<2022> Li Metal Anode Technology Development Trend and Market Outlook

Amidst

various activities to conserve the environment and establish a sustainable

society carried out across the board and stricter environment regulations in place

to address ever-worsening climate change issues in the 21st century,

there has been a growing significance on the necessity of developing renewable

energy and clean energy technologies. The secondary battery industry is one of

the representative industries for eco-friendly energy. As our means of

transportation has been transformed from vehicles with internal combustion

engine to electric vehicles, research on various types of lithium-ion battery

has become more active than ever before.

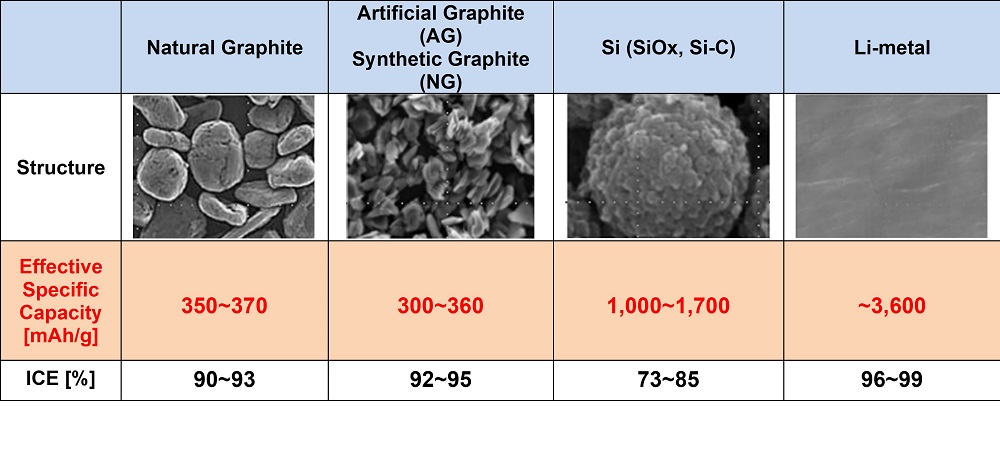

Since

the commercialization of lithium-ion battery in the 1990s, lithium-ion battery

has been successfully utilized as a power source for commercial electronic

products and electric vehicles for the past several decades. However, the

existing lithium-ion battery using a graphite anode has low theoretical

capacity (~372 mAh/g) and volumetric capacity (~735 mAh/cm3) of anode, which

imposes a limit on the upward adjustment of energy density achieved by

lithium-ion battery. To meet a growing demand of lithium secondary battery, a

new battery technology transcending the existing lithium-ion battery should be

inevitably pursued.

Lithium

metal has significantly high, theoretical capacity (~3860 mAh/g), very low

electrochemical potential (-3.04 V, compared to hydrogen electrode), and very

low density (0.53g/cm3). Thanks to these characteristics, lithium metal anode

is evaluated as the most potential material that can achieve high capacity and

power output per unit weight and unit volume.

This report covers the recent technology

trend with a focus on lithium metal that is regarded as one of the most

promising materials for anode in future. In addition, the report also takes a

close look at the status of research and development of lithium metal

technology in Korea, China, Japan, and other countries. In the

final part, the report analyzes the market trend both from the perspectives of

suppliers and consumers. In addition, the report offers a forecast on the

lithium metal anode market demand and market scale till 2030 based on the ICE

and xEV markets.

This report has the following strong points:

