, is determined by the energy density of the battery it is equipped with. The energy density of a battery is directly related to the available capacity of the cathode material. In NCM and NCA anodes, higher Ni content has the advantage of increasing the usable capacity and thus improving the energy density, so high-nickelization research has been actively conducted to increase the nickel content of the cathode, but the increase in nickel content is accompanied by a sharp decrease in life stability and thermal stability at the expense of increased usable capacity.

In addition to high-nickelization, another issue that is attracting attention in NCM and NCA cathode materials is the cobalt-free (Co free) cathode material. Cobalt is a major raw material for cathode materials that accounts for the most costs in the manufacture of electric vehicle batteries. As the demand for batteries is increasing rapidly, the price of cobalt is also skyrocketing.

As the transition to electric vehicles accelerates, the movement to reduce the use of cobalt in order to secure stable raw materials and lower prices is emerging as a new challenge in the battery industry. Therefore, in order to solve these problems, it is necessary to use the most expensive cobalt metal in very small amounts (Co-less), or ultimately, high-performance Co free cathode materials that do not use cobalt.

According to SNE Research, the market for cobalt-free (NMx) cathode materials began to be applied in 2022, and is expected to account for 1% of total cathode material demand in 2023, 6% in 2025, and 12% in 2030. Meanwhile, the price outlook for cobalt-free (NMx) cathode materials is expected to decline from $14/kg in 2023 to $12/kg in 2025, and $9/kg in 2030, with a compound annual growth rate (CAGR) of -5.5%.

This report provides a comprehensive overview of the development of cobalt-free cathode materials. It provides a detailed analysis of the global lithium-ion battery market and electric vehicle (EV) market, as well as the Chinese and European lithium-ion battery market and EV status. The report also discusses the development trends and prospects of cathode materials, and summarizes the development trends and prospects of cobalt-free cathode materials. In particular, the report analyzes the technologies and patents of Chinese and domestic companies that are leading the development and application of cobalt-free cathode materials, in order to identify the key technologies of cobalt-free cathode materials.

This report by SNE Research is expected to provide insight into the technology and market of cobalt-free cathode materials, as well as be a great help in understanding the industry surrounding it.

Strong Points of the Report

① A comprehensive overview of cobalt-free cathode materials and abundant technical content.

② Considerations for design and synthesis through case studies of cobalt-free cathode materials

③ Presentation of the development trends and future technological and market outlook of cobalt-free cathode materials

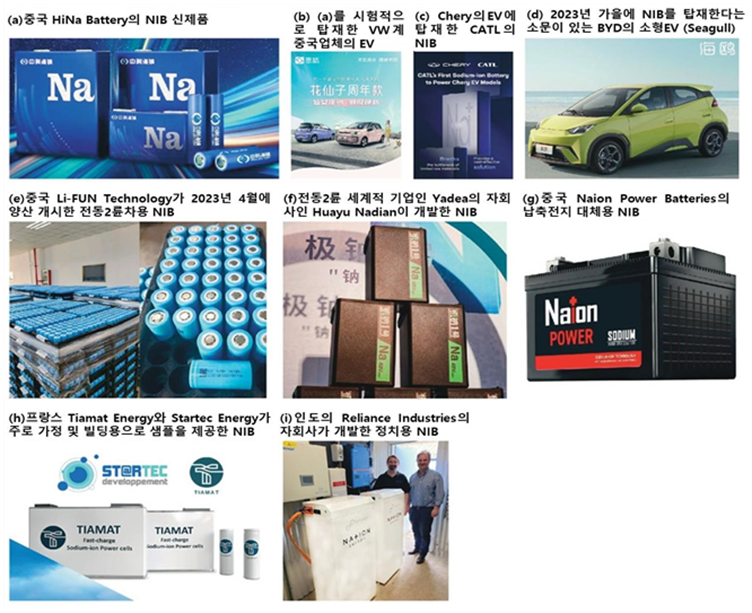

④ Presentation of key technologies and prospects of sodium-ion batteries, which are non-lithium cobalt batteries

⑤ Patent analysis of major cobalt-free cathode material development companies and research institutes.

