<2023> Oxide-based Solid-state Battery Technology Trends and Market Outlook

(Analysis of major company development trends and manufacturing technologies)

The performance of lithium-ion batteries (LIBs) has improved dramatically, especially in energy density, due to continuous technology development driven by the explosive demand for new electronics and electric vehicles. However, high energy density also poses the risk of fire or explosion, and explosive reactions can occur due to mechanical damage, over-discharge, electrical faults from overcharging, internal overheating, and secondary heat dissipation caused by external factors.

To prevent these risks, solid-state batteries are emerging as the next-generation battery technology that uses solid-state electrolytes. Solid-state batteries have the advantages of excellent safety, high energy density, high power output, and wide operating temperature range, and are free from the risk of explosion, while solid-state electrolytes have better ionic conductivity than liquid electrolytes at low temperatures below 0℃ and high temperatures between 60~100℃.

Solid-state electrolytes, the most essential part of a solid-state battery, are divided into polymer-based and ceramic-based electrolytes, and ceramic-based electrolytes are further categorized into sulfide-based and oxide-based electrolytes. This report will discuss oxide-based solid-state electrolytes among ceramic-based solid-state electrolytes.

The full-scale development of oxide-based solid electrolytes began with the development of LiPON in 1992, which has the advantages of stable contact with lithium metal, a wide electrochemical window (0-5.5 V vs. Li/Li+), and negligible electrical conductivity. Therefore, LiPON was widely used as a reference electrolyte in the R&D of thin-film solid-state lithium batteries. However, it was only suitable for use as a thin-film electrolyte due to its low ionic conductivity (about 10-6 S/cm at 25℃) and was too fragile for application to large-scale batteries.

In 1993, perovskite-type LLTO (Li0.5La0.5TiO3) was developed, showing an ionic conductivity of over 2×10-5 S/cm, and in 1997, NASICON-type inorganic solid electrolytes including LAGP (Li1+xAlxGe2-x(PO4)3) and LATP (Li1+xAlxTi2-x(PO4)3) were first developed, showing high ionic conductivities of 10-4 S/cm and 1.3×10-3 S/cm, respectively. In 2007, a garnet-type ionic conductor LLZO (Li7La3Zr2O12) was first reported, which exhibited an excellent ionic conductivity of 3×10-4 S/cm at room temperature and excellent thermal and chemical stability, showing potential for application in solid-state lithium batteries.

Solid-state batteries with oxide solid electrolytes are still used as low-capacity power sources for IoT and small electronic devices because they need to be sintered at high temperatures, have low ionic conductivity, and are difficult to scale up, and the method using multilayer ceramic capacitor (MLCC) manufacturing technology is widely used.

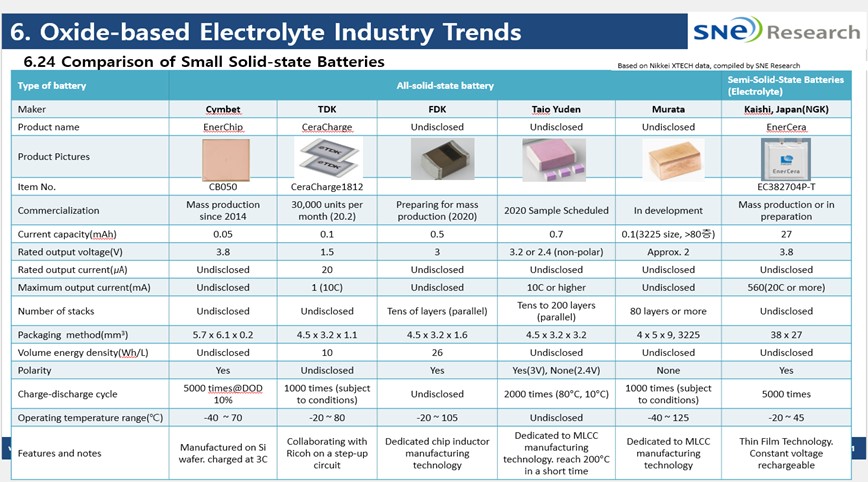

The table below summarizes the manufacturers and specifications of cells with oxide-based solid electrolytes that are currently commercialized and in preparation. Most of them are commercialized by Japanese companies, which are strong in MLCC technology.

Meanwhile, attempts to use batteries with oxide-based solid electrolytes for xEVs have also been made recently, and WeLion, a Chinese company, has developed a hybrid battery using Garnet and NASICON-based oxides, which has passed safety tests and is reported to be used in the NIO 150kWh battery pack. WeLion is currently building a large-scale manufacturing line with a capacity of 2GWh.

The overall market outlook for solid-state batteries is expected to grow to 149 GWh in 2030 and 950 GWh in 2035, accounting for 10% of the total battery market. Among them, solid-state batteries with oxide solid electrolytes are divided into large bulk type and small thin-film and laminated types. The bulk type is expected to be developed for xEVs, but due to high technical barriers to commercialization, it is currently expected to be used as a hybrid or quasi solid battery like WeLion and is expected to grow from about 27 GWh in 2030 to about 87 GWh in 2035.

This report, in addition to dealing with the overall overview and technology of inorganic solid electrolytes, also summarizes the key issues related to oxide solid electrolytes and the research and development status for solving them in detail. It also covers the latest trends and manufacturing processes of companies that are commercializing oxide batteries, and finally conducts a survey and analysis of important patents. This report will be a great help to readers who want to know the status, technology flow, and market of oxide solid electrolytes and batteries that apply them.

Strong Points of this Report

Technically rich content on oxide-based solid-state electrolytes

① Research and development status, major issues, and solutions for oxide-based solid-state electrolytes

② Manufacturing process technology of oxide-based solid-state batteries

③ Trends and technologies of major players in the oxide-based electrolyte industry

④ Market outlook for oxide-based solid-state electrolytes

⑤ Patent analysis of major players related to oxide-based solid-state batteries