①

Overview

of Li Metal Production Technology and Issues

②

Understanding

of Overall Research and Development Trend for Li Metal Anode

③

Major

Players for Li Metal Anode and Their Technology Trend and Strategy

- Contents -

1. Introduction

1.1 LIB Requirements

1.2 LIB Development Trend

2. Anode Material Technology and

Development Trend

2.1 LIB Anode Overview

2.2 LIB Anode Material Development Trend

3. Li Metal Manufacturing

Technology and Supply Status

3.1 Lithium Production and Supply Status

3.1.1 Lithium world reserves 및 consumption

3.1.2 World Li Volumes 및 Current Production

3.1.3 World Li mine Production 및 Demand

3.1.4 Li resources : Mineral

3.1.5 Li resources : Ores

3.1.6 Li resources : Brines

3.1.7 Li Materials Supply Structure

3.2 Li Metal Manufacturing Technology

3.2.1 Li material technology

3.2.2 Li thin film technology

3.3 Li Metal Production Issues

3.3.1 Li thin film technology

limitations

3.3.2 Cost Structure

4. Li Metal Anode Technology and

Major Characteristics

4.1 Li Metal

Anode Overview

4.2 Li Metal Anode Development History

4.2.1 History Overview

4.2.2 Li metal battery(LMB) History

4.2.3 Li metal battery(LMB) Initial

Development

4.2.4 LIB Development & Market

Domination

4.2.5 Emergence of Necessity for LMB

4.3 Li

metal anode R&D Trend

4.3.1 Artificial

surface protective film (ASEI formation)

4.3.2 New Structure

4.3.3 Electrolyte modification

4.4 Li metal anode issue

4.4.1

Li dendritic growth

4.4.2

SEI Layer issue

5. Li Metal Development Status by

Company

5.1 Overview

5.2 Companies in Asia

5.2.1 Samsung SDI

5.2.2 LGES

5.2.3 SK on

5.2.4 CATL

5.2.5 Prologium

5.2.6 Hyundai Motor

5.2.7 POSCO Chem.

5.2.8 Neba Corp

5.2.9 Ulvac Inc

5.2.10 Santoku

5.2.11 Honjo metal

5.2.12 Wuxi Sunenergy Lithium

Industrial Co

5.2.13 China Energy Lithium Co

5.2.14 Ganfeng Lithium

5.2.15 Tianqi Lithium

5.2.16 Softbank Next-generation Lab

5.2.17 AIST

5.2.18 NIMS - ALCA SPRING

5.3 Companies

in Europe

5.3.1 Blue Solutions

5.3.2 Volkswagen

5.3.3 DAIMLER

5.3.4 SIDRABE

5.3.5 IMEC

5.4 Companies in North America

5.4.1 SES

5.4.2 QuantumScape

5.4.3 Solid Power

5.4.4 SOELECT

5.4.5 TeraWatt

5.4.6 Hydro Quebec

5.4.7 Brightvolt

5.4.8 Sion Power

5.4.9

SEEO

5.4.10 Cuberg

5.4.11 Enpower Greentech

5.4.12 PolyPlus

5.4.13 Sepion Technologies Inc

5.4.14 Ion Storage Systems

5.4.15 GM

5.4.16 Li Metal Corp

5.4.17 Ionic Materials

5.4.18 Albemarle

5.4.19 SQM

5.4.20 Livent Corp

5.4.21 Pure Lithium Corp

5.5 Summary of Major Companies

6. Outlook for Li Metal Anode

Market (~`30)

6.1 Overview

6.1.1

Types of Li metal anode batteries & Composition of Li metal costs

6.1.2

Roadmap of Li-metal-anode application

6.1.3

Commercialization scenario of Li

metal anode

6.2 Outlook for Li metal anode market

6.2.1

Outlook for Li metal anode demand

6.2.2 Outlook for Li metal anode price

(Conservative Scenario)

6.2.3

Outlook for Li metal anode price (Optimistic Scenario)

6.2.4

Base for Price Outlook of Li metal anode

6.2.5

Outlook for Li metal anode

market mize (Conservative Scenario)

6.2.6 Outlook for Li metal anode market mize (Optimistic Scenario)

6.2.7

Outlook for Price of All-solid-state LMBs (Conservative)

6.2.8 Outlook for price of all-solid-state

LMBs (Optimistic)

6.2.9 Outlook for Price of All-solid-state LMBs (Conservative)

6.2.10 Outlook for Price of All-solid-state LMBs (Optimistic)

6.2.11 Percentage of usage of

all-solid-state LMBs

6.2.12 Outlook for Li metal anode by

Application