Table of Content

1. State of the Lithium-ion Battery and EV Market

1.1 Lithium-ion Battery Market Status and Outlook

1.1.1 Global Lithium-ion Battery Market Status----------------------------------------------------8

1.1.2 Global xEV Lithium-ion Battery Demand Outlook--------------------------------------------9

1.1.3 Global Lithium-ion Battery Market Outlook for xEVs --------------------------------------10

1.1.4~8 China's Lithium-ion Battery Market Status-----------------------------------------------11

1.1.9~10 Europe’s Lithium-ion Battery Market Status--------------------------------------------16

1.1.11 South Korea's Lithium-ion Battery Market Status-----------------------------------------18

1.1.12 Japan's Lithium-ion Battery Market Status-------------------------------------------------19

1.2 Electric Vehicle Market Status and Outlook

1.2.1 Global EV Market Status and Outlook ----------------------------------------------------20

1.2.2 China's EV Market Status and Outlook -----------------------------------------------------22

1.2.3 Europe’s EV Market Status and Outlook--------------------------------------------------26

1.2.4 South Korea’s EV Market Status and Outlook ---------------------------------------------30

1.2.5 Japan’s EV Market Status and Outlook -----------------------------------------------------33

2. State of Lithium Cathode for Secondary Battery

2.1 Status of Lithium Cathode Development for Secondary Battery

2.1.1 Types of Cathodes for Lithium-ion Batteries -----------------------------------------------36

2.1.2 High Voltage Cathode Technology ---------------------------------------------------------38

2.1.3 LFP/LMFP, Blade battery---------------------------------------------------------------------39

2.1.4 NCMSingle Crystal --------------------------------------------------------------------------49

2.1.5 Bimodal Technology -------------------------------------------------------------------------52

2.1.6 Four-element NCMA Technology-----------------------------------------------------------54

2.1.7 Global Cathode Materials Market Demand Forecast---------------------------------------56

2.1.8 Market Size Forecast by Cathode Type in China -------------------------------------------58

2.2 Status of Lithium-ion Battery Cathode Raw Materials

2.2.1 Co, Ni Metal Price Status-------------------------------------------------------------------59

2.2.2 Production and Reserves of Co and Ni Metals in Major Countries-----------------------60

2.2.3 Lithium Production and Reserves in Major Countries -------------------------------------61

2.2.4 LiOH, Li2CO3 Price Status--------------------------------------------------------------------62

2.2.5 NCM523/811 Price Status-------------------------------------------------------------------63

2.2.6 Battery Price ($/Wh) Changes---------------------------------------------------------------64

3. Status of Cobalt-free Cathode Development

3.1 Overview of Co-free Cathode Materials

3.1.1~2 Cobalt-free Cathode Materials, Need and Problems------------------------------------66

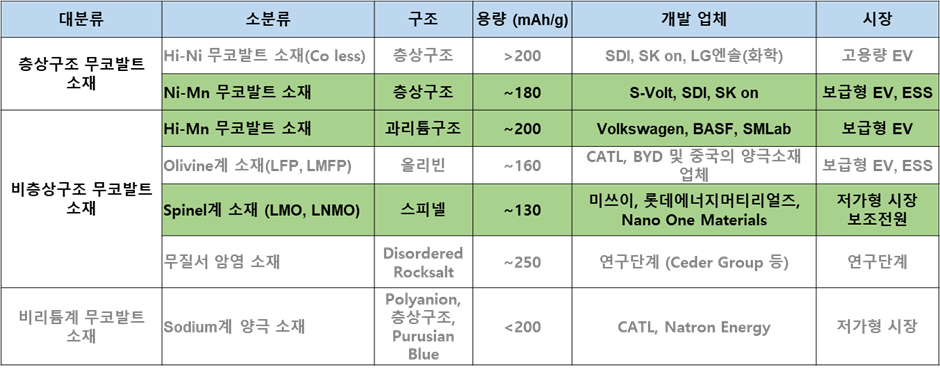

3.1.3~4 Cobalt-free Cathode Material Classification and Characteristics------------------------68

3.2 Layered Structure Cobalt-free Cathode Materials

3.2.1 The Role of Cobalt (Co) in Layered Cathode Materials ------------------------------------71

3.2.2 Features and Development Status of Hi-Ni Cobalt-free Cathode Materials --------------78

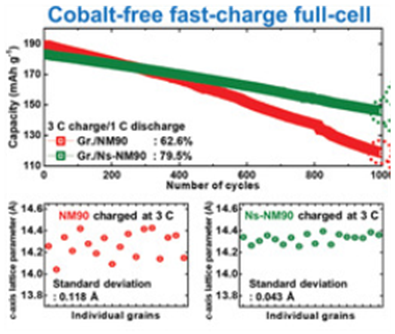

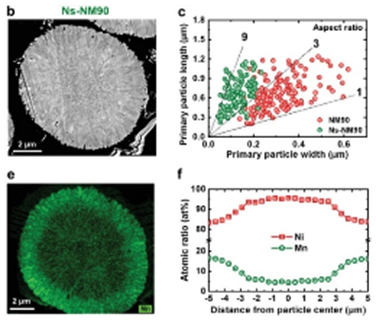

3.2.3 Features and Development Status of Ni-Mn Based Cobalt-free Cathode Materials (NMx) ---------90-

3.3 Non-layered Cobalt-free Cathode Materials

3.3.1 Development Status of Hi-Mn-based Cathode Materials---------------------------------106

3.3.2 Development Status of Olivine-based (LFP, LMFP) Cathode Materials-------------------110

3.3.3 Development Status of Spinel-based (LMO, LNMO) Cathode Materials---------------- 112

3.3.4 Development Status of Disordered Rock Salt Structure Materials------------------------118

3.4 SVOLT and Outlook for Cobalt-free Commercialization

3.4.1 SVOLT History of Cobalt-free Cathode Development-------------------------------------119

3.4.2 SVOLT Business Scope----------------------------------------------------------------------120

3.4.3 Future Technology Development Plan-----------------------------------------------------121

4. Non-lithium-based Cobalt-free: NiB Development Status

4.1 Na Ion Battery (NiB) Overview

4.1.1 Principle of Sodium-Ion Battery------------------------------------------------------------123

4.1.2 Sodium-Ion Battery vs. Lithium Secondary Battery Comparison-------------------------124

4.1.3 Analyzing the Price Competitiveness of Sodium-Ion Batteries---------------------------125

4.1.4 Leading Material Candidates for Sodium-Ion Batteries-----------------------------------126

4.2 NiB Material Development and Status

4.2.1 Cathode Development for Sodium-Ion Batteries------------------------------------------127

4.2.2 Anode Development for Sodium-Ion Batteries--------------------------------------------131

4.2.3 Sodium-Ion Battery Development Status--------------------------------------------------137

4.2.4 The Future Prospects for Sodium-Ion Batteries-------------------------------------------147

4.2.5 Market Outlook for Sodium-Ion Batteries by Research Firm-----------------------------150

5. Cobalt-free Cathode Market Outlook

5.1 Cobalt-free Cathode Market Forecast ('18 ~ '30)

5.1.1 NMx Cathode Market Outlook(1) --------------------------------------------------------152

5.1.1 NMx Cathode Market Outlook(2) ---------------------------------------------------------153

5.2 Cobalt-free Cathode Demand Forecast ('18 ~ '30)

5.2.1 Market Demand Outlook for NMx cathodes (1) -----------------------------------------154

5.2.1 Market Demand Outlook for NMx cathodes (2) -----------------------------------------155

5.3 Cobalt-free Cathode Price Forecast ('18 ~ '30)

5.3.1 NMx Cathode Price Outlook (1) -----------------------------------------------------------156

5.3.1 NMx Cathode Price Outlook (2) -----------------------------------------------------------157

6. Battery Patent Analysis for Cobalt-free Cathode Materials

6.1 Hanyang University-----------------------------------------------------------------------------159

6.2 LG------------------------------------------------------------------------------------------------164

6.3 POSCO------------------------------------------------------------------------------------------167

6.4 SVOLT-------------------------------------------------------------------------------------------171

6.5 Univ. Texas--------------------------------------------------------------------------------------175

6.6 Nano One---------------------------------------------------------------------------------------178